Commonwealth Seniors Health Card Eligibility Calculator

Our Calculator will assess your eligibility for the Health Card and Age Pension

Eligibility for the Commonwealth Seniors Health Card?

To meet the Commonwealth Seniors Health Card eligibility requirements you need to meet specific age, income and residency criteria

Age is the first requirement. You must be at least 66 and 6 months. Note that this age requirement will increase by 6 months every 2 years until July 1, 2023, when it will be 67 years.

Residency – You must be an Australian Citizen or Permanent Resident. Permanent Residents may need to wait up to 4 years to apply.

Income Test Your assessable income must be less than $101,105 if you’re a single person, or $161,768 if you’re a couple.

“How’s the income from my Account Based Pension Assessed?”

Interested in applying for the Commonwealth Seniors Health Card?

Check Your EligibilityNeed assistance with your eligibility?

If it all sounds too hard, there are many ways that Retirement Essentials can help you to get a Commonwealth Seniors Health Card.

As with the Retirement Essentials Age Pension Entitlements Calculator, we are committed to keeping the Commonwealth Seniors Health Card calculator up to date with any and all changes. So rest assured, we are always first to reflect the new thresholds as soon as they become law. And we make sure that you are alerted to any changes in our regular weekly emails.

Who can apply for a Commonwealth Seniors Health Card?

To be eligible you must meet the following conditions:

- be over the Age Pension age

- meet residence requirements (physically present and living in Australia when claim is lodged, or holding a special category visa holder)

- not be receiving a payment from Centrelink or the Department of Veterans’ Affairs

- supply a Tax File Number (or have submitted a notice of Non Lodgement to the tax office as evidence that you are exempt from having to lodge a tax return)

- meet identity requirements

- meet the income test by having an annual Adjusted Taxable Income (ATI) less than the threshold. Adjustable Tax Income includes taxable income, taxable foreign income, net investment losses, employer provided benefits and reportable superannuation contributions. This information must be from one of the two financial years prior to the year in which you are lodging your claim.

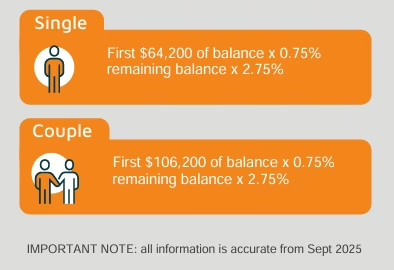

No asset test

Whilst there is no assets test on the Commonwealth Seniors Health Card, deemed income on Account Based Pensions is included in the income assessment. Both account based income streams and account based annuities are subject to this deeming, at the current deeming rate. This amount is then added to your ATI. Other financial assets such as shares, money in the bank, super in accumulation is completely exempt.

Do couples both need to apply?

Yes, the Commonwealth Seniors Health Card is awarded to an individual, so both you and your partner will need to apply. If one or the other is not yet the required age, that does not stop the older member of a couple from applying.

Interested in applying for the Commonwealth Seniors Health Card?

Check Your EligibilityEligibility thresholds for the Commonwealth Seniors Health Card

The new income thresholds, that come into effect from the 1 July 2025 are:

- $99,025 a year if you’re single

- $158,440 a year for couples

- $198,050 a year for couples separated by illness, respite care or prison.

Note that there is an additional $639.60 per year for each child in your care. Speak to us about the rules and criteria that apply in this situation.

No assets test applies

Whilst there is no assets test on the Commonwealth Seniors Health Card, deemed income on Account Based Pensions is included in the income assessment. Both account based income streams and account based annuities are subject to this deeming, at the current deeming rate. This amount is then added to your ATI. Other financial assets such as shares, money in the bank, super in accumulation is completely exempt.

How the income test for the Commonwealth Seniors Heath Card is applied

The criteria for the Commonwealth Seniors Health Card income test is reviewed and updated on 20 September each year in line with the Consumer Price Index. So if you are not eligible currently, this may change in the future. This test considers both your:

- adjusted taxable income

- a deemed amount from account based income streams.