“Start with the facts.” That was the motto of the government’s recently released review of the Australian retirement system. Don’t come up with policy recommendations; just give us the fact base to think about. A lot of the news media coverage of the review has been about policy implications. For instance, will the government back off on the promise to raise superannuation guarantee contributions from 9.5% to 12% of salary? But, I reckon it’s the treasure trove of information that might be most interesting to you. At 650 pages, the Retirement Income Review is a hefty report. We’ve waded through it for you to highlight some key learnings about how Australians retire.

One of the key topics is Adequacy – do people have enough in retirement? The review looks at that a number of ways.

First, good news:

- Australian retirees (65+) generally have higher levels of “financial satisfaction” than younger Australians (45-65).

- Retirees are less likely to be in financial stress than working-age households. About 11 per cent of retirees are in financial stress, compared with 16 per cent of working-age households.

- The Age Pension is a critical pillar of the Australian Retirement Income System and makes a big contribution to the welfare of Australian retirees.

- About 60% of single households (and 50% of couples) are on the Age Pension at eligibility age (currently 66) but that rises rapidly as people age. For 85 year-olds, about 85% of single people and 70% of couples receive some Age Pension. Overall,for those over 65, 71% are on some pension payment

- For many retirees, the Age Pension provides a higher level of income than they receive during working life after adjusting for tax. For example, the maximum-rate Age Pension is higher than wages for 21 percent of people, and 15 percent of households, aged 25-64.”

- The Age Pension has increased faster than average wages since 2009.

- While there’s a lot of worry-talk in the media about the Age Pension being unaffordable for the government, due to the ageing of the population, the Review paints a different picture. The cost of the Age Pension is currently about 2.5% of GDP and it’s expected to stay very close to that level through 2060. That looks sustainable.

- Australians’ high home ownership levels support financial adequacy in old age. The costs of home ownership is generally significantly lower as a percentage of the household budget than housing costs for renters.

- Government and other concessions to retirees also help out by reducing out-of-pocket expenses. The value of Health, Aged Care and other support services are often underestimated but they are substantial. For example,the Pensioners Concession Card and Commonwealth Seniors Health Card give card holders access to subsidised pharmaceuticals and bulk-billed medical appointments. And tax paid by retirees is low on average due to a number of favourable concessions for retirees, including account based pensions, the benefits of franking credits, and various tax offsets, like the Seniors and Pensioners Tax Offset.

- Superannuation is increasingly supplementing the Age Pension, as the compulsory savings system matures since its birth in the early 1990s.

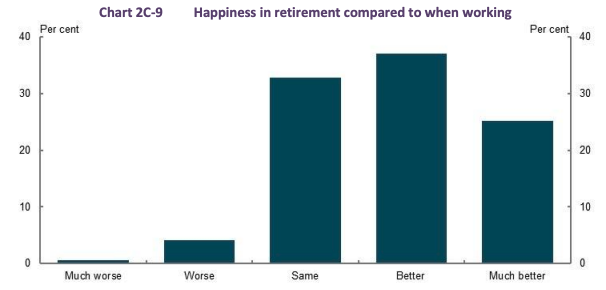

This chart shows overall happiness among retirees in a 2015 survey, which suggests retirees are a pretty happy bunch:

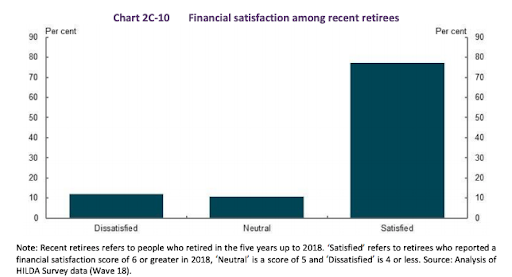

And this chart from a 2018 survey shows recent retirees nearly 80% content from a financial perspective.

Now, for some not so good news:

- Not everyone in the retirement system does well. “In particular,” the Review says, “the retirement income system does not appear to be delivering an appropriate minimum standard of living for renters and many who retire early.” Significant portions of these groups (25% or higher, compared to 11% overall for retirees) register financial stress.

- People who rent are not sufficiently compensated by Commonwealth Rent Assistance or the differential in the Age Pension for renters vs homeowners.

- Many people end up retiring early, and often not by choice but due to changing work circumstances or health issues. These people are also more likely to feel financial stress.

- There clearly remain many retirees with low incomes. The retirement system does not make the poor rich nor remove all the inequity in financial wherewithal. However, the means testing of the Age Pension does make a big difference in reducing overall inequality among retirees.

What do you think?

The question of whether we have enough is very subjective. “More is generally better” but “as long as we have enough, that’s fine” is a strongly-held Australian attitude. At least I think so.

One way to make sure you have enough is to stay on top of your Age Pension entitlements. As the Age Pension is so central to our Retirement Income System, it’s best to know how it all works and keep your eye on your entitlements. You can do that here.

How would you compare your overall wellbeing and happiness in retirement to when you were working? Are you much happier, or perhaps you think you are worse off. Let us know what you think by commenting below.

Definitely enjoy retirement. Do not miss work. Have always lived within our means and our actual annual budget hasn’t changed (although living costs have definitely gone up) in the past 10 years.

Not smoking, being a social drinker also helps.

Has the proposal for a “non-means” tested pension for over 65’s been forwarded to the Government? If it has, what was the response?

The taxes that have been paid by the those who have worked till past 70 years at age could be enormous. They are contributing to the Government in being self-funded retirees but shouldn’t the Government recognize this by giving a minimal pension. The Government could also allow them to be considered “Pensioner status” which helps in paying for utilities, car registration, etc. The Commonwealth Seniors Health Card does not offer any benefit in this respect.

Well said Beck Lee

I totally agree with you

At least some benefits can be given to people who have contributed to the Government via the tax system

Totally agree, Beck Lee.

I enjoyed my work & with good support was able to continue to 74. I will be eternally grateful as we have no financial concerns & can do pretty much anything we want . Had I retired at 60 or even 65 I believe our situation would be quite different. I appreciate not everyone can or indeed wants to work on , but I’m so glad I did.

Agree, self funded retirees over the age of 65 should receive the benefits of an aged pension, not payment, but benefits

Agree with Beck Lee’s comment. I also had an uncertainty that if we disqualify for a Pension payment on the grounds of a Means test, after holding Pension Status for a while, would we loose the “Pensioner Status” as well?

Many retirees or people ready to retire, are constantly bombarded with the “bad news” about how much you should have to live on in retirement. This creates depression and further feelings of inadequacy. How about instead of telling us the “bad news” you write some good articles about how to overcome the obstacles of having less money. Suggestions could include the mortgages taken out, or the choice of moving to a less expensive area or even how to get discounts on products.

Stop telling us the “bad news” and think of the effect you are having one us!!!

Thanks for the comment, Kimberly. Appreciate the feedback. Certainly, can do that. It’s great to know from the Retirement Income Review that most retirees are actually quite satisfied in retirement and have less financial stress than younger folks.

Every one after the retirement age should get the pension after the income or and asset test.

Just save enough to be self-sufficient dealing with Centrelink is a nightmare even for a very tiny amount of pension. If you have nothing you are ok. People with a few dollars are treated like criminals while the pre Covid bludgers just keep on getting the dole. The system is broken and financially unsustainable.

I agree with Beck Lee. Since I have worked hard until I turned 65 and made so many sacrifices and now that I am unable to work due to health reason. More products should be added to Commonwealth Seniors card rather than just discount on medicine etc. I will be happy to work part time just to pay my bills but employers not considering older folks. We all have financial stress due to high cost of living.

Yes, agree totally with you, Sandra, I lost my job and not yet of pension age (62) and I would also be happy to work part-time or full time even to pay bills but employers are not considering older people despite their wealth of experience and knowledge. I think this is discriminatory and kind of an “unwritten” policy by most companies/employers.

Is the notion of ‘saving for a rainy day’ going out of fashion? It is really important to rely on yourself when you can, and that will hopefully ensure a pool of resources you can draw on during retirement. I worry that whilst ever the government is there to support people, they won’t try to build a nest egg. Could the government give some sort of incentive to people who actually save and put themselves in a manageable position?

Hello Jeremy,

The last time we discussed “what I think” may have been in 1969 as we shared the speech night podium at TGS. Thoughts of retirement were far in the future as they are now still. So after 40 years largely in Finance like yourself, my thoughts in relation to retirement and specifically adequacy thereof are here:

1. Do not retire…. I have not.. I still seek contracts and have been surprised at the ageist discrimination, but yet ability to get the odd contract.

2. The rules relating to the aged pension eligibility and superannuation are complex, but navigable and using software and appropriate communication with all authorities and expertise provided by organisations like retirement essentials when required.

3. Adequacy – How much for How long? – Rule of thumb – for comfort 60,000 indexed 2% till you are 80 – Single 40,000 similarly indexed till age 80. Why 80? You are not crashing too many discos after 80 doing bee gees karaoke.

4. Finally when the contracts dry up… The plan is to live on a property growing produce and selling it by the roadside… Never retire.

As a self-funded retiree about to turn 65, I like many others have watched my superannuation nestegg dwindle by around 10% over the past 12 months. I have significant health issues, requiring treatment with several prescription medications, all of which must be purchased at full price as I will not qualify for either the seniors health card or part-age pension for another 18 months. Money is tight! Is there anything that can be done for those individuals and couples who fall between the cracks!?

I am not enjoying forced retirement. My Filapina partner works hard part time, The money she gets is hers as its the first time she has been able to have any money. And I am happy for her, however I am only receiving less than $100 a week from centerlink because of this. I have next to no super and still paying off our house.

I am 72 my husband 74. I have bone cancer; my husband has had open heart surgery and a stroke. I work one day weekly; my husband was contracting one day weekly until the end of last year. We receive a part pension. The recent raise in costs mean we are trying to hang on to our house we’ve had almost 20 years. It’s all working – but barely. Should inflation rise further, our situation would be quite challenging. We don’t drink, eat simply (vegetarian 50 yrs.), and no holidays. Gratitude sustains us, but certainly would find further financial squeezing to be unsustainable.