If so, what can you do?

The hottest topics in the news right now seem to be the twin challenges of cost-of-living and inflation. It’s not just a talking point either, with many elections occurring across the globe this year, data indicates that any government in power during a time of rising cost-of-living is likely to be removed at the ballot box. Interestingly, as we’ve reported, many of the pressures that are causing the current increased cost-of-living are external factors. But that’s not our topic today. What matters most to Australian retirees is how to best respond to challenging economic conditions. Today we share a five-step approach to tackling this challenge, which suggests you:

- Understand the fundamentals

- Understand the broader context

- Learn how retiree spending is affected

- Review your own key indicators, and …

- Take action!

1. The fundamentals: what are you dealing with?

Ignoring the ‘noise’ of public commentary is usually the smartest way to better understand an important topic. This is especially the case when the subject is money. Media usually earns its money by getting eyeballs – and loudest headlines usually deliver greatest engagement. So let’s put shouty commentary aside for the time being and use some definitions from trusted sources.

(a) What is inflation?

According to the International Monetary Fund (IMF), inflation is the rate of increase in prices over a given period of time. It is typically a broad measure, such as the overall increase in prices or the increase in the cost-of-living in a country.

(b) What is causing Australia’s current inflation?

Quoting directly from the Reserve Bank,

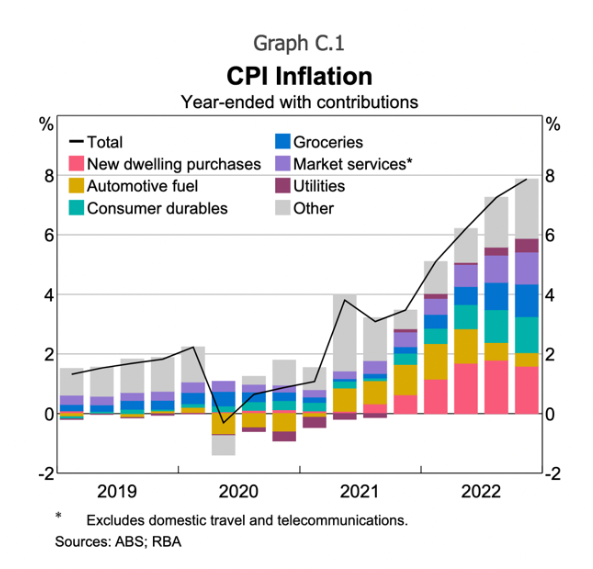

“High inflation outcomes in Australia reflect a range of developments, including supply issues related to the war in Ukraine; other global supply disruptions resulting from the COVID-19 pandemic; and domestic supply disruptions from poor weather. Strong domestic and global demand has also played a role, reflecting the rapid economic recovery following the significant fiscal and monetary policy responses to the pandemic and the faster-than-expected development of effective vaccines. As a result, the increase in inflation has been broadly based across many goods and services in the CPI (Graph C.1 as shown above).”

(c) Is inflation the same as cost-of-living?

The Consumer Price Index (CPI) is the standard measurement of cost-of-living in Australia.

According to the Reserve Bank, while the CPI measures price changes, cost-of-living inflation is the actual change in spending by households that is required to maintain a given standard of living. This means that, in theory, prices might rise, but if you do not need to purchase the more expensive items then you are not wholly affected by these CPI increases.

2. What is the broader context?

For most budgets, be they national or at a household level, there are incomings and outgoings. Concentrating only on price movements in outgoings (i.e. the current inflation rate of 4.1% to May 31 this year) may suggest that you will have less ability to purchase goods and services. But that is not necessarily the case. It depends how you earn your income. If you are a wage-earner, your earnings may well have increased over and above the rate of inflation. It’s possible of course, that they have remained static, but the Australian Industry Group data reports that Australian wages increased 4.1% in the year to March 31. If your earnings come from investments, the Financial Year 2023-24 increase quoted by the ASX is 8% for stocks, and 12% if dividends are included. We also reported last week on expectations for returns on superannuation funds of 6-10%. So whilst prices are definitely elevated, earnings are also up. It’s definitely worth bearing this in mind if the frequent coverage of higher prices is starting to get to you!

3. Are retirees specifically vulnerable to inflation?

You could be encouraged to believe this is the case, but the evidence is slightly more nuanced. The short answer to this question is that it really depends what you choose, or are compelled, to spend your money on. Not every retirement is the same, not every retiree has the same decision-making capacity. So those who are living on an Age Pension and renting are spending more than 40% of their income on housing. And rentals have risen in the order of nearly 8% over the past year, so these retirees are particularly pressed. Commonwealth Rent Assistance has been increased, but not at the same rate. One reliable indicator of the cost-of-living for retiree households is the Retirement Affordability Index published by YourLifeChoices. This index charts actual retirement household expenditure. In the most recent update (May 2024), The Australia Institute economist, Matt Grudnoff noted that while inflation is falling from a high of 7.8% at end 2022, the main drivers of inflation are essentials for retirees; health, insurance, housing and food. Insurance, in particular, increased due to natural disasters. But electricity prices fell, ameliorated by energy bill relief from state and federal governments. Travel also fell, by 5.9%. Higher earning retiree households were less affected by inflation (their cost-of-living increase remained below the national average) as the essentials formed a smaller proportion of their overall outgoings. I would encourage you to compare your own expenditure to the Retirement Affordability Index as it may just reassure you that you are quite similar to your own retirement tribe when it comes to the detail of your expenses.

4. Review, review, review

There are many concrete actions you can take to adjust your overall financial situation. But first, if retired, you need to know how your income is formed. This requires a review of your investments, be they cash, shares, indexed funds, superannuation, property or other forms of income. We have talked a lot about risk recently, and again last week about differing fund returns depending upon the mix. Scrutinising your own asset class mix is important. Cash investments, whether cash or term deposits, are often eroded by inflation. In times of high inflation, different investment stances can help you protect your savings. For instance when there is an economic squeeze, shares in consumer goods may not fare as well as those in infrastructure or essential services such as health. Thinking about your mix of investments and how it is likely to perform during times of inflation is useful. Seeking professional advice if you feel out of your depth is also wise. It also often helps to better understand your spending options across your full retirement journey. Working with an adviser in a 55-minute Retirement Forecasting appointment will give you the chance to ‘move the dials’ and see a few projections which take into account your super savings, other assets and Age Pension prospects. This knowledge supports your future budgeting as well as giving peace of mind.

5. Take action

There is no substitute for knowing where your money goes. That means keeping a budget. I’ve been using the one on the Moneysmart website this year and it works well. But it doesn’t matter much which one you choose to use, it’s the doing that matters. If you have a clear idea of how much you earn, how much you spend and if there is a net surplus or loss at the end of the month, you are well placed to adjust your situation. It’s also worth remembering that many older Australians are now enjoying the opportunity to contribute for longer in the work place, partly made possible by the increased Work Bonus credit. Reconsidering if you can earn a little extra if need be is sensible. Most people gain more from work than the remuneration, the sense of contribution and social engagement is really valuable.

‘Don’t just stand there, do something!’ is frequently quoted advice. There’s a reason why. Whatever action you choose to take, it’s sure to be better than worrying about the volatility of the Australian economy.

How do you keep track of your own cost-of-living?

Do you follow media reports closely?

Or are you more inclined to use your own budgets as a guide?

As to the Reserve Bank’s statement re inflation: one of the main drivers is the Western sanctions regime placed on Russian natural resources which has caused sky-rocketing energy prices which flow on into every aspect of everyday life. Don’t water it down as ‘supply issues due to the war in Ukraine’. Tell the truth and let intelligent people decide what is best.

Some ways to save money

1. Shop fortnightly, not weekly (impulse buying is halved)

2. Buy in bulk and only on special. Half price apps help. Watch for supermarket markdowns.

3. Minimise travel

4. Grow some of your own food. Pumpkins are easy and prolific

5. Be ruthless on cutting out expense items especially vanity items. A good quality second-hand car is much cheaper than a new car.

6. Shop at second hand shops for clothes

7. Use supermarket Loyalty schemes for fuel purchases. We obtain 4 cents off plus another 4 cents off from our electricity supplier plus another 5% off by purchasing an eGift card for Seniors and paying with it. This means that $2 per litre becomes less than $1.83 per litre.

8. Ask for discounts for online purchases. 10% discount is not unusual just by asking.

Hi Bart, these strategies are really helpful, so thank you for sharing them. The fuel discounts work well – you used to get them with receipts but it’s now all done with apps I think? Either way 4c a litre is a significant amount. And you are right – asking for discounts often brings rewards … if you don’t ask, you’ll never know. warmest Kaye

The stage 3 tax cuts were changed by Labor to give more low income earners a tax cut while reducing the higher income earners tax cut.

The overall cost to the government is the same as LNP’s

The biggest saving you can have to your energy bill is to install solar panels. They pay themselves within 3 years.

It was the previous LNP government that left us with a trillion dollar debt .

John Howard’s 25 year locked in gas deal that has cost us $400 Billion in lost revenue on our gas exports.

Why doesn’t this Labour Government realize that the enlarged Stage 3 Tax Cuts will boost inflation…and why hasn’t anyone been prepared to call this out !!

Coupled with the extreme spending on Renewal energy projects which are unfunded and reaching Trillions of Dollars and will add significantly to inflation.

Do our politicians believe that if we tell lies and don’t admit to these truths that the voters will let them get away with this.

I take exception to your opposition to renewable energy. Over the last 15 years I have invested in solar panels, batteries and solar hot water. The cost over that time has been approximately $14,000. My annual bill for household energy consumption 2021 $470.80. 2022 $391.97.2023 $52.56. I have refrigerated air con throughout the house which I use to heat and cool when necessary. I live in Perth. The monthly average unit cost in 2021 11 Cents 2022 9 cents 2023 9 cents. The unit cost is far less than I was paying in year 1989. I rest my case.

Australia ranks fifth in the 2023 Mercer CFA Institute Global Pension Index, achieving a B+ grade with an overall score of 77.3. The index measures the adequacy, sustainability, and integrity of retirement income systems in 47 countries. Australia’s score improved from 76.8 in 2022 due to higher mandatory contributions and increased pension assets

2024 we may get to 4th 🙂

Hi Mykel, that’s helpful information and great data driven endorsement of our overall system

We need government to wind back Tony Abbott’s punitive assets test. This has been in place for about 12 years and is grossly unfair to older women.

Politically biased comments are obvious and do nothing to help.

Missing from this whole assessment is the BEST advice: be sure that you look at YOUR OWN situation where you live.

I don’t have any exposure at all to mortgage interest rates but I DO care about home insurance increases. For example, I don’t care too much about increases in the cost of fuel (don’t use enough of it now that we are retired!) but I do care about increases at the supermarket. I know energy costs have been increasing but, where I live, it’s not a big deal.

In winter, we spend a lot on energy staying warm, but then, we always have! In summer, we spend very little on energy but I can understand that people on the coast or up north spend a lot!

Do the homework, folks…..