And the winner is:

Max who needs more time

We’ve been delighted with the volume and depth of responses to the inaugural Retirement Essentials Retirement Pulse survey, launched in October. You may recall we asked you to share the issue or question you would most like to ask one of our advisers. And the response selected as the most informative or interesting would win a one hour consultation.

So it’s congratulations to Max who has won an appointment with Nicole, for the following response:

‘Only an hour?

Superannuation rules/gotchas

It seems the only way to put it all together would be to sit at a round table with specialists in super, tax, pensions, accounting and estate planning – AT THE SAME TIME.’

Love the gentle humour in questioning whether one hour is enough. Not to mention the caps – raising your voice to note that all these areas of expertise need to be combined in order to manage super rules – particularly the ‘gotchas’.

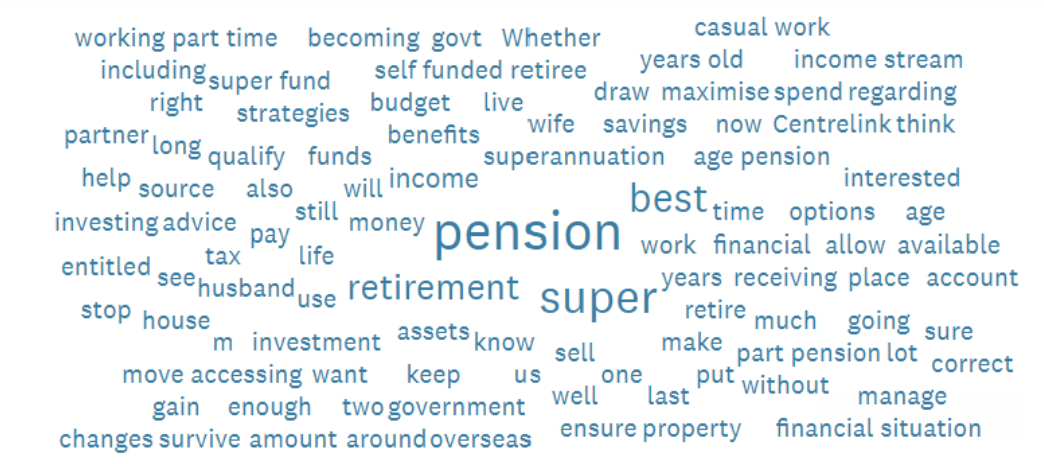

As well as enjoying Max’s sense of humour, his feedback also accurately reflects the sentiments of many other Retirement Essentials’ members. Today we have shared a word cloud – at the top of this page – which shows you the main words used in answer to this question.

The larger the font, the more often that word was used.

So you could be forgiven for thinking that ‘pension’ is the topic that most respondents wish to explore with an adviser.

Close, but no cigar.

If you look closely, you will see that the word ‘super’ is almost as large as ‘pension’, and ‘superannuation’ also features. Overall more people wanted advice on super than the Age Pension.

Super and the Age Pension were definitely the hot topics with 54% of people mentioning one of the two.

Which takes us back to Max’s reply.

What we don’t try to do in an adviser consultation is to cover all the complexity of retirement options in one session.

This is not the intention of the meeting. Retirement Essentials’ adviser consultations have been carefully structured to meet the three or four most common financial needs for retirees, in affordable ‘bite-sized’ sessions.

So when Max has his appointment, we will ask him to clarify the main concern he has, which seems to be how he can safeguard and maximise his super. Nicole can then step him through the rules and his options and will share a strategy paper which details the likely outcomes if he proceeds with his current settings, or if he tries some other options.

Such consultations typically focus on mortgage debt, super contributions, mixing the Age Pension with other income streams or when to commence an Account-Based pension.

The discussion is always determined by your most urgent needs.

We’re looking forward to helping Max with his superannuation challenges and are ready, willing and able to work with you also, if you wish to book an appointment.

And don’t forget – the November 2022 Retirement Pulse survey is now open for your feedback – and another opportunity to win a one hour consultation with one of the experienced Retirement Essentials advice team. You can also book a consultation with one of our advisers below.

Also this week

If I make application for an aged pension (I’m 71years) how long is the average time before it is processed, and payments occur. I own my own home, but have it rented out to my son.

Hi Mark, thanks for seeking clarity! Timeframes for claim approval can vary greatly depending on various factors. As a guide Centrelink advise that claims can take up to 13 weeks to be approved. We often get our customers’ claims approved in 4-6 weeks. The good news is that once approved you will receive a lump sum back payment to cover the period from the day you lodged your claim up to the day it is approved so you will not miss out on any pension regardless of how long it takes to be approved.