Perhaps the most frequent comment we receive concerns the different Age Pension entitlements received by singles and couples. Opinions are strongly divided on this issue however one sentiment is shared – The system isn’t fair. This week we have decided to outline some of the arguments on both sides of this debate.

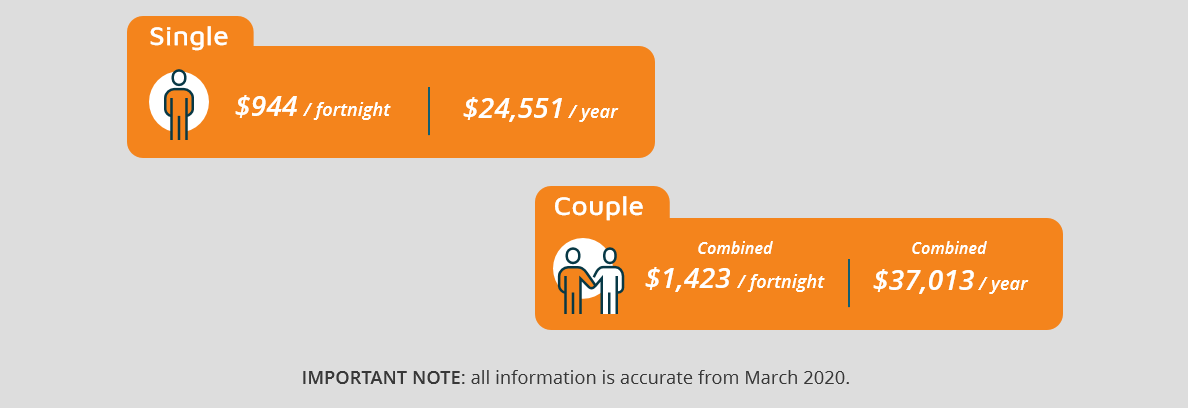

Firstly let’s look at what singles and couples can receive and then look at some of the comments received on both sides of the arguments

The perspective of a single person

“I have to pay rates, or rent, electricity and gas and these are largely the same for a single as a couple. Why do I get so much less?”

“Running a home costs me as much as it does a couple. Why don’t I get the same as them?”

The perspective of a couple

“There are two of us – we have to pay for two lots of food, clothes and entertainment. Why don’t we each get our full entitlements.”

“We both worked and paid our taxes. Now we are getting punished for being in a relationship.”

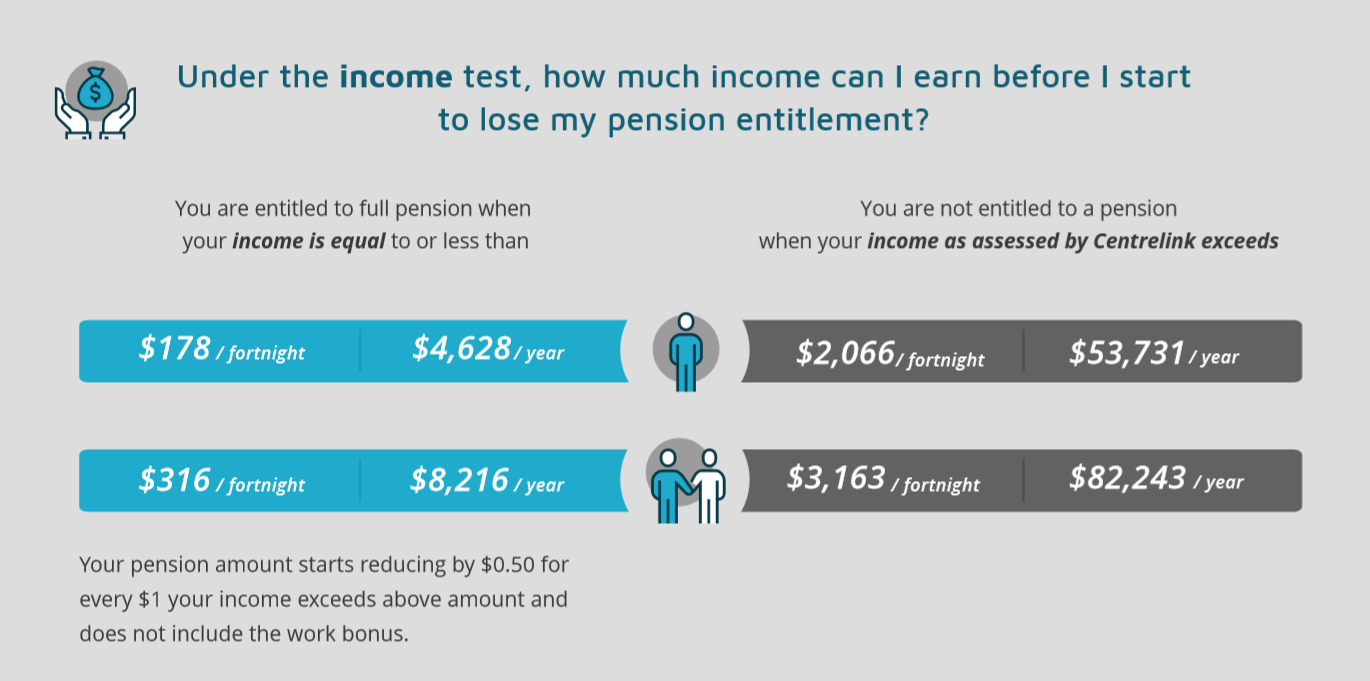

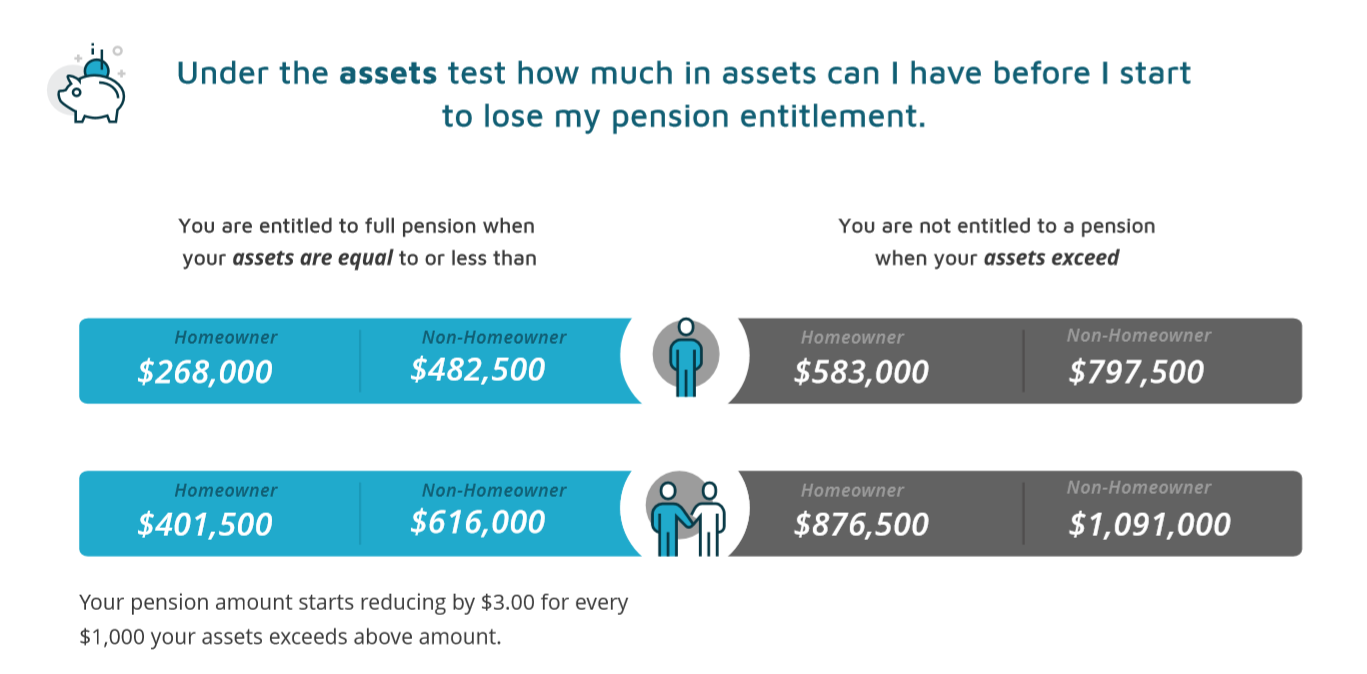

Singles and couples also have different thresholds for income and assets before their pension starts getting affected. Again there are very different perspectives on whether these are fair. We have included the latest thresholds at the bottom of this post.

So why has the Government set the levels the way they are? Well it can come down to two key points

It makes sense that two people need more money to live on than one. So many expenses aren’t shared.

It doesn’t however cost a couple twice as much to live e.g. it doesn’t cost double to heat or cool a house and rates or rent aren’t doubled.

The current system endeavours to cater for both these factors.

Many people on the Age Pension, singles and couples, struggle to make ends meet so it’s not surprising that there are strong views on this issue. We see both sides of the argument and our focus is to help people get all their entitlements regardless of their circumstances. Why not check your entitlements now

While we can’t change the rules we would love to hear your views. Please tell us what you think.

This information is very helpful and easy to understand

I thank you for keeping us informed and supplying this service.

I do have a question re the assets test

The $3.00 reduction per $1,000 over the Asset limit

Is that reduced from the fortnightly income.

Looking forward to your reply

Regards

Laurie.

Hi Laurence, this is correct. Every $1,000 over the minimum asset threshold will incur a $3 reduction in your fortnightly pension. I hope this helps!

Thanks,

Retirement Essentials

I am single fem and in Oct 22 old enough to retire if i am still around. Am very sick person with lots if recorded ailments with health. I don’t mean to seem rude but i cannot for the life of me understand why a couple get apx $200 per week per head extra. That is insane. Or have I read it wrong.

Sorry your wrong a single gets over $900 and me as a couple male I get just over $700. I get tax out of mine So I get $661.80. Thank you my wife isn’t on the pension yet. She don’t work so we do struggle

I think it’s unfair that couples get so much more in pension than singles. I still have rates body corporate insurances electricity and many other expenses. The only difference I can see is food. We all have to buy clothes and petrol so I think singles are getting a bad deal. By the way I worked until I was 73.

There are lots of assumptions made about couples that are based on old fashioned values and ways of living. My partner and I are totally financially independent and always have been. The couples pension is very low. We have our own cars and associated costs, health insurance is double, food is double, utilities costs are greater than for a single, clothes shoes etc all individual costs. I travel independently. The main differences I can see are that we can share house rates and insurance costs but they do not equate to the vast difference between a single and each person in a couple. I think like in some other countries everyone should be treated individually and lifestyle choices are their own personal business. Anyway that is why I am still working at 70. I do not want to for the first time in my life to suddenly be linked to a person in a way I have never lived my life.