Age Pension Rates (March 2025 to September 2025)

The Australian Age Pension is one of the more complex and more generous pension systems in the world. Consequently, it can be hard to understand. But we are here to help guide you along your retirement journey and put you in control.

The minimum age for both men and women to qualify for the Age Pension is 67. No further age increases are currently legislated.

Because the Age Pension provides core funding for about seven out of ten Australian retirees and at least some income to eight in every ten people over the age of 65 it is relevant and important to all of us.

Even if you aren’t eligible today, it’s highly likely that you will become eligible for at least some pension payment at some point during your retirement.

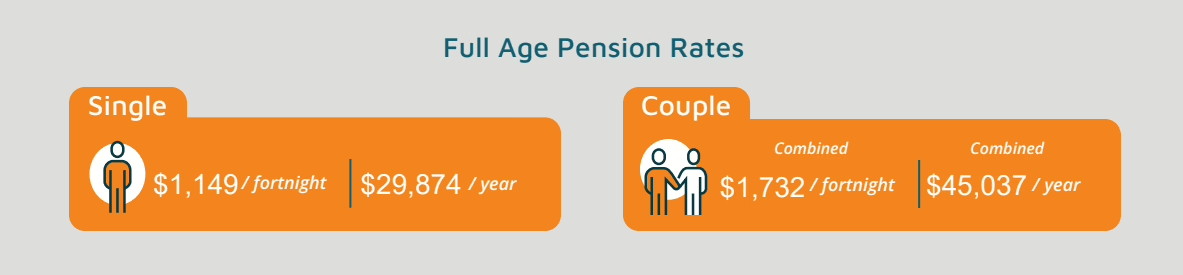

Age Pension Rates

From 20 March 2025, the Age Pension in Australia has increased. The information detailed below shows the increases including supplements for singles and couples.

- Single: $1,149.00 per fortnight ($29,874 per year)

- Couple (each): $866.10 per fortnight ($22,518.60 per year)

- Couple (combined): $1,732.20 per fortnight ($45,037.20 per year)

Australian Government updates the Age Pension payment rates and the means tests three times every year. So it’s important to keep up to date, check your eligibility and ensure you are getting all your entitlements

How is the Age Pension Calculated?

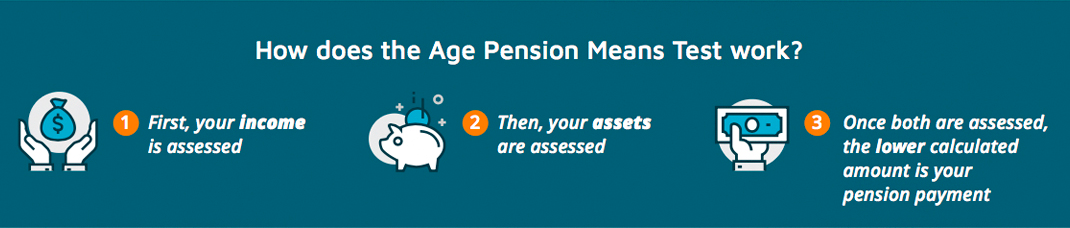

Centrelink, as the delivery agency for Services Australia, calculates your entitlement based upon a means test. There are two separate parts to this assessment – the income test and the assets test:

Struggling to get on top of how the rules are applied in your particular situation? You’re not alone. Many Retirement Essentials members have been relieved to share their questions and concerns in one-on-one entitlement consultations with our friendly Customer Service Team or advisers.

When will Age Pension rates change in 2025?

The base rate of the Age Pension is recalculated every March and September. The new rates are published on or about the 20th of March and September. The base rate is indexed using a mix of three different measures; Consumer Price Index, Pensioner Beneficiary Living Cost Index and the Male Total Average Weekly Earnings. Here’s how indexation works.

When will Age Pension thresholds change in 2025?

The thresholds for the income and assets test are indexed and adjusted along with the rates in March and September each year. There is also an additional indexed adjustment in July.

When do the Deeming rates change?

These rates are reviewed by the Minister for Social Services and can change without warning.

The current deeming rates are:

- 0.25% on your financial assets up to $64,200 (Singles) or $106,200 (Couples)

- and 2.25% on your financial assets over these thresholds.