Age Pension Eligibility

Age Pension Eligibility

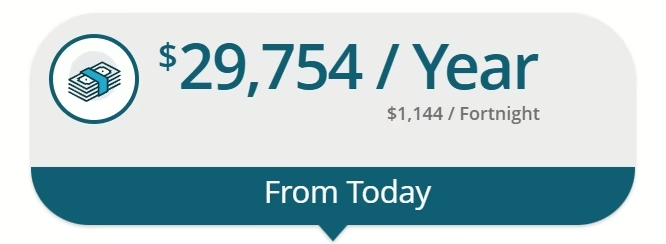

Determining your Age Pension eligibility can be complex. Retirement Essentials offers a user-friendly Age Pension Eligibility Calculator. This tool simplifies the process, providing a quick and personalised estimate of your potential entitlements in under five minutes.

Are you eligible for the Age Pension?

Superannuation & Age Pension Eligibility

To qualify for the Centrelink Age Pension you must pass both the Income and Assets test and meet the minimum age and residency requirements. Your superannuation balance directly influences your Age Pension eligibility through the assets test. While it doesn’t disqualify you outright, higher super balances can reduce or eliminate your Age Pension entitlements.

Income Test – Your assessable income must be less than $65,416 if you’re a single person, or $99,954 if you’re a couple.

Asset Test – If you’re a home owner, singles can have up to $704,500 and couples $1,059,000. If you’re not a home owner, singles can have up to $962,500 and couples $1,317,000

Age is the first requirement. You must be at least 67 to be eligible for the Age Pension.

Residency – You don’t have to be an Australian citizen to qualify for the Centrelink Age Pension. But you must have been a Permanent Resident for at least 10 years AND have lived in Australia for at least 5 years of those 10 uninterrupted (excluding short holidays).