What would you do if you won a lottery prize of $766,000? That’s a life-changing amount of money for most people. What if you found out you could be entitled to even more – over $1.1 million? The good news is you don’t need a winning ticket to receive that kind of financial boost. You could be entitled to that much if you receive a full Age Pension.

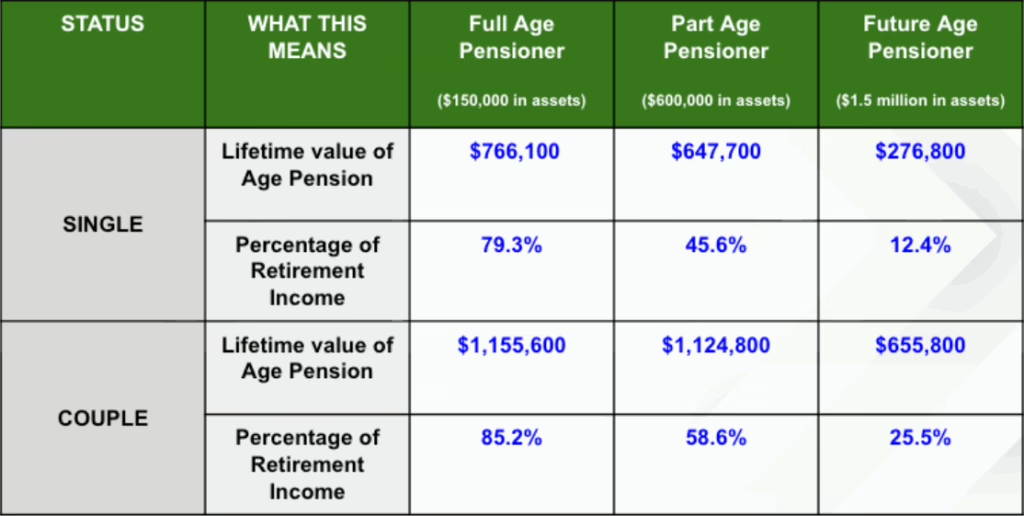

While the Age Pension may not feel like winning the lottery – because you receive it in a stream of fortnightly payments – for many Australians, its lifetime value is equivalent to a very high lottery payment. In fact, as the table below shows, the lifetime value of the Age Pension –calculated to age 92 – for a full single recipient is $766,100, and for a couple, it’s a staggering $1,155,600. This isn’t just a small supplement; it can represent a huge portion of a person’s total retirement income. For someone receiving the full Age Pension with $150,000 in assessable assets, Retirement Essentials estimates show this might represent 79% of lifetime retirement income.

You don’t have to qualify for a full Age Pension to get enormous lifetime value out of this vital benefit. Again, we can calculate that a couple with $600,000 in super assets at age 67 will get over $1.1 million in inflation-adjusted income over the course of their lifetime to age 92. And that represents about 59% of their expected retirement income.

Even someone who doesn’t get the Age Pension now, perhaps because their current assets are too high, can still expect very substantial payouts over their lifetime. In the table, you can see the examples of a single and a couple with $1.5 million in assets who aren’t currently eligible. But as they spend down their super in retirement, they will become eligible. And the single might get $277,000 of lifetime benefits and the couple might get $655,800. (As my late mother used to say: ‘better than a poke in the eye with a sharp stick!’ and ‘all contributions gratefully received!’)

Sometimes it’s hard to appreciate how much lifetime value you will get out of the Age Pension. It often starts in a small way for those on a part Age Pension. But as you spend down your super to fund your retirement, you become eligible for higher payments and it becomes a very significant part of your retirement income. You can use the free Retirement Essentials Age Pension Eligibility Calculator to see how this works, by simply varying the amount of super assets you input.

The numbers clearly show the incredible financial security the Age Pension provides. However, just like any other major prize, claiming it isn’t always easy. For many, the process of applying for the Age Pension through Centrelink is a major barrier. It’s often complex, confusing, and frustrating. You can also easily supply information in the ‘wrong’ way – and miss out – even though you are eligible.

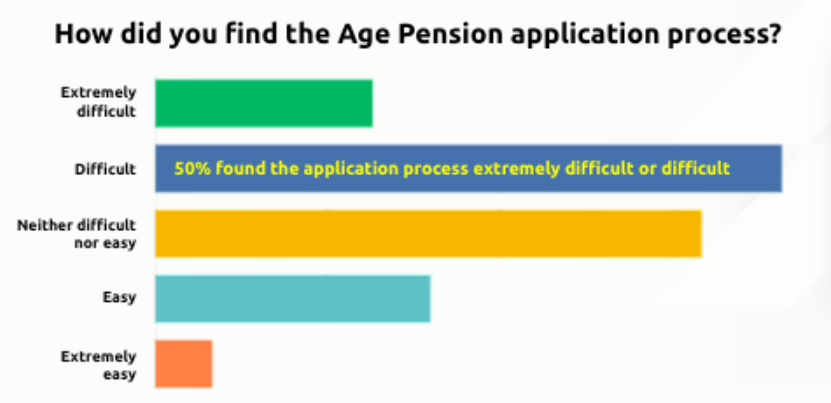

As the survey data below reveals, the Age Pension application process is a major pain point for many.

Source: Link Group Retirement Reality Survey, 2022

An incredible 50% find the Age Pension application process either difficult or extremely difficult. In another survey question, consumers said 60% found Centrelink difficult to deal with. This shows that while the Age Pension is extremely valuable, the complexity of the application can deter people from getting what they deserve.

This is where Retirement Essentials comes in. Our team understands that navigating the Centrelink system and the Age Pension application process can be really challenging. Retirement Essentials’ mission is to simplify this for you, so you can confidently apply for and receive the benefits you’re entitled to without the stress and frustration.

Another key survey finding was that many people put off applying for the Age Pension, often because of the difficulty in the process. 56% applied late, with about one third applying over a year late. As there’s no back pay on the Age Pension, that’s a very expensive delay.

It’s important not to let the complexity of the process prevent you from claiming a benefit that could be worth hundreds of thousands of dollars to you over your retirement. Retirement Essentials customer support and advisers are here to help you secure your financial future and make the process of obtaining the Age Pension as smooth and easy as possible.

Want to explore how the Age Pension fits into your retirement picture?

A Retirement Essentials Retirement Advice Consultation can help you understand your entitlements and unlock the value of your Age Pension.

Here are a few questions to consider:

Did you realise the full value of a lifetime’s Age Pension entitlements?

If you are already receiving a benefit, did you apply on time?

Yea applying through Centrelink was very frustrating mainly because you don’t have a case manager and items uploaded as requested are not followed up until you call. This can also be a 75min hold in the phone.

The other main benefits are the cheaper medicine, free registration and car licence, money off Council rates.

So is was worth the 7 months it took to navigate through Centrelink

It is important to note that you can apply for the Age Pension up to 13 weeks before turning 67. This can help to avoid payment delays. If it takes more than 13 weeks the pension is back paid to the date you turned 67. It really pays to go through the checklists to make sure you have all of the documentation necessary before this time.

Whilst not part of the discussion, for those under 67 and not earning a lot of work income, it can also pay to see if you are eligible for a LIHCC (low income health care card). This can often result in very similar discounts on energy, water and rates, that you would receive with a Pension Concession Card When I last checked you can have up to $2.5 million in super assets, bank, shares etc and still qualify.