Can you beat inflation? – Highest price rises in 20 years

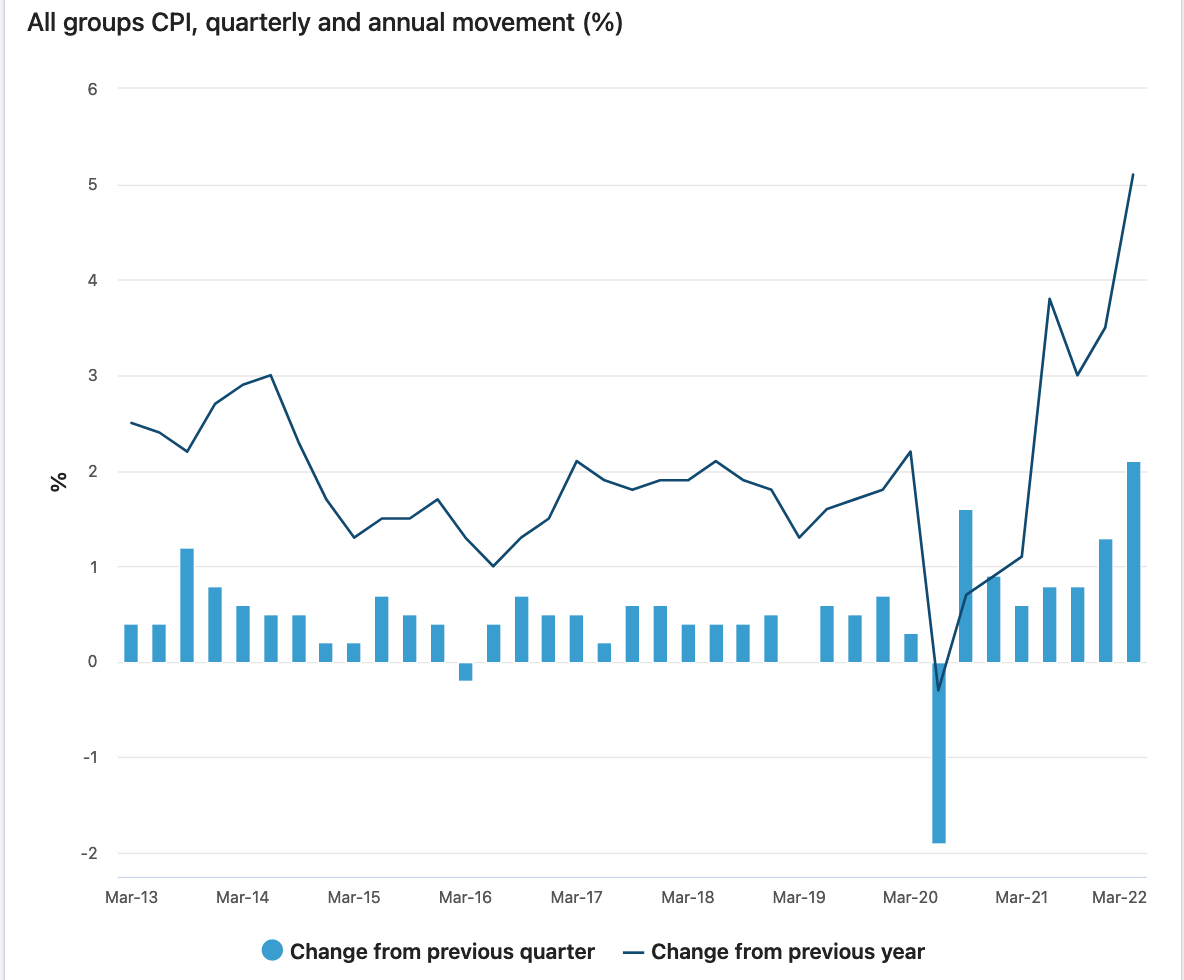

Last Thursday, the long awaited Consumer Price Index (CPI) update for the March 2022 quarter was released by the Australian Bureau of Statistics (ABS). The graph below shows it all – a sharp spike in prices means that inflation is now running at 5.1% per annum.

source Australian Bureau of Statistics (ABS)

This is the single largest jump in inflation since the GST was introduced in 2000, more than 20 years ago. As the newly introduced GST added to price increases, it is worth noting that this year’s increase on an ‘apples for apples’ basis, is actually the highest since December 1995 – more than 26 years ago.

And the last time the annual level of 5.1% was recorded (March 2009) was when interest rates were 4.75%. The CPI increase on a quarterly basis (i.e.; between January 1 and March 31 2022) is 2.1%.

The breakdown of items which have risen the most during the past year is:

- Food 4.3%

- Housing 6.7%

- Health 3.5%

- Transport 13.7%

A major contributor to the lift in transport costs is the price of fuel which has now been modified by a reduction in excise duty until September.

So whilst most consumers were aware that high fuel prices were likely to lead to a spike in the current CPI, it is the staples of housing and food that are of concern to anyone on a fixed income.

Which leads to the question, can you ever beat inflation?

The short answer is probably not.

The longer answer is that you can beat inflation – but only if you achieve returns on investment that are higher than the inflation rate, now 5.1%

Many retirees are invested in cash. Current returns on cash deposits are at record lows, with any accounts delivering higher than a 2% return considered strong.

Others might be invested in the share market – either directly with private savings or indirectly through a super fund. Share prices can be quite volatile – prices go up and down on a daily basis – and many people can be uncomfortable with this.

One asset class that does seem to be steadily rising in value is housing – but this is only helpful if you are lucky enough to own a dwelling, either fully or with a manageable mortgage.

The key point to understand when it comes to beating inflation, is that it is important not to feel simply powerless when prices rise rapidly.

If you are feeling as though you are going backwards as the cost of living gallops upward, it is worth remembering that you can make active decisions about your assets. This involves reviewing where you are invested – cash, stock market, superannuation, property, other investments – and evaluating the return on each separate asset class. Don’t think that money in super is tied up forever – it is actively invested in an account with your name on it, with a risk profile which guides the return. Such settings can be changed.

You do, therefore, have control over your various asset classes and can review and revise as suits the changing external conditions.

For many people such a review will result in leaving things as they are. And this is because they feel comfortable with their current asset mix and that they will be able to access funds if needed. This is a valid response if it brings peace of mind.

Others may be surprised to learn there is a better return to be achieved, by changing the type or extent of investment at hand. This latter course of action does not necessarily mean that your funds are any less assessable. For instance, changing your risk profile has no bearing whatsoever on your ability to draw out funds in super.

We don’t pretend it is easy to make financial decisions, which is why Retirement Essentials offers a handy calculator to help you keep track of your entitlements (Age Pension Eligibility Calculator) and consultations to help maximise your entitlements and answer questions on how you can work within the rules in order to increase your ongoing retirement income.