What are deeming rates?

The way they work is that Centrelink determines that your financial assets are deemed to earn a certain rate of return, regardless of what they actually earn. This return is used to assess your eligibility for entitlements such as the Age Pension. Financial assets that can have deeming rates applied can include:

- savings accounts and term deposits

- managed investments, loans and debentures

- listed shares and securities

- some income streams such as account-based pensions

Many seniors feel hard done by with deeming rates as their money is often invested in savings accounts and term deposits which typically don’t generate the returns Centrelink “deems” they do. Essentially you are deemed to be earning more than you actually are and this can affect your entitlements.

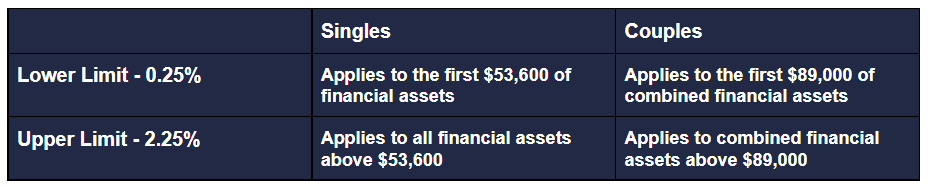

In May 2020 some steps were taken to help redress this issue. The lower threshold rate was reduced from 1% to 0.25% and the upper threshold rate from 3% to 2.25%. This was great news although many claim they are still too high.

This year the Government has made a further, albeit small, adjustment to the threshold limit effective from 1st July 2021. The following table gives all the current rates and thresholds.

The lower the deeming rates, and the higher the threshold the better off seniors will be under the income test.

So do deeming rates seem about right to you? Perhaps you are earning a little more or maybe not as much. We would love to know what you think. Please add your comments below.

Still way too high. I would just love to know where I can get 2.25% interest on my investments

Check http://www.latroberfinancial.com.au

Their investment rates are good.

We have just had a reduction of $126 from our fortnightly pension. As we have bought shares in the past year that have done well even though we have not sold could this be the reason. Nothing else has changed

Thank you for advising the new Deeming Rates.

Together my wife and I have more than 89.000 in safe bank deposits earning less than 0.25%pa but our main assets are our pension funds where our capital growth and dividends have been around 5% in the last financial year. So we are quite happy with the new rates.

Perhaps we should have a pension of $30k per annum paid to every person who has worked there & paid tax (irrespective of how many assets or millions one has)

I totally agree. Currently you are effectively penalised for saving hard during working life. Very much a disincentive!

to whom it may concern.

Me and my wife have about $290K invested in two listed shares. these two companies are developing miners that are not in production and mines that are not yest built.

My question is. Would Centrelink deem this $290K which does not earn a return still apply the rule?

Kind Regards

Geoff & Bev.

Centrelink will still apply the deeming rates as your shares will be treated as a financial asset

Deeming rates suck, the threshold should be based I what you actually gain. Better still give everyone over 65 a pension and do away with all the bureaucratic nonsense!

The whole concept of deeming rates and means testing your age pension here is just morally wrong. You as an individual contribute to your super for most of your working life , it’s your money even though your employer pays it either as an addition to your salary or included in a total salary. Now that you have retired and your fund is giving you your own money back the government still want to grab a slice of it back. The whole pension system in Australia is I believe purposely designed to be over complicated and unwieldy. The entire system should be thrown out and replaced with a simple one. IE this is your age pension , no if’s no but’s , no if you have this saved we dock this etc. There needs to be a separate pension fund like Medicare instead of it all coming from the general tax pool. This is how they do it in UK and there you get a pension based on how many years you have contributed to the system ( IE paid tax ) , it is NOT means tested so no matter how much you may have saved for your retirement you still get a full ( if you contributed the full number of years and pro rata if not )state pension because you have paid for it via tax.

A civilised society would have an age pension. Australia does not. It spends $600million in administering the assets & income test to reduce pensions by $150million !!! Go figure.

Pensions are not a cost. They do not impact the Common Wealth of Australia. They do not appear in the nation’s Balance Sheet. They only appear in the Financial Statement (the annual cash flow). They are paid fortnightly & spent fortnightly, returning to the Gov a/c as GST, creating jobs which pay income tax. It takes less than 7 weeks to return to the Gov. They are a short-term loan !!

Sure you’ve had it before but, why am I penalised for being efficient at saving. Those under $89,000 savings are better off on pension than those who worked their insides out to have a nest egg.

Very unfair system that actually disincentivises everybody.

It’s the Robin Hood system of stealing from the (rich) or responsible as I believe they should be called and giving to the poor ( or lazy as I believe they should be called )

I here youths saying they won’t bother saving because you are penalised if you do – their opinion is to live off the tax payers.