This week one of our team, Mikahil Walden, pointed out an anomaly in the Age Pension thresholds that really disadvantages one group of people. And in the midst of a national housing crisis it’s renters that are missing out.

So what’s going on?

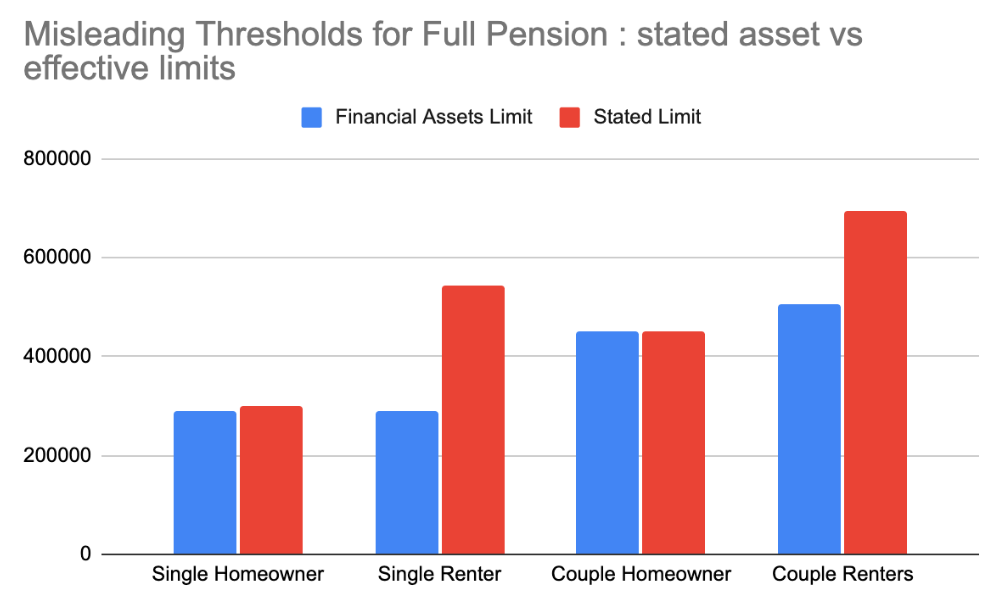

The recent release of the new Age Pension rates and thresholds has highlighted yet again a major inequity in our system. Many that don’t own their own home, particularly singles, are being disadvantaged by income and asset thresholds. Services Australia says a single nonhomeowner can have $544k in assets and still get the Full Age Pension. Mikhail’s analysis shows that in some circumstances the real impact of the asset threshold for a single person renting their home cuts in at just over half – 53% – of what the government and its agencies promote.

Couple nonhomeowners also can’t have all the threshold asset total in super to get the Full Age Pension. They can only have $505k of the $694k threshold, or 73%. Meanwhile, couple homeowners can have their entire limit in financial assets without impacting their pension, and single homeowners are only marginally impacted.

In theory renters have higher asset thresholds for the Age Pension than homeowners. This is in part to compensate for the family home being exempt from the asset test and also recognises renters will have a higher cost of living – they have to pay rent – than most homeowners. But in reality many don’t receive the benefits of those higher thresholds. This is because they are subject to both the income and asset test when assessing their entitlements. And their financial assets are subject to deeming so even if they are under the assets test limits those same assets can cause them to lose some of their entitlements due to the deemed income. The following chart shows what is happening in reality.

You can see the stated thresholds in red, but in blue the actual thresholds when those assets are held as financial assets. It’s misleading and unfair. And it could lead to perverse outcomes where a renter might “invest” in non deemable assets such as cars just to get more Age Pension. It’s probably not a good idea and I doubt it’s what the government intended.

So should something be done to redress this? The whole point of giving renters a higher threshold is to recognise the disadvantage they have relative to homeowners and give them a chance to get a comparable standard of living. Renter retirees face two major disadvantages compared to homeowners

- higher outgoings because their rent is a huge portion of their budget; and

- they don’t have a home as a source of capital in the future.

For single renter retirees, deeming eliminates the potential advantage of higher thresholds.

The thresholds are hard to understand, and sometimes even harder is getting those thresholds to work for you, not against you as is sometimes the case. A good first step is to check your entitlements on our free Age Pension calculator. And then if you think you might be able to get some more you can consider booking a maximising entitlements consultation with one of our advisers.

So what is your view? Should more be done to address the anomaly that the system doesn’t appear to be working the way it was intended for renters? Or perhaps you are happy with the way the thresholds are working. Let us know what you think.

If I decide to drink,gamble,smoke go over seas fro annual holidays and not look towards purchasing a house etc for my long term need. Should I be entitled to a more generous pension.

Maybe the Govt rules should look at the spending history of individuals rather than just the current circumstances

I totally agree with Graham.

I’ve got family members like you !! Public “service” jobs their entire life dedicated to squirreling away as much as possible and now bleating that they get nothing. Bah !!!

Spoken like a fully funded retiree, jealous that he is not getting a govt handout…

Divest yourself and go on the pension see how you like it….

I am a SFR and am definitely NOT jealous that I am not getting a government handout. I am much happier living on my own money and not being accountable especially when it comes to gifting and also don’t have to think about the deeming rate.

But to get to where I am I did have to do without to put extra money into my super. I also didn’t drink, gamble or smoke.

I made the conscious decision that either I lived for today or saved for tomorrow and chose the latter. This was partly due to having seen people struggling financially and not wanting to do the same.

For most fully or partly funded retirees, to accumulate the assets that preclude them from a pension, they worked and paid taxes. Once those taxes were partly to fund the age pension and many older people still think that way, but in 1992 when the super guarantee started in Australia, it meant that eventually (say by 2032) many fewer people would get the age pension so not only would it cost the government less but people would have much more than the pension amount – so a win-win.

I accepted a very long time ago that I would not ever get a pension so it does not enter my head to feel resentful that I don’t but nonetheless I can understand why many hardworking taxpayers who don’t get one can say that it is unfair that people who did not look after their finances so well do. However we choose to live in a country that uses this welfare system and there is not enough in our budget to pay a universal pension.

One can do all the saving you like but life is like a Christmas tree. Give it a good rattle and some ornaments will fall off and break !! A divorce and a couple of redundancies ( private sector no payout ) will soon blow holes in the best of plans. Good luck to those who hit the pension age finishing tape in good shape. Not all of us do !!!

Exactly! Wasteful practice has led to overspending and reckless Planning for independence in retirement. Cautious, careful folk should not be disadvantaged. They are after all whilst not paying rent, are paying the equivalent, insurance and rates and ongoing maintenance. The rent payer’s costs are often considerably less.

While the exceptional increases in the costs of home buying and the consequential increases of rents makes affordability an issue for those caught out. It’s obvious the pension compensation isn’t up to the task. But the consequences for those still paying mortgages while living on the age pension isn’t a walk in the park either. And further one can’t just walk away like I believe one can in the USA. Yes many “home owners” might be in a position to be able to sell and possibly move to another place but every move is facing similar price rises. All home “owners” (and I use that term lightly) are faced with increased local and state government taxes (Rates) coupled with increasing house (building) insurances. Not to mention ongoing maintenance costs. None of us are actually looking at “fairness” in this regards

Thanks Peter and I completely agree. Its defintiely no walk in the park for homeowners with a mortgage either. That situation you mention in the USA was sometimes termed “Jingle Bells Mail” where some people simply mailed the keys back to the bank and walked away from their home and mortgage.

Graham.

Doing that is gonna be hard and would require another army of public servants. That is “look at the spending history of individuals”.

SFR’s are the ones that are victimised and disadvantaged

But basically agree with Graham re . “drink,gamble,smoke go over seas”

The responders have provided an excellent coverage of the pros and cons of home ownership Vs non home ownership.

My wife and I are currently preparing for retirement by “simplifying” our home, garden and pool for our pending old age so that we can maximise the years that we can stay in our home without over burdening our kids. The cost burden of home retention and maintenance is still significant when living off super and pension entitlements even if the mortgage is cleared.

Yes we have the option to sell up, downsize and cash up but I’m sure most parents want to leave what they can for their children.

There are deeper issues with pension entitlements. Citizens that have paid tax all their life should be entitled to the pension irrespective of their wealth. People who chose to spend their income having fun etc should only be entitled to the minimum pension level and allowed higher income level at retirement. People who are disadvantaged physically/mentally should be supported to moderate-high level pension support.

I understand that people renting are at a disadvantage to homeowners. But there are many factors to the equation and it seems simplistic to make direct comparisons. For instance often homeowners have had to make many years of personal sacrifice to become /remain home owners. Owning a home unit involves quite expensive ongoing and at times high special levies for unseen events. Insurance on houses/ units has become increasingly expensive and sometime seems exorbitant. Renters have mostly only rent to pay whereas homeowners have expenses coming at them from various directions.

I think the current set up with considerably higher asset allowances for renters vs owners is reasonably equitable as it stands.

We are two teachers who subscribed the maximum amount to our pension over many years which was matched by the government, and when we retired, our deemed pension was reduced by 50% as we contributed that amount with after-tax dollars. In 2017 the rules were changed and the 50% discount was reduced to 10%. So now we are non-homeowners leasing a villa in a retirement village with minimal assets and are considered too rich to qualify for a pension due to a combined income just above the threshold, while a mate in the eastern suburbs lives in a house valued at $5 million and qualifies for a full pension.

There are many countries that consider a house as part of your assets. why not here? The full value will be passed on to his children with no capital gains. Is this equitable?

Gee there sure is a lot of SFR’s that want a government handout as well. Funnily enough persons that are on the pension are not complaining about the persons on SFR’s.

Amazing, they scrimp and save for there retirement so that they are an SFR and then complain about not getting the part pension or pension and supposed people living in 5 million dollar houses that do. I wish my house was worth 5 million. I would sell it and join the SFR’s.