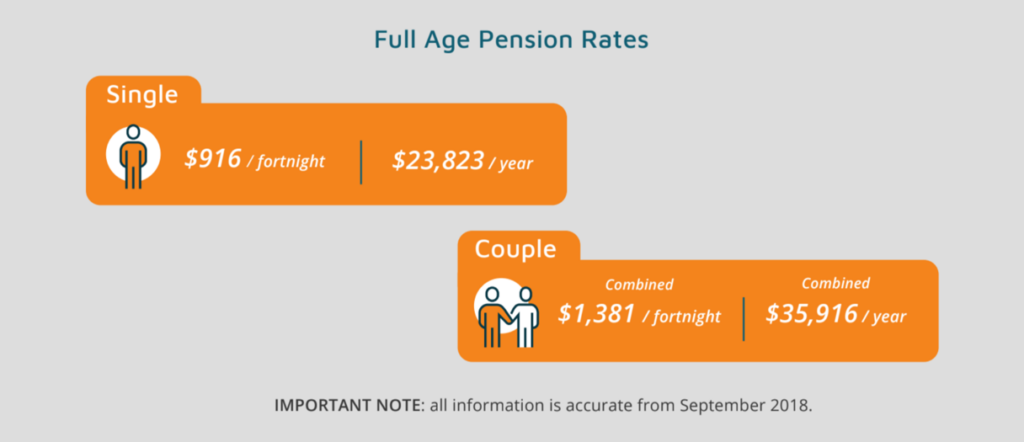

Effective from 20 September 2018. What are the latest changes?

Yesterday, Centrelink announced it’s regular changes to Age Pension rates in an attempt to keep payments in line with inflation. These new rates will be effective from 20 September, 2018.

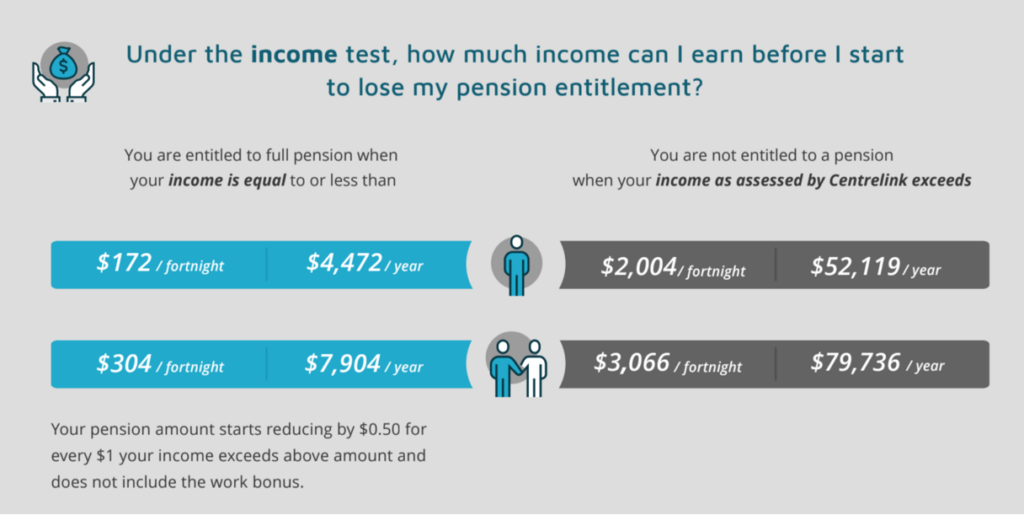

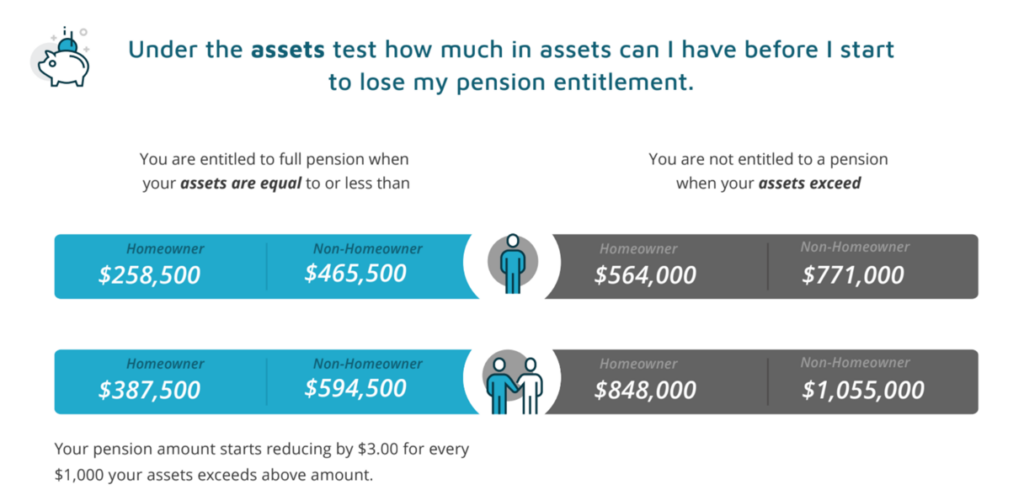

As you may know, Centrelink determines an applicant’s Age Pension entitlement and therefore their Age Pension payment rate by assessing their income and assets independently, which is referred to as the Means Tests. The Means Tests are there to ensure the Age Pension is targeted to those who need it most.

Centrelink has also increased the income and assets limits for these test as follows:

To find out what you could be eligible for under these changes, click here to use our Age Pension calculator. Our Age Pension Calculator has been updated and will give you an accurate assessment.

Or, if you have any questions simply call us 1300 527 727. Our Age Pension Specialists are waiting to take your call.

If on a single pension, how much can the partner earn who hasn’t yet reached pension age

Hi Reg

The maximum income a couple can earn before you lose a full pension payment is $7,904 gross per annum. The maximum income you can earn before you lose a part pension is $79,736 gross per annum. These income threshold includes both income generated from employment and deemed income from your assets.

It doesn’t matter if your partner hasn’t reached Age Pension age, the same threshold applies to your joint income.

Canyou tell me if the amount of money earned in a fortnight is it the net or gross income?

Hi Ann

When advising Centrelink of your income it needs to be the gross amount.