Commonwealth Seniors Health Card Benefits

It is conservatively estimated that the Commonwealth Seniors Health Card discounts might add up to $2000-3000 per year!

The Commonwealth Seniors Health Card provides many benefits not least of which is peace of mind. Age Pension recipients get all these benefits and more, so if at some point in the future you become eligible for the Age Pension you’ll just be getting more of what you’ve worked hard and paid taxes for.

The top six benefits of the Commonwealth Seniors Health Card (CSHC) include:

- Cheaper Prescription Medicine and other benefits under the Pharmaceutical Benefits Scheme

- Bigger refunds on medical costs when you reach the Medicare Safety Net

- Free or lower rates on other healthcare expenses. This can include ambulance, eye checkups, hearing and dental care

- Discounts in some states on water and property rates. For example in WA, CSHC holders may be entitled to receive up to 50% rebate on water service charges.

- Discounts on electricity and gas bills. Card holders can often apply for Seniors Energy Rebates in different states to help cover electricity costs and gas costs. Check your state guides.

- Discounts on transport and recreational activities. Card holders are often eligible to receive metropolitan and regional travel discounts. Recreational centres, parks, and movie theatres all over Australia offer discounts to Commonwealth Seniors Health Card holders.

Use our Commonwealth Seniors Health Card Calculator

Check Your EligibilityCommonwealth Seniors Health Card Eligibility Calculator

Determining your eligibility can be complex. Retirement Essentials offers a user-friendly Eligibility Calculator. This tool simplifies the process, providing a quick and personalised estimate of your potential entitlements in under five minutes.

Use our Commonwealth Seniors Health Card Calculator

Check Your EligibilityWho can get a Health Card?

To meet the Health Card eligibility requirements you need to meet specific age, income and residency criteria

Age is the first requirement. You must be at least 67 years of age.

Residency – You must be an Australian Citizen or Permanent Resident. Permanent Residents may need to wait up to 4 years to apply.

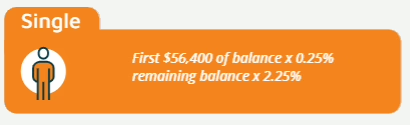

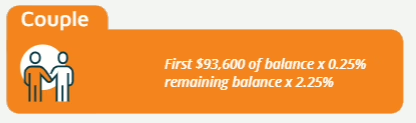

Income Test Your assessable income must be less than $99,025 if you’re a single person, or $158,440 if you’re a couple.

How is income from an Account Based Pension assessed?

As Seen On