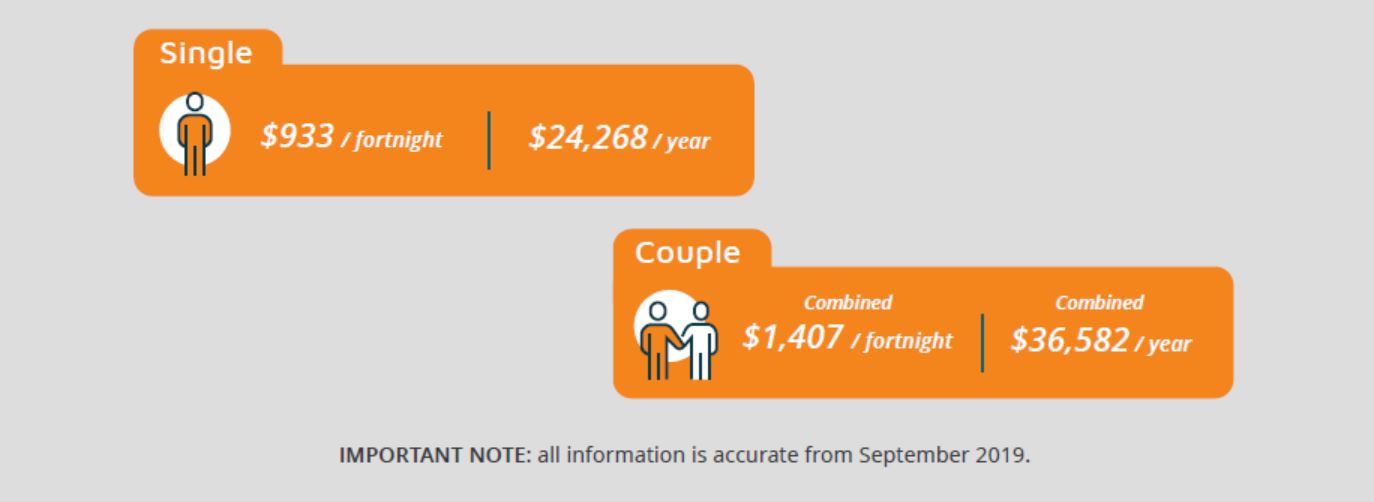

New Age Pension payment rates and Income and Asset test thresholds have come into effect today.

Age Pension Payment Rate Changes

Centrelink has reviewed and increased Age Pension payment rates. For senior Australians who are receiving the full Age Pension this translates to an additional $7 per fortnight for singles and $10 per fortnight for couples combined:

Centrelink determines an applicant’s Age Pension payment rate by assessing their income and assets independently, this is referred to as the Means Test. The Means Test ensures the Age Pension is provided to those who need it most.

Income Test Changes

The new disqualifying income limits for singles is $2,040 per fortnight (up from $2,026) and couples combined is $3,122/fortnight (up from $3,100):

Asset Test Changes

The new disqualifying asset limits for single homeowners is $574,500 (up from $572,000); single non-homeowners $785,000 (up from $782,500); couple combined homeowners $863,500 (up from $860,000); couple combined non-homeowners $1,074,000 (up from $1,070,500):

Our quick and easy to use Age Pension Calculator has been updated with these new rates and will give you an accurate assessment. Click below to check how these changes impact you.

Retirement Essentials also offers an easy to use online application service if you would like a helping hand with applying for your Age Pension. If you have any questions simply call us 1300 527 727. Our friendly Age Pension Specialists are waiting to take your call.

These changes are helpful, but we also know that the cost of living is rising, how will these rate changes affect your retirement lifestyle? We love hearing from our customers, share your story below in the comments section.

Thank you to all contributing Aussies. I’m Aussie born and bred never doubting their generosity. Thank you Australia.

Really appreciate all assistance given to me as a retired pensioner….we are a lucky country

Thankyou for the peace of mind Australia gives to me each week. Live to all stay happy & healthy.

Do the pollies have to do what us pensioners have to do the ASSET test when they retire?

Or do they get a handsome payout and still claim the pension on top of that.?

Thank you for the increase.

I am grateful for our Medicare and Age Pension benefits.

ARE POLITITIONS , ASSET TESTED. ??

Not only that, and one has 40 negatively geared properties, they get well paid gigs outside politics without it affecting their pensions.

Thanks for the update. We intend applying in person in Feb 2020.

Many thanks

If you own your home and you are on a full pension ,but have $100,000 in super does the interest effect your pension,and can can you spend your super how you want or are there restrictions on what you can pull out of your super ?

The fact that you’re on full pension means that your super is not affecting your pension

You can lodge the application 3 months prior to age pen age. This will give them time to assess as Centrelink can take as long as 6 months to finalise a claim

Wow can they afford it..

Yeah can they – the government not really as they have to pay themselves 200 a day increase, what joke! ?

Yeah wow! A whole $10.00 PF!! tell me again how much the Pollies give thenselves. Where as i dontbecoect ibcrease ls like tgat but $10.00 pf is ridiculous

I agree $10 pf is outrageous. My rates went up $15 pm and my insurance the same. Still waiting to see how much electricity and water will go up this year. Every year it gets harder to survive on single pension. We have no way of earning money at 77 and no money for maintenance on the house and garden. Shameful that polices take enormous increases in salary when so many people are struggling.

Yeah Christine i agree a whole 10 a fortnight for us yet the pollies get a pay rise more than a years pension is worth what a joke!,?

Dear Sir/Madam

Thank you for this forum I am 71 have been in full Age P since Jan 2019 due to working full-time. Could you please explain how the Deeming is calculated? I know it’s on shares and super. Where does the fnight earnings allowance come in?

Where to they take the 50c off?

Also as a pensioner I let one room to a boarder for 125.00

CL deducts 88.00 per week. I also pay for the water, And extra insurance..so little profit, and loss of privacy.

Why is this not treated as earnings income as its like a job keeping house clean, etc.

If govt wants to house the homeless this does not help or encourage pensioners to give up privacy and rent out rooms.

Please comment.Thank you Pat

Makes no sense to me. I am retired. My wife works 2 nights a fortnight. Her earnings come off of my pension. I have $8000 in work credits. Makes no difference to our pension. Surely if her income is shared my work bonus should be shared. Not likely

Work bonus applies to the pensioner only, ie, if you’re employed. It’s an incentive for pensioner to return to work ; full time or part time

Same here Ian .My wife is not eligible until 66.She is physically not capable of more than the 2 days a fortnight she works.Earns about $450 a fortnight and they take $70 off me.Great incentive for her to get out of bed.I also have a work bonus acrewed,but it’s worthless. Unless you work for someone else.Another great incentive to try and look after yourself.

How do I apply for aged pension next year

I have just turned 65 in August

Hi Paulette

We would love to help you apply for your Age Pension next year. Please know that Centrelink will accept your application 13 weeks ahead of your 66th birthday. Please give us a call on 1300 527 727 a few weeks prior to this date and we will get your started with our easy to use online service.

Paulette 13 weeks ahead but it take months to get every thing thru

What is the aged pension amount for single person please .

About $900 a fortnight take the rent out it does not leave much to pay other bills

It is good that there is a organisation where you can get some help

Hi Owen

That’s so kind of you to say this. We have worked very hard to build a service that makes the process so much simpler for senior Australians to get access to t heir Age Pension entitlement.

I live with my son and 3 grandchildren for medical reasons and loose my rent assistance what you can’t share with your own family this has to be some sort of a joke

Disgusting enough for loaf bread and small pizza carton milk so generous

how much is rent assistance now?

Hi Kerry

Centrelink will assess your eligible for rent assistance as part of the Age Pension approval process

How much is rent assistance if you are sharing not partners flat mates

How much do you charge for AP applications?

Hi Kate we prepare your application and get you origanised to lodge it with Centrelink and then liaise with Centrelink to get your pension approved as quickly as possible. All of this for $330

I am 68 and on a disability pension. Will there be a stop to my pension if I transfer to old age or is it a simple process.

Hi Robyn, the transfer from disability to aged pension was a straight forward simple process for me. Nothing stopped, it just changed from disability one fortnight then aged pension after that.

Few weeks before age pen age, you will actually be sent a transfer to Age pension form for completion. It’s a simple process

What happened to the cup of cofee a day from 7 eleven increase as mention earlier that 7 dollar a fortnight is a insult to the struggling pensioner

This document states Single Payment $933. fortnight from Sept 2019 is this in NSW because my payment is $882.30 fortnight a difference of approximately $51. Why is this?

Am I entitled for rent assistance due to I am now in an over 55’s retirement village

Why is that you can live in your own house valued at $200,000 and have $900,000 in supa and not receive any pension But can live in your $2,000,000 house with $100,000 in supa and get the full pension??? Does that seem right to you??

Hi Margaret

Your principal home is an exempt asset ( for now anyway). So regardless of the value, whether it is $200000 or $2000000, it’s exempted. Any other assets are assessable with exception of a few.

Thank you to the Morrison Government for their generous [not] increase in our pension.I’m sure you’ll agree it will go a long way in helping us keep our heads above the waterline! [not.] It’s outrageous & very insulting in light of the increases politicians just received!

I am divorcing my husband in the very near future, just started proceedings, can you please tell me until we can sell our house, which is on the market now, we have to live under the same roof as each other. As soon as my divorce is finalised I will revert to my maiden name as I don’t want to keep his name any longer. Am I able to change from a married couple age pension to a single pension although I have to stay living in the same house with him until its sold.

Why aren’t we getting it now

i Have been married 50 years been on age pension 4years we are penalisedwe have to live on one it’s less then single pensions I can see why my grandparents Separatedin there 70s so they could get 2pension every little bite helps

I’m 69 retired no super own my house that’s it my wife works part time 20 hours a week. Centerlink take most of my pension maybe get 200 a fortnight so wrong

Thankyou to me for the 50 years of work and tax paying to ensure I had a pension at the end. What a pity the government saw fit to reduce it to a less than sustainable income.

I really feel for the poor buggers out there paying rent and trying to live.

Wow $7.00 a fortnight think I will go and have a Senior’s small coffee at Macca’s and celebrate. What an insult when they literally throw money at refugees and give Billions in foreign

Aid to Countries that protect Terrorists.

My comment to

Centrelink is about the super funds I have not worked for 30+ years due to looking after my disabled daughter and therefore have no super Centrelink should introduce a volunteer system where Minimal money could be taken out of pension and banked in a super fund for retirement