Last week, I discussed the most common retirement questions our members ask during strategy consultations with our advisers. One of the big ones is: ‘Do I have enough? Sometimes that thought is closely linked to ‘Do I have enough – yet?’

The real question isn’t just about whether it’s enough, it’s more likely, ‘How can I make my savings last?’

Your superannuation balance and investments, spending levels, Age Pension entitlements, and investment choices will all play a role in sustaining your income over time.

Understanding retirement standards

The Association of Superannuation Funds of Australia (ASFA) provides guidelines to help individuals plan for retirement, which they update quarterly. As of the September quarter in 2024, ASFA’s Retirement Standard suggests that the following is needed:

For couples:

- Comfortable lifestyle: Annual spending of $73,031, requiring approximately $690,000 in superannuation savings at retirement.

- Modest lifestyle: Annual spending of $47,475, requiring approximately $100,000 in superannuation savings at retirement.

For singles:

- Comfortable lifestyle: Annual spending of $51,814, with a recommended superannuation balance of around $595,000.

- Modest lifestyle: Annual spending of $32,930, requiring approximately $100,000 in superannuation savings at retirement.

These figures assume retirees own their homes outright and are eligible for a part Age Pension.

By comparison, the full Age Pension rates are currently:

- Couples (combined): $44,855 per year

- Singles: $29,754 per year.

ASFA provides detailed budgets for both of these ‘modest’ and ‘comfortable’ retirement lifestyles. A modest lifestyle allows for a slightly better standard of living than the full Age Pension, but still only covers basic needs – requiring a modest superannuation balance of $100,000.

In contrast, a comfortable lifestyle requires significantly higher super savings to afford a higher standard of living, with additional spending on leisure, private health insurance, household upgrades and occasional travel.

According to ASFA’s latest update on superannuation balances, around 30% of retirees currently meet or exceed the comfortable standard. Their research indicates that, by 2050, approximately 50% of retiree households will reach this level.

Median superannuation balances

Despite ASFA’s recommended targets, many Australians retire with superannuation balances well below the comfortable level. In its latest update on superannuation balances among those approaching retirement, ASFA reported that, as of June 2021 the median super balances for Australians aged 60-64 were:

- Males: $211,996

- Females: $158,806

The median refers to half of Australians between 60-64 having a higher superannuation balance than the median, and the other half having a lower balance.

If the ‘median couple’ both aged 67, were to retire with just their combined super balance of $370,802 ($211,996 plus $158,806), plus other assets of $10,000 cash in the bank and personal assets of $25,000, their total wealth would be $405,802. They would qualify for the full Age Pension.

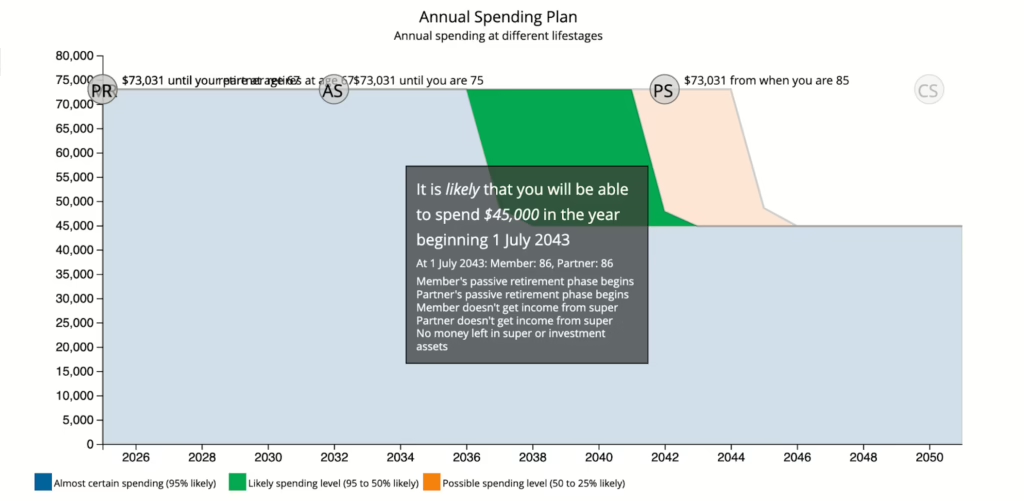

If they spend at the ASFA comfortable level of $73,031 per year, by drawing down the extra amount they need for living costs above the Age Pension, their savings would likely last through their 70’s but be depleted by their mid-80’s. At that point, they would be relying solely on the Age Pension for income, currently $44,855 per year for a couple.

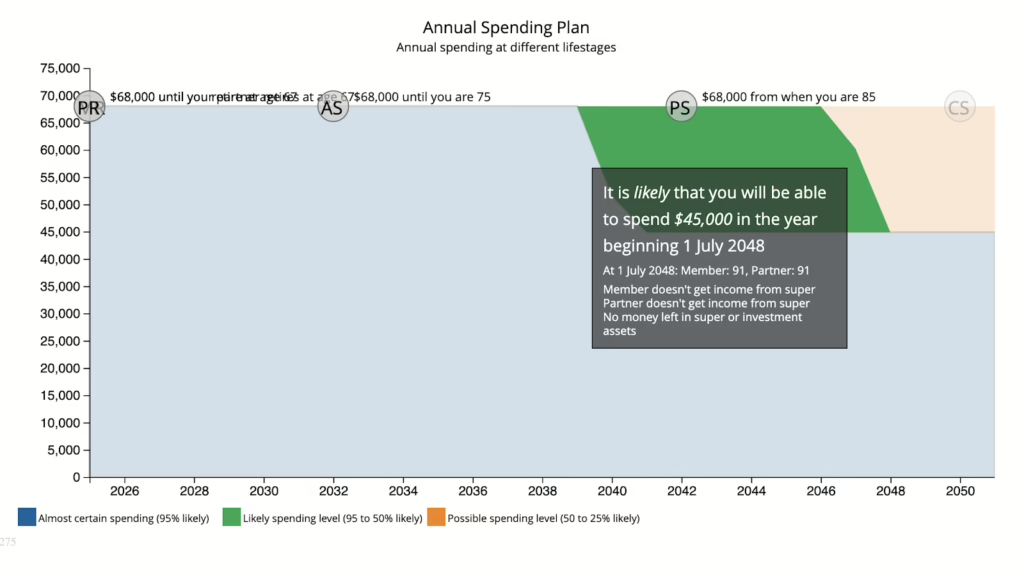

By adjusting their spending to $68,000 per year from the start of their retirement, they could stretch their savings for an additional five years, likely supporting them until age 91 in 2048 before relying solely on the Age Pension.

Further reduced spending in later retirement to around $60,000 per year would extend their savings even longer – likely past age 95. In reality, many retirees naturally adjust their spending as circumstances change.

Making your retirement savings last

Even with superannuation balances below ASFA’s ‘comfortable’ targets, many retirees can maintain a satisfactory standard of living by:

- Maximising the Age Pension: The Age Pension provides a safety net, supplementing superannuation income, so understanding and making the most of the benefits available makes sense.

- Adjusting spending: Reviewing annual spending with available resources can help ensure savings last throughout retirement. Annual spending in later years of retirement will often decrease.

- Part-time work: Continuing part-time employment can boost income and reduce the need to draw down on superannuation savings early in retirement. This is where the Work Bonus can kick in and make a big difference to retiree spending levels.

Why get a retirement health check?

While understanding how much you need to retire is crucial, knowing how to manage your savings and plan effectively can make all the difference. Retirement Essentials Retirement Health Check helps you to assess your financial situation, maximise your superannuation and Centrelink entitlements, and ensure your retirement savings last as long as possible.

Want a clearer picture of your retirement readiness? Why not take our Retirement Health Check today to gain the insights you need to take control of your retirement.

What about you?

What is your biggest worry about retirement? Is it the fear of running out (FORO)?

If so, what’s stopping you from crunching the numbers on your retirement?

How do you calculate how much you need in retirement funds once you are 70, 75, 80 or older.

Anxiety provoking not knowing whether you have sufficient funds left in pension funds to survive to an advanced old age after you retire. Please can you do an article on that giving some actual figures for Australians in their seventies, eighties and nineties compared to what you would need at 65.

Really good question Linda Verg.

It would be great to get actual insight on how much 70, 75, 80 and older people spend per year, what their situation is e.g. their health, where they live, home or care home, whether they had any unexpected expenses that they didn’t plan for e.g. major home repairs, health issues, replacing major appliances and how/if they managed to do all this and continue living a comfortable retirement.

Did they have enough to do any overseas travel, how often, did they go on holidays within Australia, how often?

Linda, Having enough income in one,s most senior years is a concern. My wife and I are very conservative when it comes to matters financial. At present we are in our 66/67 years respectively. We own our home. Have no debt. We have two investment properties (no mortgages). We have more than the so called magic number in super ($1mill.)….We live simply….I,m still working part-time in my own business….but we still think shall we be ok financially in 25 years time…will future governments tax super/introduce wealth taxes etc to maintain social services….

Hi I will be 59 this year and thinking of retiring, my husband is 58 and also thinking of retiring. We are moving back to the UK in August. What would be the best think to do with our private pensions until we can draw on them at the age of 60?

Hi Annette, Thanks for reaching out! It’s exciting that you and your husband are planning your retirement and move to the UK. The best approach for managing your retirement savings will depend on your financial needs, tax considerations, and how you plan to manage your income until you can access them at 60.

Our financial advice strategy consultations can help you explore your options and ensure you’re making the most of your savings during this transition. In your case, I’d recommend starting with a quick 10-minute consult to see how we can assist. You can [CLICK HERE] to book a session.