Age Pension eligibility rates, assets test and income tests in 2025

All you need to know about

The Australian Government updates the Age Pension asset and income tests three times every year. So it’s important to keep up to date, check your eligibility and ensure you are getting all your entitlements.

The Age Pension provides core funding for about seven out of ten Australian retirees. Currently around 8 in every 10 people over the age of 65 receive some level of age pension.

The stated intention of this entitlement, according to the responsible department, the Department of Social Services, is to to support the basic living standards of older Australians who meet age and residency requirements.

Yet many of those who receive a pension can find it difficult to keep up with frequent annual changes to rates and entitlements, whilst the timing of these changes can also seem unexpected. Additionally, those who miss out on an Age Pension are sometimes left in the dark as to why.

Today we share an overview of the rates, dates and main rules so that you can keep on top of your own entitlements, share this information with loved ones and friends, and follow-up if you have any concerns that the rules have been mis-applied in your own situation. This article will give you an overview of:

- How the Age Pension is calculated

- The income thresholds – How much you can earn before your pension is affected

- The asset thresholds

- The current Age Pension rates

- When Age Pension rates change each year

- When the asset and income thresholds change each year

- Other changes that could occur in 2025 that could impact the Age Pension including the end of the work bonus extension.

How is the Age Pension Calculated?

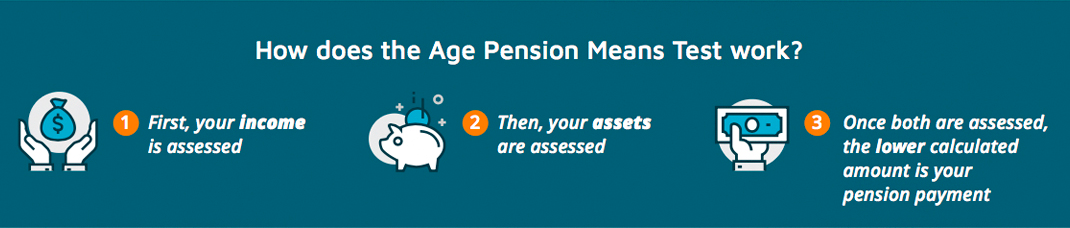

Centrelink, as the delivery agency for Services Australia, calculates your entitlement based upon a means test. There are two separate parts to this assessment – the income test and the assets test:

How much income can you earn?

Knowing how Centrelink calculates the Age Pension will help you to understand the questions they ask and why they need the information. Centrelink determines your Age Pension entitlement by assessing your income and your assets independently, which is referred to as the Means Tests. The Means Tests are there to ensure the Age Pension is targeted to those who need it most. Currently around 7 in every 10 people over the age of 65 receive some level of age pension.

Under the income test, how much income can I earn before I start to lose my pension entitlement?

| You are entitled to a full pension when your income is equal to or less than* | |

| Single | |

| $218 per fortnight | $5,668 per year |

| Couple | |

| $380 per fortnight | $9,880 per year |

*Your pension amount starts reducing by $0.50 for every $1 your income exceeds above and does not include the work bonus

| You are not entitled to a pension when your income as assessed by Centrelink exceeds | |

| Single | |

| $2,575.40 per fortnight | $66,960.40 per year |

| Couple | |

| $3,934 per fortnight | $102,284 per year |

Centrelink assesses the income you generate anywhere in the world from:

- Employment, including part time, casual or seasonal work

- Rental property income

- Business incomes or profits

- Pensions or social security style benefits from other authorities

However, Centrelink does NOT assess the income you actually receive on your financial assets (e.g. bank accounts, shares, bonds, loans, superannuation, etc). To make the assessment process simpler Centrelink ‘deems’ (calculates) the income they include in the Income Test from your financial assets. The current deeming rates are 0.75% on your financial assets up to $64,200 (Singles) or $106,200 (Couples) and 2.75% on your financial assets over these thresholds.

| Deeming Example | Single |

| Bank account: | $5,000.00 |

| Term deposit: | $30,000.00 |

| Shares: | $50,000.00 |

| Superannuation: | $100,000.00 |

| Total Financial Assets | $185,000.00 |

| 0.75% on first $64,200 | $160.50 |

| 2.75% on excess over $64,200 | $2754.00 |

| Deemed Income | $2,910.50 |

IMPORTANT NOTE: The deeming rates are reviewed annually in July

| Deeming Example | Couple |

| Bank account: | $5,000.00 |

| Term deposit: | $30,000.00 |

| Shares: | $50,000.00 |

| Superannuation: | $100,000.00 |

| Total Financial Assets | $185,000.00 |

| 0.75% on first $106,200 | $259.50 |

| 2.75% on excess over $106,200 | $1827.00 |

| Deemed Income | $2,086.50 |

IMPORTANT NOTE: The deeming rates are reviewed annually in July

Assets Test

Centrelink uses different thresholds to assess assets for single homeowners, single non-homeowners, couple homeowners, and couple non-homeowners as well as those separated by illness or certain other reasons.

Here are the current thresholds

Under the assets test, how much assets can I have before I start to lose my pension entitlement?

| You are entitled to a full pension when your assets are equal to or less than* | |

| Homeowner (Single) | Non-Homeowner (Single) |

| $321,500 | $579,500 |

| Homeowner (Couple) | Non-Homeowner (Couple) |

| $481,500 | $739,500 |

*Your pension amount starts reducing by $3.00 for every $1,000 your assets exceeds above amount.

| You are not entitled to a pension when your assets exceed | |

| Homeowner (Single) | Non-Homeowner (Single) |

| $714,500 | $972,500 |

| Homeowner (Couple) | Non-Homeowner (Couple) |

| $1,074,000 | $1,332,000 |

Full Age Pension Rates

| Single | |

| $1,178.70 per fortnight | $30,646.20 per year |

| Couple | |

| $1,777 per fortnight | $46,202 per year |

IMPORTANT NOTE: all information is accurate from September 20 2025

When will Age Pension rates change in 2025?

The base rate of the Age Pension is recalculated every March and September. The new rates are published on or about the 20th of March and September. The base rate is indexed using a mix of three different measures; Consumer Price Index, Pensioner Beneficiary Living Cost Index and the Male Total Average Weekly Earnings. Here’s how indexation works.

When will Age Pension thresholds change in 2025?

The thresholds for the income and assets test are indexed and adjusted along with the rates in March and September each year. There is also an additional indexed adjustment in July.

When do the Deeming rates change?

These rates are reviewed by the Minister for Social Services and can change without warning.

The current deeming rates are:

- 0.75% on your financial assets up to $64,200 (Singles) or $106,200 (Couples)

- and 2.75% on your financial assets over these thresholds.

1 July Qualification for Age Pension

Since 1 July 2017, the minimum age for both men and women to qualify for the Age Pension began to increase. For men and women born on or after 1 July 1952 the pension age will reach 67 on 1 July 2023. No further age increases are currently legislated.

The above offers a brief summary of the main detail of the Age Pension.

Struggling to get on top of how the rules are applied in your particular situation? You’re not alone. Many Retirement Essentials members have been relieved to share their questions and concerns in one-on-one entitlement consultations with our friendly Customer Service Team or advisers.

We can help you determine if you are eligible to get the Age Pension or Commonwealth Seniors Health Card

Latest Centrelink & Age Pension Articles

Using Age Pension changes to your advantage

The Age Pension payment changes on 20 September could mean so much more than a few extra dollars. Here’s how to use this trigger to maximise your income sooner rather than later. As we advised late last month, 20 September will deliver a fortnightly $29.70 increase to...

Gifting and the Age Pension: What you need to know

Many people like to help family members financially. While gifting can be a meaningful way to support loved ones, it can also have unintended consequences for current or future Age Pension entitlements. Centrelink has strict rules on how much you can give away...

Is the Age Pension more valuable than you think?

What would you do if you won a lottery prize of $766,000? That's a life-changing amount of money for most people. What if you found out you could be entitled to even more – over $1.1 million? The good news is you don't need a winning ticket to receive that kind of...