We believe all Australians deserve to enjoy their best possible retirement

We help make this possible by providing financial guidance and support throughout your retirement journey.

Get advice and support for your big decisions

Our financial advisers provide affordable financial advice, one issue at a time.

Everyone has questions, issues and challenges when it comes to retirement. Which is why we’ve created our cost effective, and easy to try, advice services.

We will give you the knowledge and tools to take the right steps, and avoid common mistakes, so you can maximise your entitlements and manage your retirement finances with confidence.

Application support

Government entitlements are an important foundation for most Australian’s retirement.

So we have simplified the process to get, keep and maximise your Centrelink entitlements.

Our team has handled thousands of claims for the Age Pension and Commonwealth Seniors Health Card. Their knowledge and experience will ensure your claim is prepared on time, correctly and is approved as quickly as possible.

Our team can then guide you through your retirement journey step-by-step. We can help you get the Age Pension or Commonwealth Seniors Health Card. We can also provide assistance for life’s big financial questions to put your mind at ease and you in control.

Will the changes to super affect your overall income?

As reported last week, in a surprise announcement on Monday 13 October, the Treasurer Jim Chalmers announced major changes to his...

New Aged Care changes: Staying at home under the new system

Big changes are coming to Australia’s aged care system on 1 November 2025, especially for those of us who want to stay in our own homes as...

Do you need to tell Centrelink about a gift?

When we shared an update article on gifting rules it sparked plenty of follow up questions from our members. Retirement Essentials Head of...

Licensed, professional

service

Our team of Retirement Experts are ready to help.

Confidential &

Secure

Get personalised help in a safe online environment.

Australian

Owned

We’re 100% Australian owned & operated.

Retirement Essentials is the smart way to apply for your Age Pension

At Retirement Essentials we’ve simplified the process to make it easy for senior Australians to get and keep their Centrelink Entitlements.

|

If you apply for the Age Pension directly to Centrelink yourself, here’s what you can expect:

Retirement Essentials provides an easier Age Pension application service:

|

Why use Retirement Essentials?

Be confident that you’re getting all your Age Pension entitlements.

Feel supported and in control of your money, Age Pension Specialists are waiting to help you.

Saves you time – Apply from the comfort of your own home and at your pace.

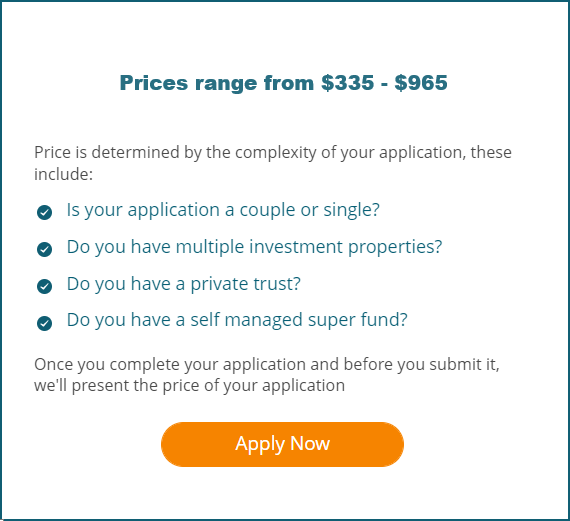

Learn how our Age Pension Service works in 3 easy steps

As seen on

Simple online process

Simple online process