Any idea which group of workers are paying the highest tax? I’m disappointed to report that it’s older Australians on an Age Pension. We uncovered this disappointing fact while completing research for leading super fund HESTA. The key takeaway was the severe burden on many retirees on a part Age Pension who are earning a wage. The study, which attracted a lot of media attention, revealed that Age Pensioners can face the highest (effective marginal) tax rates of any group in Australian society. This is hardly fair.

Today we share a brief explanation of how this anomaly might affect you or your partner. And if there is anything you can do about it.

Let’s start at the beginning

Many people want to work after age 67. But, once you understand and apply the Age Pension Income Test taper rate and taxes, you may find you don’t get much of a boost to your spendable income. Here’s why:

First, it’s important to say there is a threshold level of income you can earn which truly adds to your spendable income. The Age Pension rules grant singles the first $5,668 (or $218 per fortnight) of income as exempt under the Income Test..and then a Work Bonus adds $7,800 per year without a reduction in your Age Pension. And in the first year, there’s a $4000 bonus on top which allows those on the Age Pension to earn up to $17,104 in the first year and $13,104 after that annually to receive a full Age Pension payment, before the tapering effect begins.

What is a taper rate?

After the above level of income, the Age Pension Income Test starts to reduce your Age Pension by 50 cents for every extra dollar you earn in income. That’s the so-called ‘50% Taper’ rate on income.

When do you start paying tax?

When your income reaches a certain level, you need to pay income tax, as well. Many people forget that the Age Pension is taxable income. You may not have to pay tax if you are not under the tax-free threshold or if you benefit from the offsets under the Seniors and Pensioners Tax Offset (SAPTO), but these benefits also phase out with higher income levels.

So, as your work income goes up, the taper rate takes half of the extra income, income taxes kick in, you lose the SAPTO benefit … and you find that what you keep out of your extra income is only a small fraction of your actual extra pay.

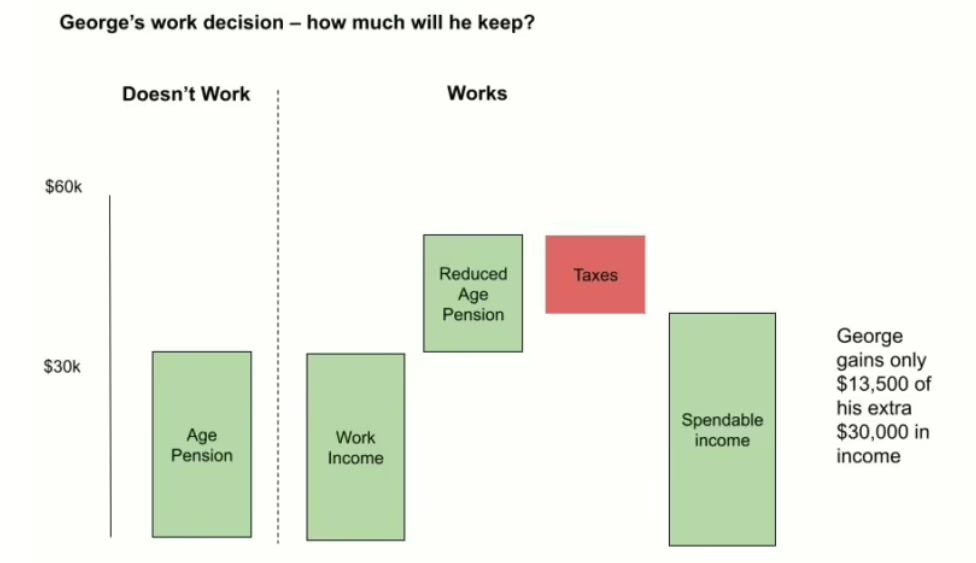

This example might explain it better. Consider George. He’s 67 with $200,000 in super. He’s on the full Age Pension getting nearly $30,000 in benefits. He’s been offered a part time job paying $30,000. He might assume or dream it would get him $60,000 of total income. But, not so fast, George. Your Age Pension will be reduced and you’ll have to pay taxes. We find George’s income, after taxes and reduction in his Age Pension, only goes up about $13,500 or less than half his pay.

This is what it looks like– the before and after:

Where’s the incentive when considering whether they might work a bit more, they might receive very little benefit?t. Taking into account the loss of Age Pension benefits as a ‘tax’ on work, we found their marginal effective tax rate (i.e. the taper rate on the Age Pension plus the impact of income taxes) could be 77% or higher.

Here’s another example of how this works

Say George was previously working and earning $25,000 and was considering some extra hours that would raise his work income from $25,000 to $30,000. He could find that, of the extra $5,000 in pay, he’d only keep an extra $1,150 or 23% of their extra work income, which equates to a ‘marginal effective tax rate’ of 77%! Ouch!

Couples on the part-Age Pension face similarly high effective tax rates once one of them works. The Income Test works on the household level of income. When one partner earns income the taper rate may kick in and reduce the combined income by 50% for every dollar earned. And again income tax is applied..

The Age Pension is far from simple

As you may know already, many aspects of the Age Pension are complex.. The benefit you retain from work income will vary depending on your assessable assets because there’s the Assets Test to consider as well. Your Age Pension is determined by whichever test delivers the lower amount – either the Income or Assets Test.

The Retirement Essentials research also revealed another strange, you might even say perverse, result. people who have higher levels of assets may have a lower effective marginal tax rate on extra work than those with lower assets since the Asset Test may be the determining rule for them.

How does this affect your income?

If you’re working or considering working after age 67, you may want to check whether you’re going to get the rewards you expect. The extra pay may not lead to much of an increase in ‘spendable’ income. Centrelink rules do not offer much incentive for working for many people over 67. It may be that full retirement is more attractive once you consider what you could have in Age Pension benefits if you stopped work entirely.

It’s a very personal decision…and the maths can be quite complex. Retirement Essentials offers tailored consultations to help you compare your income options and reach the best decision for your retirement needs. advisers can help you through these types of decisions……

What does it mean for the greater good?

The findings from Retirement Essentials research really got my goat! I think the disincentives for older Australians to work. They basically mean that part Age Pensioners are the highest marginally taxed group in Australia.

Many older Australians want to work. So it’s fair to ask why they are not allowed to earn some significant additional income without losing so much of their Age Pension. In my opinion, the taper rate on income is too high at 50%. And the Work Bonus is too low an exemption.

I think it’s in Australia’s interest to be more generous to older Australians who want to work. It would help fill to skills gap we keep hearing about, add to our overall productivity and allow older Australians to continue to connect and contribute.