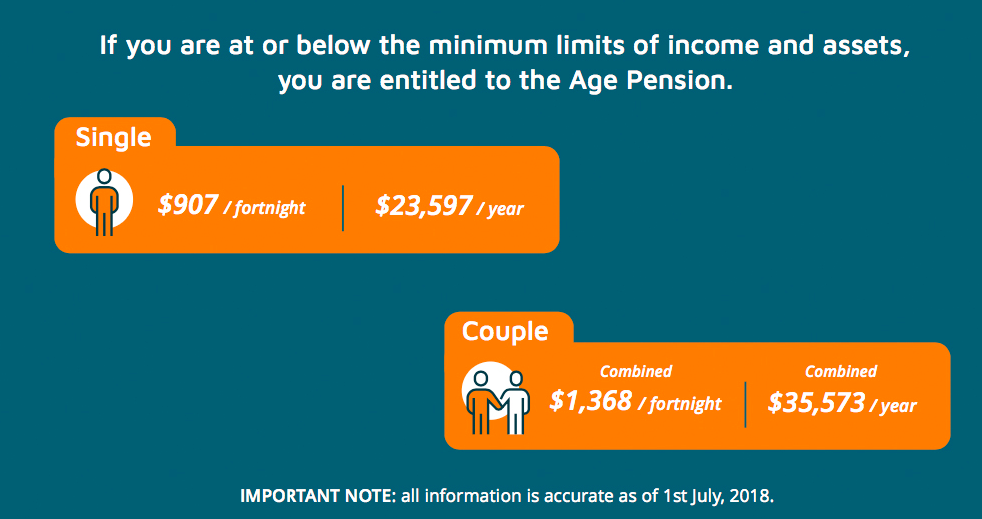

As you may know, Centrelink determines an applicant’s Age Pension entitlement by assessing their income and assets independently, which is referred to as the Means Tests. The Means Tests are there to ensure the Age Pension is targeted to those who need it most. From 1 July 1st 2018, Centrelink will follow new thresholds for the Means Tests

Changes to the Income Test

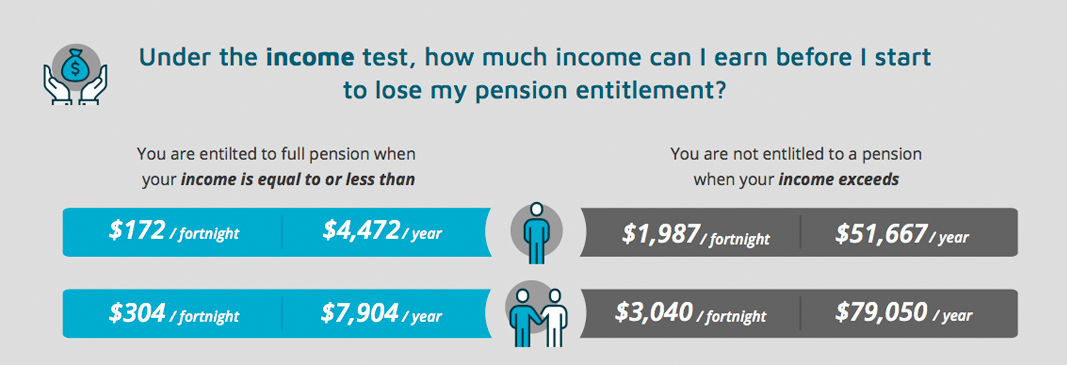

The lower and upper income thresholds for the Age Pension income test will increase again from 1 July 2018. The new income test thresholds are as follows:

The pension amount starts reducing by $0.50 for every $1 your income exceeds these amounts and does not include the work bonus.

There have also been changes to deeming rules. Centrelink does not assess the actual income that you receive on your financial assets, which includes superannuation, loans, bonds, shares, or bank accounts. To make the assessment process easier, Centrelink “deems” or calculates the income they include in the Income Test from your financial assets. Starting 1 July, the deeming rates will be 1.75% on your financial assets up to $51,200 (Singles) or $85,000 (Couples) and 3.25% on your financial assets over these thresholds.

Changes to the Assets Test

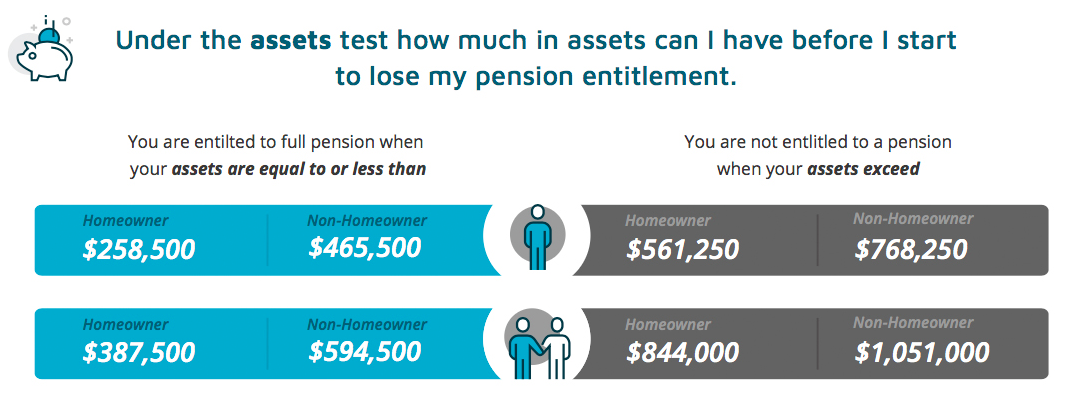

The lower and upper assets thresholds for the Age Pension assets test will increase starting 1 July 2018. The new assets test thresholds are as follows:

Under the Assets Test, your pension amount starts reducing by $3 for every $1,000 your assets exceed these amounts.

It is important to take note that Centrelink regularly adjusts the thresholds and deeming rates for the Means Tests. For example, the upper income threshold for the Age Pension income test is adjusted three times a year – March, July, and September. On the other hand, the lower threshold for the assets test is only adjusted annually every July.

Our Age Pension Calculator has been updated and will give you an accurate view of what you will be entitled to from 1 July, 2018. Check your entitlements under the new rules here.

Or, if you have any questions simply call us 1300 527 727. Our Age Pension Specialists are waiting to take your call.

Does the value of the home you live at the time of the test count for the Assets test.

Eg. Married couple , value of the current home is 1 million.

Income test passed.

Hi there Palitha

The home that you own and live in is not counted in the Age Pension calculation.

We are under the threshold for income but we are not sure if the balance of our superannuation, which pays our income stream fortnightly, is counted in our assets?

Super is counted as an asset once you turn Age Pension age.

Income test are figures quoted gross or net

Hi Paul

The quoted income rates are gross ie before tax is paid.

what is counted in your assets test?

Hi Michael

Your assets are superannuation, savings and investments (in the bank and shares etc), investment property and personal assets such as a car, boat, caravan and the contents of your home.

I am trying to get my wife onto a Disability Support Pension and then I will reduce my hours down so that we are on the maximum income allowed for a couple living together. I am 70 and still working. Will this cause me not to apply for a part pension?

Hi Mike

You can continue working and potentially be eligible for an Age Pension, even if your wife is on a Disability Pension. Sounds like you may benefit from having a chat with one of our Age Pension Specialists about your circumstances, give us a call on 1300 527 727 9am-5pm Mon- Fri AEST.

Hi again Ally, thanks so much for this information because I was becoming confused and worried about how much our income would be once both my husband and I are on the pension later this year. We live in a retirement village, which means that we don’t own our own home (if I understand the rules correctly). But even if we did, we would be living in it and our assets would come in way below the threshold.

Thanks again,

Monique Williams

I only get 2.2% on investment yet you seem much more ????

Hi Thomas

We are just using the deeming rules that Centrelink applies to assets for the Age Pension calculation. In this article we have explained the new deeming thresholds and rates as at 1 July.

Can the pension amount be adjusted when your asset has reduced or been depleted?

It sure does Merly, you just need to keep Centrelink up to date on your financial circumstances and they will adjust you Pension amount accordingly.

Is mortgage & credit card debt subtracted from assets when calculating net assets for the Age pension assets test?

Hi John

The home that you own and live in is not included in the Asset Test for the Age Pension. If the mortgage you refer to is for this same property then this wouldn’t be included in your Age Pension application. And lastly, credit card debt is not included in the Age Pension calculation. Hope this helps.

My husband earns $934 weekly gross and I will be entitled to age Pension November 2018. Will his earnings affect my pension in any way. We are renting and own 1 car and no savings. What would I be entitled to.

Hi Eva

With your husband’s current income you could qualify for a part pension. There is also the assets test, but it sounds like you will be well under this threshold of $1,051,000 for a non-home owning couple. And lastly, did you know that Centrelink will accept your Age Pension application 13 weeks ahead of turn 65.5 years old? We’d love to help make this process easier for you when you are ready to apply.

Hi Allyson,

I am of the age required for Age Pension however my wife was born in 1958 and would need to wait another 7 years for eligibility.

.Would that mean I would receive a Single Persons Pension until she reaches Age Pension Age, subject to the Income and Assets Tests for a Single Person?

Best regards, George

Hi George

Great question and is one we get asked a lot! You can apply now for your Age Pension and you will be assessed as a couple. If you are eligible for an Age Pension then it will be your portion of the couples pension. Hope this makes sense.

How much of a defined benefit superannuation is counted towards assets. e.g. i receive a defined benefit of $2000 fortnightly from First State Super (SSS). Is that whole amount counted?

Hi Anthony

The total value of your Defined Benefit is counted, not the fortnightly payment amount. If you don’t know the total value of your defined benefit then give First State Super a call, tell them you need to know the actual value of your defined benefit to be able to apply for the Age Pension.

Hi

I will be going on a age pension in December 2018 and my husband will be eligible December 2022. Husband is working so I will receive part pension. When he is eligible he will get approx $110000 superanuation. We are non home owners own 1 car. No cash in bank accounts. Will superannuation be counted as assets if taken in a lump sum when my husband retires. Thanks

Hi Susan

Thanks for your question. If your husband takes his super out in a lump sum I assume it will be put into a bank account, as such money in the bank is classified as an asset. Hope this helps.

Hello

I have two separate 100,000 life time annuities which both commenced in early June 2017. No doubt they will be considered ‘asset’s’ under the assets rule.

Could you please advise me how Centrelink calculates their current value & what that may be today as I am intending to submit a claim for part pension as my overall assets now fall under the upper threshold for a single home owner.

Your Age Pension entitlement is determined by an income test and an assets test. The balance of your annuity will be assessed under the Centrelink assets test. Part of the income you get each financial year will be assessed under the income test.

Hi there. I used your calculator and we will be eligible for the full pension of $35,100, or so.

What is the tax rate that will be applied? Many Thanks.

Hi there Cheryl

You don’t pay tax on Age Pension payments.

I am 70 and my wife is 62 and I think it’s time we received some financial aid from the

Government. We both still work part time but we could both retire tomorrow if necessary.

Our problem is the “deeming” side of our investments. Our returns are over12% per annum and will remain so for at least another 5 years ( on a $400,000 investment). My question is will this $400,000 be deemed at 3.25% or 12%? We own our home (country) and $200,000

in the bank. Thanks very much, Owen.

Great question Owen. Centrelink applies a standard deemed rate of interest on all financial assets when calculating your Age Pension entitlement. Currently for couples this is – the first $85,000 of your combined financial assets has the deemed rate of interest 1.75% applied. Anything over $85,000 is deemed to earn 3.25%. So, this is well below your expected 12%! In this instance the deeming rules have fallen in your favour.

HI. I am in a retirement village that I pay site fees on. I have 700,000 in the bank and a car valued at 30,000 . would I be able to get a part pension. I haave no Super or Insurance.

Good morning Vonnie,

It might be best if you gave us a call to chat through your circumstance. There are a few variants in this that would be better to discuss over the phone. Give us a call on 1300 527 72 Mon – Fri 9-5pm (AEST) and one of our Age Pension Specialists will be able to help you.

How do I treat income received from a discretionary trust?

Hi Margaret,

While this income will count towards the Income Thresholds set out by Centrelink, it is important not to declare this as income you personally receive in the employment section as it will already be noted in the additional MODPT form you must complete. Double declaring may cause further issues down the line while Centrelink reviews the claim. You can give us a call on 1300 527 727 to discuss further if you did choose to go ahead with our service. Many thanks!