New Age Pension Rates commenced today

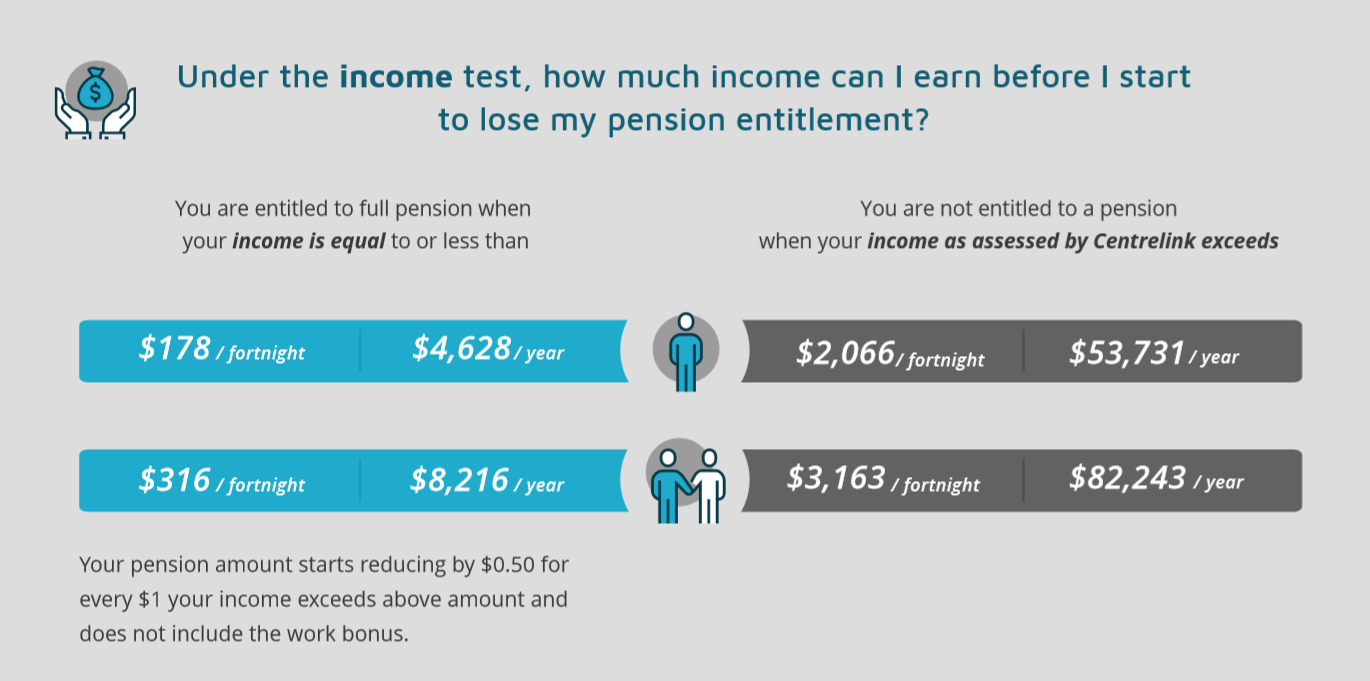

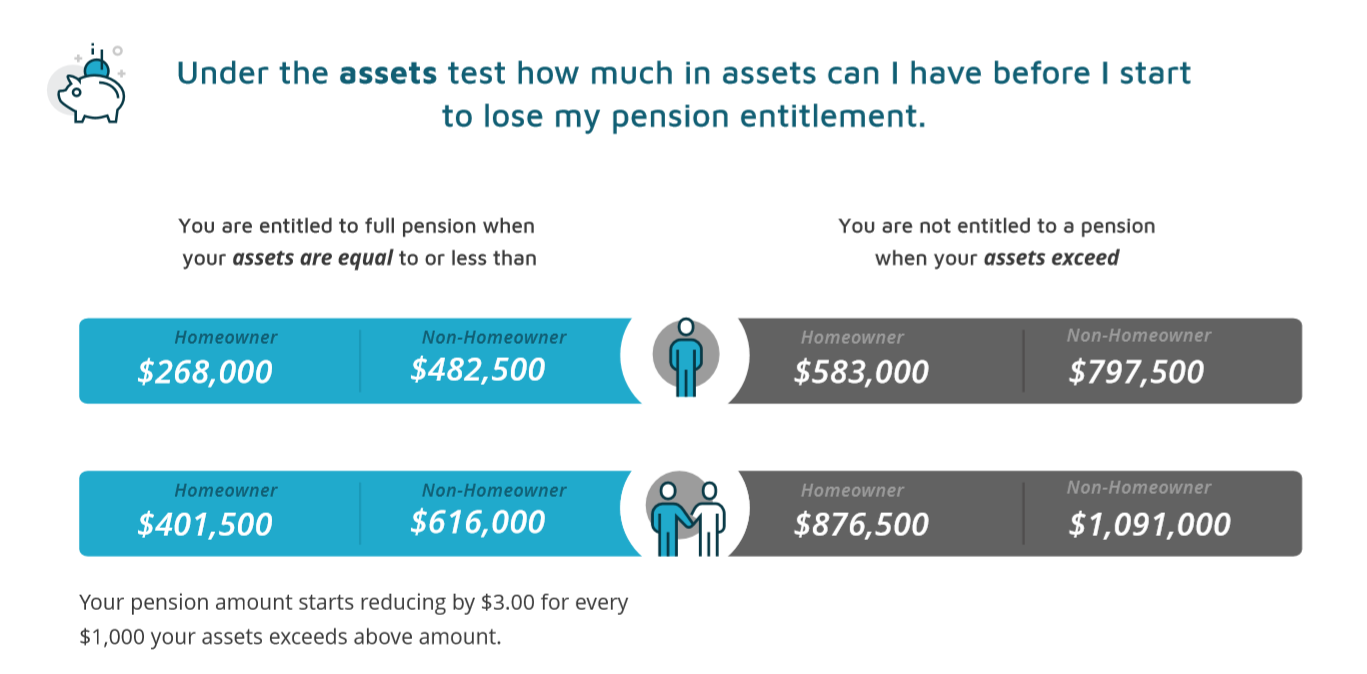

The new Age Pension rates for the Means Test commenced July 1st. This means Seniors can earn slightly more, or have slightly higher assets, before they start losing some of their Age Pension entitlements. Some of the changes include…

Singles

- The amount that can be earned and still get a full Age Pension has increased by $104 p/a to $4,628 while the upper limit where you can no longer get any pension has increased to $53,731 p/a

- The lower limit on the assets test for a non-home owner has increased by $8,750 to $482,500 and the upper limit has increased to $797,500.

Couples

- The amount that can be earned and still get a full Age Pension has increased by $208 p/a to $8,216 while the upper limit where you can no longer get any pension has increased to $82,243 p/a

- The lower limit on the assets test for non-home owners has increased by $11,000 to $616,000 and the upper limit has increased to $1,091,000.

All the new levels for the income and assets test are shown in the following tables.

Income Test

Asset Test

If you are eligible for a payment but haven’t lodged your application yet – stop delaying. You are missing out on your entitlement, which will only be back dated to the date that you lodge your application, not from when you became eligible.

Retirement Essentials makes it easy for you to complete your application plus we work with Centrelink to get your application processed quickly. Go on, give us a try. We’ve already helped hundreds of senior Australians get their pension the easy way and we also offer a money back guarantee.

I still struggle to understand why a single home owner can only have $268k in assets whilst a single non home owner can have $482k in assets and then get rent assistance. To be honest, if they have $482k in assets there is no reason why they could not buy their own unit. I always thought the home was not means tested, but it quite clearly is. I get it if your house is worth $1mill plus, but many like myself just have a very small home.

I so agree with you. I also think the single pension should be closer to the amount a couple gets. Almost all of the expenses are the same for single or couple.

I agree singles use the same amount of energy to cool or heat their home. Use the same amount of laundry costs and cooking costs, refrigeration costs! Even rent, I pay $300 per week for a one bedroom tiny unit in a retirement village, couples pay the same for rent!

I no longer have a car but the costs of having a car are the same for single as it does for a couple. We living alone are highly disadvantaged! The only thing a couple pay more for would be clothes, food and medication! North Queenslanders have much higher costs than those in southern east corner! Our living costs are higher and we have to still travel to Brisbane for some medical services that are not available outside of Brisbane!

My husband was scheduled to have his leg amputated because of a blood clot! A flight to Brisbane would have killed him we were told and I asked for him to be transferred to a Private hospital because we had private health. Miraculously, a Vascular surgeon was contacted and he flew from where he was on vacation, back to Townsville and did the surgery and my husband had bi pass surgery and saved his leg! I was shocked that as a public patient leg would come off but as a private patient his leg remained!

Many people need to continually travel to Brisbane from Townsville and other areas for medical. It is dreadful that people need to travel far from family support to Brisbane from their north or north west areas for medical treatments. Townsville and Cairns aught to have the same services that Brisbane has.

AGREE. I am a single person who worked for 50 years, paying taxes all that time. It cost singles just as much to live as it does for couples. It’s about time singles situation are given much more priority than in the past.

Sharyn Russell my wife and I also worked 50 years paying taxes , so your saying one of us should be entitled to no return on that because we’re a couple, effectively our position is compromised for no other reason than discrimination for being a couple. Probably be much fairer if each individual received the same amount , after all there a a huge number of pensioners where both get single pension income but they are sharing homes, might help control that wrought.

It is impossible to safely earn 2.25% in any investment in 2020. The Morrison government needs to slash deeming rates to what banks pay on term deposits or Super funds earn on Cash.

Yes why is the deeming rate so high when you can only get 1% from banks, this is the government ripping people off.

My question is why is there such a huge difference in single rate and a person who is a member of a couple. We r a home owner and married and find it a struggle to survive

Pam, a single person finds it harder than a couple as gas, electricity, water, council rates, running a car, home maintenance, insurances etc etc are all the same for one person as two in a home. The main exceptions are extra food and clothes and a couple gets more than a single person to cover those expenses. If a couple chooses to have two cars that is their prerogative but most don’t.

If you are a couple you get more together than one person on their own. I know this as my husband has passed away and now I have a lower income as I am only one person not two. I still have nearly the same expenses except only 1 to feed, clothe extra. It’s a struggle but I happy to be able to stay in our home.

The fact remains that there are numerous couples that are not declaring correctly, and are both receiving full single pensions!

We all know of these situations, but the government seems to ignore it! Absolutely not fair!

what this boils down to is nothing.

I need some suggestions about assets limits for couples, own house.

Hi and thanks for your comment. We have all the asset limits for couples, singles, home owners and non home owners on this page. Regards

My assetts are around 6.000 dollars , i have private rental and pay over 1.000 per month the rent will go up 10. Per week in feb ,but out pensioners onle go up by 4.50 week

How are we supposed to live on this, we pay tge same for food, we pay the same for our cars and their maintenance,

So why our government that in somes instances we need more on the pension .Follow Canads way please

I live in a village we pay to get in to the unit but is not really owned do we get rent assent

Hi Margaret, Best to speak directly to Centrelink for information on rent assistance. You can reach them during business hours on 136 240 and ask to speak to an operator. Many thanks!

Hi every body I know their’s a difference between a single & couples pension but you have to remember that the couple pay two lots of taxes when working so why should they not get a little extra in retirement