We believe all Australians deserve to enjoy their best possible retirement

We help make this possible by providing financial guidance and support throughout your retirement journey.

Get advice and support for your big decisions

Our financial advisers provide affordable financial advice, one issue at a time.

Everyone has questions, issues and challenges when it comes to retirement. Which is why we’ve created our cost effective, and easy to try, advice services.

We will give you the knowledge and tools to take the right steps, and avoid common mistakes, so you can maximise your entitlements and manage your retirement finances with confidence.

Application support

Government entitlements are an important foundation for most Australian’s retirement.

So we have simplified the process to get, keep and maximise your Centrelink entitlements.

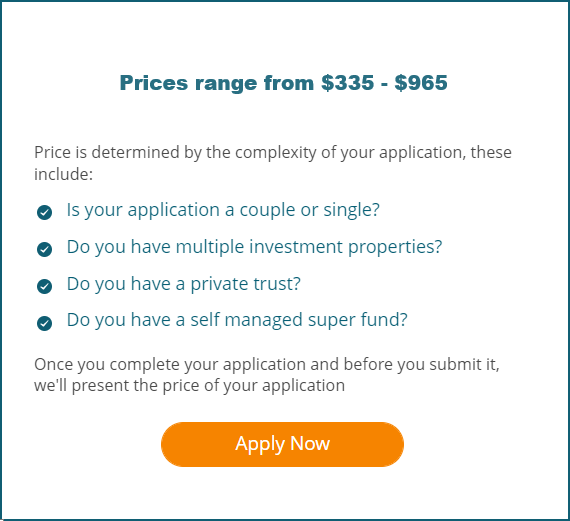

Our team has handled thousands of claims for the Age Pension and Commonwealth Seniors Health Card. Their knowledge and experience will ensure your claim is prepared on time, correctly and is approved as quickly as possible.

Our team can then guide you through your retirement journey step-by-step. We can help you get the Age Pension or Commonwealth Seniors Health Card. We can also provide assistance for life’s big financial questions to put your mind at ease and you in control.

Turning 60: Is it time to rethink your super?

This birthday changes more than just your age. It could change your future. There’s something quietly powerful about turning 60. It might...

Mapping your retirement planning options without the stress

Retirement planning can feel like a merry-go round of decisions, leaving you dizzy with the different directions you can pursue. With so...

Rental income and Your Age Pension: Understanding the rules

How does Centrelink assess your investment property earnings? Owning an investment property can be a great way to boost your retirement...

Licensed, professional

service

Our team of Retirement Experts are ready to help.

Confidential &

Secure

Get personalised help in a safe online environment.

Australian

Owned

We’re 100% Australian owned & operated.

Retirement Essentials is the smart way to apply for your Age Pension

At Retirement Essentials we’ve simplified the process to make it easy for senior Australians to get and keep their Centrelink Entitlements.

|

If you apply for the Age Pension directly to Centrelink yourself, here’s what you can expect:

Retirement Essentials provides an easier Age Pension application service:

|

Why use Retirement Essentials?

Be confident that you’re getting all your Age Pension entitlements.

Feel supported and in control of your money, Age Pension Specialists are waiting to help you.

Saves you time – Apply from the comfort of your own home and at your pace.

Learn how our Age Pension Service works in 3 easy steps

As seen on

Simple online process

Simple online process