Age Pension Benefits Calculator

Benefits of the Age Pension

The Age Pension primarily provides regular fortnightly payments to support the living expenses of eligible older Australians. To qualify you must be at least 67 to be eligible for the Age Pension. In addition to these crucial payments, recipients can access valuable extras which includes:

Pensioner Concession Card (PCC) – provides access to discounted healthcare, medicines, and public transport.

Pension & Energy Supplements – Designed to help with everyday expenses, such as utility bills, phone and internet costs, and medical expenses.

Rent Assistance – If you’re an Age Pension recipient and pay rent, you may be eligible for Rent Assistance, which provides financial support to help with rental costs.

Additional Support – There are also many other forms of support that can be linked to receiving the Age Pension, such as help with medical equipment costs, and also help with deductions for bills.

Age Pension Payment Rates

| Per Fortnight | Single | Couple combined |

| Maximum basic rate | $1051.30 | $1585.00 |

| Maximum Pension supplement | $83.60 | $126.00 |

| Energy Supplement | $14.10 | $21.20 |

| Total | $1149.00 | $1732.20 |

Rent Assistance

| Family Situation | Maximum payment per fortnight |

| Single | $212.00 |

| Couple | $199.80 |

Which Age Pension and Commonwealth Seniors Health Card benefits and entitlements you are eligible for?

Age Pension Benefits

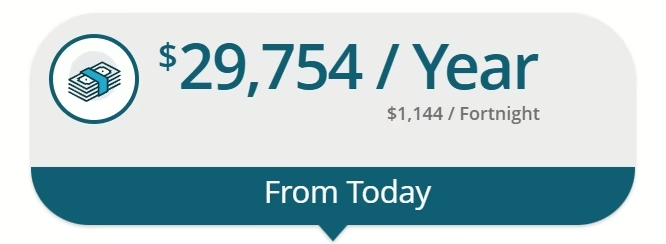

Determining your Age Pension benefits can be complex. Retirement Essentials offers a user-friendly Age Pension Benefits Calculator. This tool simplifies the process, providing a quick and personalised estimate of your potential entitlements in under five minutes.

Use our free Age Pension Benefits Calculator

Age Pension Eligibility Rules

To qualify for the Centrelink Age Pension you must pass both the Income and Assets test and meet the minimum age and residency requirements.

Age is the first requirement. You must be at least 67 to be eligible for the Age Pension.

Residency – You don’t have to be an Australian citizen to qualify for the Centrelink Age Pension. But you must have been a Permanent Resident for at least 10 years AND have lived in Australia for at least 5 years of those 10 uninterrupted (excluding short holidays).

Income Test Your assessable income must be less than $65,260 if you’re a single person, or $99,746 if you’re a couple.

Asset Test – If you’re a home owner, singles can have up to $697,000 and couples $1,047,500. If you’re not a home owner, singles can have up to $949,000 and couples $1,299,500