Tax rules for retirees

Thursday marks the end of financial year 2022. Or the EOFY as it’s now commonly known.

Many people assume – incorrectly – that retirees who don’t earn income don’t need to file anything.

This is not true.

There are two points to make here.

Firstly that the Australian Tax Office requires you to lodge a return if you earn a certain amount of income.

If you are not earning enough income to pay tax, you can submit a Non Lodgement Advice (NLA) which will be necessary for Centrelink applications.

Secondly, if you do have taxable income, then you are required by law to lodge a Tax Return. It may be that you have already paid enough tax and so will be rewarded by a tax return in your bank account. If you have not paid enough tax you will, of course, receive a notice to pay the outstanding amount.

When it comes to tax, retirees can be classified in one of three broad income-based categories:

- Full Age Pensioners

- Part Age Pensioners

- Self-funded retirees

Full Age Pensioners often do not pay tax, but some might because of earnings on small investments. Other Age Pensioners may have had tax withheld by Centrelink and they are required to lodge a return. (You can check if you have had tax withheld from your benefit by reading your PAYG statement).

Part Age Pensioners are highly likely to have income from other streams and must declare this on a tax return

Fully self-funded retirees are usually tax payers as well and need to detail earnings to the ATO for this reason.

Retirement income can be treated in different ways by the taxman. Here are some of the main aspects of retirement income taxation that will help you decide what you might need to do.

SAPTO rebates for older Australians

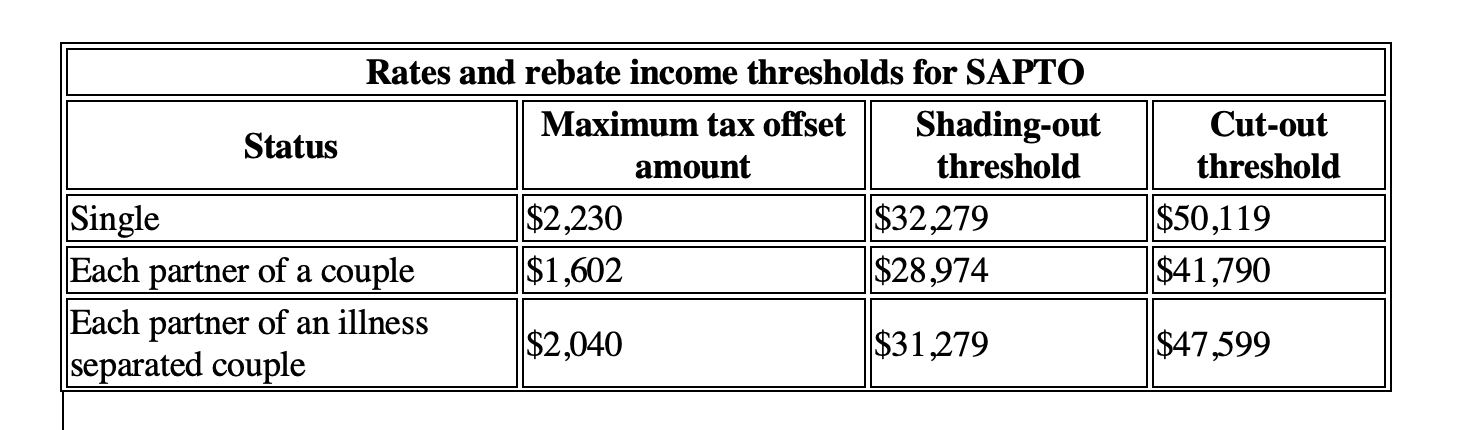

You may have heard of the Seniors and Age Pensioners Tax Offset (SAPTO). This is a non-refundable tax offset that can benefit senior Australians.

Eligibility for SAPTO requirements include Age, Residency and the Government Pension Test. There is also an income test which ensures the offset is only available to lower income taxpayers.

The current rates and thresholds as published by the ATO are:

If more than one item in the table above applies to you during the income year, your offset amount will be based on the amount that gives you the greatest entitlement.

And here’s a handy case study of how the SAPTO is applied, also from the ATO’s website

Example – Couple living together and rebate income below threshold

Clare and Roy are married and live together. Both Clare and Roy receive an Age pension from Centrelink. Clare’s rebate income is $23,020 and Roy’s is $25,677.

Clare and Roy are each entitled to the maximum SAPTO amount of $1,602 as each of their rebate income is below the shading-out threshold of $28,974.

Tax treatment of income from super

In most cases, those who have reached preservation age and are now withdrawing an income stream from their super enjoy this money tax-free after 60 years of age. Such income streams are typically an Account-Based Pension or an annuity.

If you are under 60, things can get a little more complex so check out links at the end of this article to further explore these rules.

Similarly, if you have a Defined Benefit Pension, an untaxed super fund, a Self-Managed Super Fund (SMSF) or are using a Transition to Retirement strategy, you will definitely need to be across the detail of your taxation requirements (see the links we have provided at the end of this article).

Ask before you leap

Pre-retirees face a whole raft of different rules. It is important to know and understand these rules before you retire. It’s critical, in fact, as there are very specific concessions to be enjoyed, but you need to know what they are in order to fully maximise these benefits.

Typically, tax is paid on employer contributions and salary sacrifice contributions, while personal contributions are often referred to as after tax contributions.

You will not need to pay tax on after-tax contributions or government co-contributions. If you are still working full-time and yet to reach preservation age, it is highly advisable to seek advice about the ways you can maximise your retirement nest egg, before you commit to an action that actually reduces it, due to a lack of knowledge on how tax and retirement interact. You may already have a trusted tax accountant or be working with a financial planner. Alternatively, if you would like the chance to learn more about the superannuation rules in a one-on-one consultation with one of our experienced advisers, you can book an appointment here.

Speaking of which, we asked our advisers if there are any mistakes that retirees make when it comes to tax and they identified three easily avoidable errors.

Big three tax mistakes to avoid

Low income does not always mean no lodgement

Low or no income is not a free pass to avoid dealing with the ATO. If, due to low income, you do not lodge a tax return, that is fine unless you wish to apply for an Age Pension or Commonwealth Seniors Health Card, in which case Centrelink will require the information on your return and assessment.

Commonwealth Seniors Health Card (CSHC)

As we report today in our CSHC update, around 50,000 older Australians on higher incomes will soon be able to qualify for this money-saving card. Your assets aren’t assessed. But your income is – and to process an application, it helps to know the following.

- When applying for the CSHC you are assessed based on your adjusted taxable income (plus deemed income from any income streams) for one of the last two financial years. You nominate which one. This includes providing the tax return and Notice of Assessment (NOA) for the year you choose. If you have not been working and not done a tax return then you instead need to submit a Non-Lodgement Advice with the ATO and their response is what you provide to Centrelink in place of the tax return and NOA.

Private Company or Trusts matter

Separately, if you are applying for the Age Pension and are involved with a Private Company/Trust you must provide the most recent financial year’s tax return and a Notice of Assessment as part of your supporting documentation. Many people say ‘I haven’t used it for years, the last time we did a tax return was four years ago. Centrelink considers this your responsibility. If you want the Age Pension then you need to have this evidence.

Next steps – we’ve made it easy for you.

If its clear that you must lodge something on June 30, here are some handy links for tax lodgements

Completing a digital tax return and other handy links

- First step is to have a myGov account linked to the ATO

- You can then lodge your tax return online with myTax

- Or download the ATO App

- and to lodge a Non Lodgement Advice you can go here.

- For further insights into retirement income and tax, the government’s MoneySmart website is also useful.

- And here is the promised link to the full detail of the SAPTO.

If you, too would like to better understand the tax treatment of superannutaion and income streams such as an account based pension why not book a consultation with one of our experienced advisers today.

This article is provided by Retirement Essentials Representative Number: 001260855. We are an authorised representative of SuperEd Pty Ltd ABN 88 118 480 907 AFSL #468859. This information is not intended as financial product advice, legal advice or taxation advice. It does not take into account your personal situation, goals or needs and you should assess your own financial situation, consider if the information is suitable for you and ensure you read the relevant Product Disclosure Statement (PDS) if you choose to make any changes to your financial situation. It is always advisable to consult a financial adviser before making financial decisions.

my wife and i are aged pensioners i earn 17.440 per annum do i get taxed

Hi Raymond, thanks for reaching out! The Age Pension does form part of your taxable income. However, if it is your only source of retirement income, you will pay no tax. This does not mean you do not have to lodge a Tax Return though. Everyone should submit either a Tax Return or a Non-Lodgement Advice to the ATO so please speak with your accountant/tax agent to clarify which is best for you.

We are a couple who emigrated from NZ some years ago. We are in receipt of NZ Superannuation which is taxed at source & we receive the net amount.

In addition we receive a small fortnightly top up pension from Aust Old Age pension to bring our income up to what Aust Pensioners receive of $137 each fortnightly.( varies with exchange rate) We have no other income. nor investments.Because of this we understand we don’t need to lodge a tax return in Australia. However if we had an ABN No then we would have to. It would be helpful if you could include pensioners like us in your comments I. Your future reports. Thank you.

Hi Iris and John, thanks for joining the conversation! Whilst you may not be obligated to lodge a Tax Return we do highly recommend you consider it or complete a Non-Lodgement Advice instead. We are not tax experts though so best to speak with you tax agent/accountant.

hi i recieve part age pension which varys as my wife works casual average 2 days per week as supply teacher im 70 yrs she is 63yrs she pays tax i dont have any other income do i need to lodge tax return or maybe no lodgement notice thanking you john stone

Hi John, thanks for asking an important question! We recommend contacting your accountant/tax agent to confirm what is best for you specifically but in general is a good idea to always complete a Tax Return or Non-Lodgement Advice each financial year.

If I migrated to AU in November do I declare all income from that date to end of June? How does this affect my tax free threshold? I receive some NZ govt super by arrangement with Centrelink. Considering the share market losses recently (and all my other income is from investments) should I apply for a reassessment?

Hi Rosemary, thanks for seeking clarity. Centrelink assess all income you earn whether it be in Australia or foreign so yes you need to declare everything. Regarding a reassessment, we suggest people consider updating the values of their income/assets with Centrelink regularly to ensure they are getting as accurate a pension as possible. This does mean that you need to provide Centrelink with new bank statements and other supporting documents (depends on what assets/income you have) as proof of the new balances though.

I am using my Superannuation fund to provide an annual income stream of $2,222 per fortnight. I also receive a small fortnightly payment of $76 from Centrelink.

Do I have to pay tax?

Hi Sandra, thanks for reaching out! It is best for you to speak with a tax specialist as there are many areas that need to be considered to determine whether you have to pay tax or not. We can only help inform you on the impacts of doing/not doing a tax return regarding Centrelink entitlements.

Hi I retire 1 July 2022. I will be getting my final payment on Friday 1 July or after. I will do my tax return for FYE 2022 asap. When I apply for a part pension (if eligible) I will need to supply my income tax return because we have a non operating Family Trust and would like to get the CSHC. Is Centrelink going to use my 2022 ITR to assess eligibility for the pension and/or the CSHC? Hope that makes sense !

Hi Peter, thanks for giving it your best shot, I think I understand what you are asking so here it goes! Firstly you will only need to apply for Age Pension (AP) OR CSHC, never both. The Age Pension provides a Pensioner Concession Card (PCC) which includes all the benefits of a CSHC plus more. In terms of how you prove your employment situation, it is a similar process either way.

So long as you have a separation certificate or equivalent to show that you have retired and will not receive any further income from employment, Centrelink will not hold the previous income earned against you. In your case, whether you apply for AP or CSHC Centrelink will ask you to provide your Tax Return and Notice of Assessment so yes they will see your previous earnings but as I said, the separation certificate lets them know that what is shown on the Tax Return is not indicative of what you will earn moving forward.

Therefore you should pass the income assessment for the Age Pension but there is the assets test that also needs to be met. In case you don’t meet the assets test to receive Age Pension you can feel confident that you will pass the income test for CSHC so you have that in your back pocket.