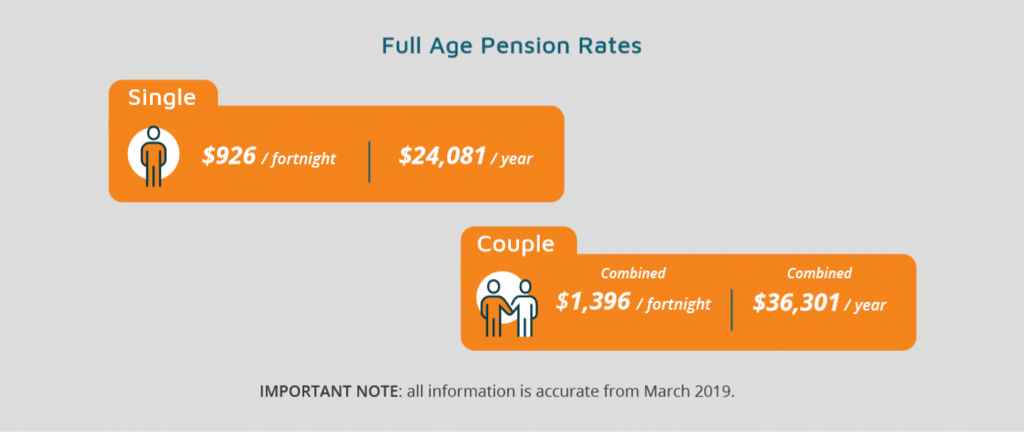

Centrelink have released its regular change to Age Pension rates in an attempt to keep payments in line with inflation. These new rates are effective from 20 March 2019.

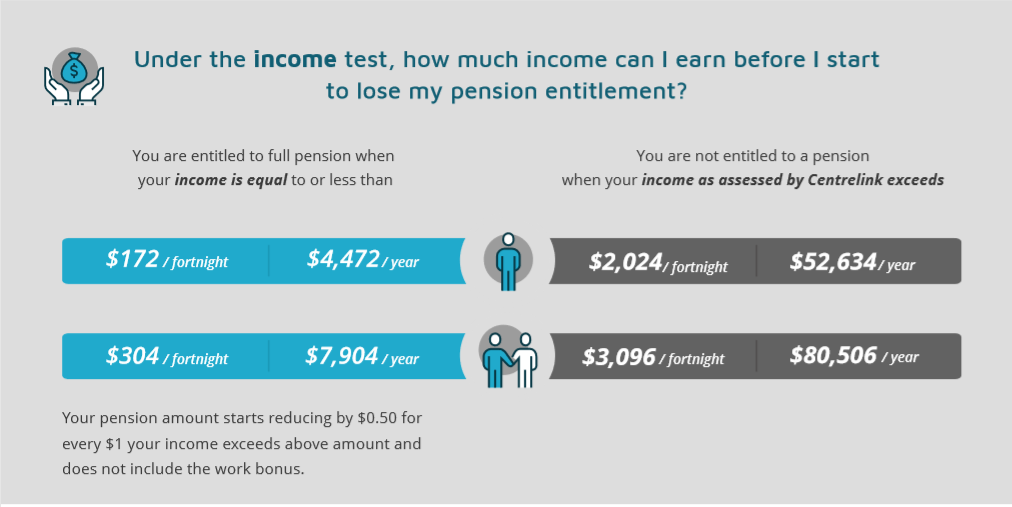

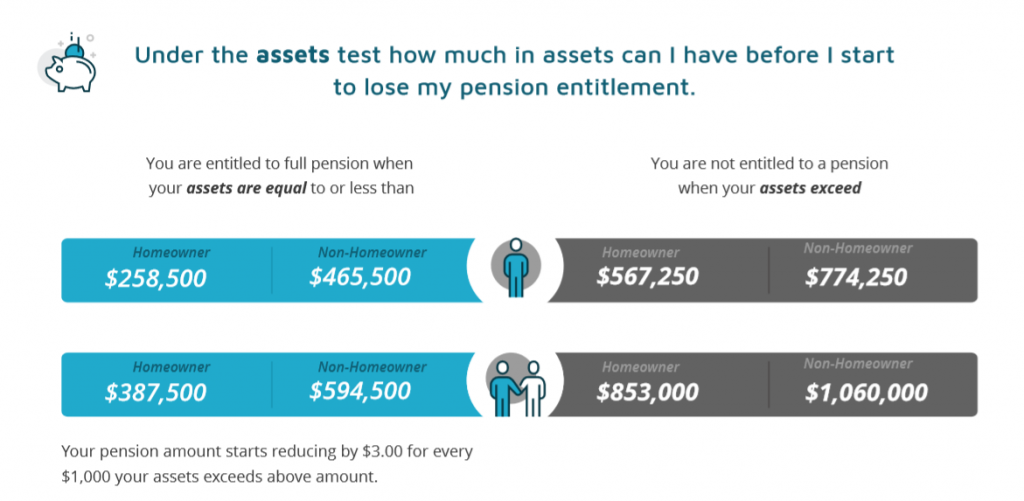

Centrelink determines an applicant’s Age Pension entitlement and therefore their Age Pension payment rate by assessing their income and assets independently, this is referred to as the Means Test. The Means Test ensures the Age Pension is provided to those who need it most.

Centrelink has also reviewed and increased the limits for both the Assets and Income tests as follows:

To find out what you could be eligible for with these changes, click here to use our Age Pension calculator. Our Calculator has been updated with the new rates and will give you an accurate assessment.

We also have developed an easy to use online application service if you would like a helping hand with applying for your Age Pension. If you have any questions simply call us 1300 527 727. Our Age Pension Specialists are waiting to take your call.

In my opinion my Centrelink Payments should be Tax Free , I am working 25 hrs per week & I Sacrafice an Extra $20./$30 every pay period so as that I do not have to pay a lump sum at the end of the financial year. After paying Income Tax for over 50 years there should be some Tax Relief for Pensioners who do part time work.