What is assessed as income?

Working out your income for the Centrelink income tests isn’t as simple as looking at your payslip or a bank statement. Your total earnings from various sources, including what is known as “deemed” income, needs to be included. Deemed income is particularly tricky as it based on the income your financial assets are assumed to earn, rather than what they actually earn. The assumptions Centrelink applies are known as deeming rates.

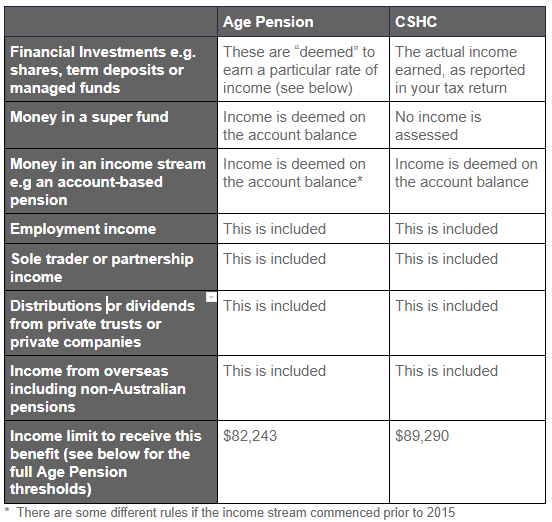

To complicate matters further slightly different rules apply to the Age Pension and the Commonwealth Seniors Health Card (CSHC). If you don’t qualify for the Age Pension you might still be eligible for the CSHC as there is no assets test and the income threshold is higher.

The table below gives a summary of how income is treated for the Age Pension and the CSHC.

What are the deeming rates?

The current deeming rates are 0.25% on your financial assets up to $53,000 (Singles) or $88,000 (Couples) and 2.25% on your financial assets over these thresholds.

Our eligibility calculator includes all the latest rules and deeming rates and can assess whether you are likely to be eligible for the CSHC or Age Pension and how much pension you are eligible to receive. You can check your eligibility here.