Q: We’re still working but my husband’s health isn’t great. Could we clear our mortgage using super so he can stop working sooner?

That’s the question Mia brought to me recently. She and her husband Raj live in a family home in outer Melbourne. Both are in their mid-60s and still working, but Raj’s recent health issues have made keeping up with their mortgage repayments a source of anxiety.

Raj has been working mainly to cover the mortgage, and this ongoing stress was starting to affect his wellbeing. Mia was wondering: if they knew it was financially possible to retire and pay off the mortgage, would Raj feel more at ease about stepping back?

Mia and Raj’s situation is a great example of the many unique conversations I have with clients. Retirement planning is rarely just about numbers—it’s about peace of mind, wellbeing, and balancing financial security with life’s uncertainties.

Amanda discusses how she helped Raj make a key decision

Taking stock of their situation

During our consultation, we took a detailed look at their financial picture. They own their home in outer Melbourne, with a remaining mortgage of around $180,000. Both Mia and Raj are working—combined incomes of approximately $110,000 a year. Their superannuation balances total about $650,000 combined, split roughly evenly between them. Aside from the mortgage, their other living costs are moderate and manageable.

The immediate question was: could they pay off the mortgage using their super, allowing Raj to stop working and reduce his stress? And would this be sustainable over the long term?

Exploring the options

We explored two main scenarios:

- Keep working and keep the mortgage: This option meant continuing their current lifestyle, with steady incomes covering repayments and expenses. It preserved their super balance but meant Raj would continue under considerable stress.

- Pay off the mortgage with super and stop working earlier: This involved withdrawing a lump sum from their super to clear the mortgage, then relying on their super income and Age Pension entitlements (when eligible) to cover living expenses going forward.

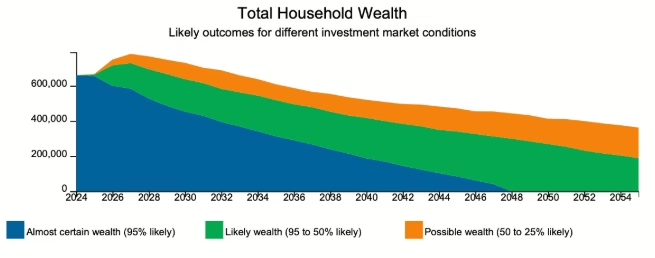

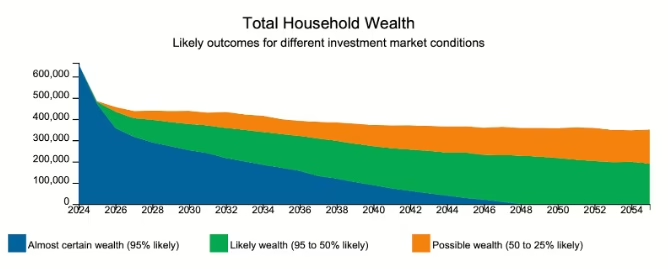

Using the Retirement Forecaster tool, we modelled their income and expenses under both options, including the impact on Age Pension entitlements and how long their super would last.

So what did they decide?

Mia and Raj found reassurance in the numbers. Paying off the mortgage early was financially feasible. The modelling showed they could comfortably cover their living costs, even if Raj stopped working, without risking running out of money prematurely.

Most importantly, the consultation gave them clarity and peace of mind. They understood the trade-offs—less working income now but better wellbeing and less financial stress, versus keeping the mortgage longer but maintaining a larger super balance.

Raj felt relief knowing the mortgage could be cleared and that stopping work earlier was a viable option. Mia appreciated the clearer picture, which helped them make decisions together with confidence.

What do you need to know before paying off your mortgage with super?

Using superannuation to pay off your mortgage before retirement isn’t a decision to take lightly. Super is designed to provide income through retirement, and drawing a large lump sum early can reduce your future income potential.

Here are some things to keep in mind:

- Access to super before retirement age is generally restricted. You need to meet a condition of release, such as reaching your preservation age and retiring.

- Once you withdraw money from super, putting it back isn’t usually possible due to contribution caps and age limits.

- Paying off your mortgage reduces your debts and can lower living costs, but it also reduces the capital you have invested to generate income later.

- It’s important to consider how this impacts your eligibility for the Age Pension, which depends upon your assets and income.

How a Retirement Advice Consultation can help

Many people find themselves juggling questions about working longer, managing mortgages, and tapping into super. You may wonder if you should keep working, or if it’s time to pay down debt and reduce stress.That’s exactly what a guided Retirement Advice Consultation offers—an opportunity to review your personal situation, explore different scenarios, and get clear, tailored advice. It’s about helping you balance your financial security with your wellbeing and life goals.

What about you?

Are you thinking about using super to pay off your mortgage?

Have you already made a decision one way or the other?

What helped you decide?

This article is provided by Retirement Essentials Representative Number: 001260855. We are an authorised representative of SuperEd Pty Ltd ABN 88 118 480 907 AFSL #468859. This information is not intended as financial product advice, legal advice or taxation advice. It does not take into account your personal situation, goals or needs and you should assess your own financial situation, consider if the information is suitable for you and ensure you read the relevant Product Disclosure Statement (PDS) if you choose to make any changes to your financial situation. It is always advisable to consult a financial adviser before making financial decisions.