How Steve stopped struggling…

Steve has a very clear vision of his ideal retirement. A divorced 65-year old with a modest home and $75,000 mortgage, he has no difficulty articulating what life will be like when he leaves full time work. He wants to volunteer, work part-time as a mechanic and enjoy some weekends away with friends from his local Rotary club.

But what eludes him is the magic number that he needs to have saved to ensure he can achieve these plans within a couple of years. And not spend decades worrying about whether his savings will run out.

Funnily enough, there’s just one number that can help Steve to understand the longevity of his money. And that’s his own likely lifespan. Here’s how a few simple sums, based on Steve’s likely longevity, were able to set his mind at rest.

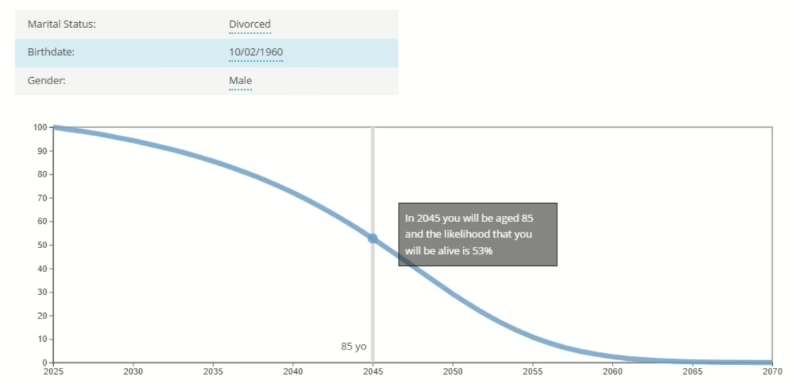

Because Steve is a member of Retirement Essentials he has access to the member portal where he can use all calculators for free. First up we encouraged him to do his own initial research by using the Retirement Essentials Life Expectancy calculator which is in the retirement planning section of the members’ portal. This simple tool requires just three things: your birthdate, relationship status and gender. Here’s the information that Steve received when he entered his details:

Based upon Australian life expectancy tables, it provides critical information for Steve; his likelihood of being alive at various ages, expressed as a percentage in the relevant year. We’ve highlighted the fact that he has a 53% likelihood of being alive at 85, so that’s a ‘magic’ number to get his planning underway. But our advisers like to take a conservative approach when using another handy calculator – the Retirement Essentials Safe Spending Simulator. This calculator factors in your savings, earnings, spending needs and Age Pension eligibility prospects to estimate how long your money may be able to fund your ideal retirement. Advisers Nicole Bell and Andrew Dunkerley both said they liked to factor in an extra 5-10 years, to enable members to see what a slightly longer life will require money-wise. This conservative approach has the added benefit of giving members a ‘buffer’ for unexpected expenses should they arise.

Says Andrew:

‘There’s an old rule that you take the youngest person’s life expectancy and add 10 years. As a result, my default position is 95. Why? We’re forecasting their retirement future and estimating what they will spend going forward. But forecasts aren’t guarantees. Going to age 95 provides a buffer against unforeseen events. While most people will spend less in the later years of retirement, some will spend more, predominantly because of medical expenses.’

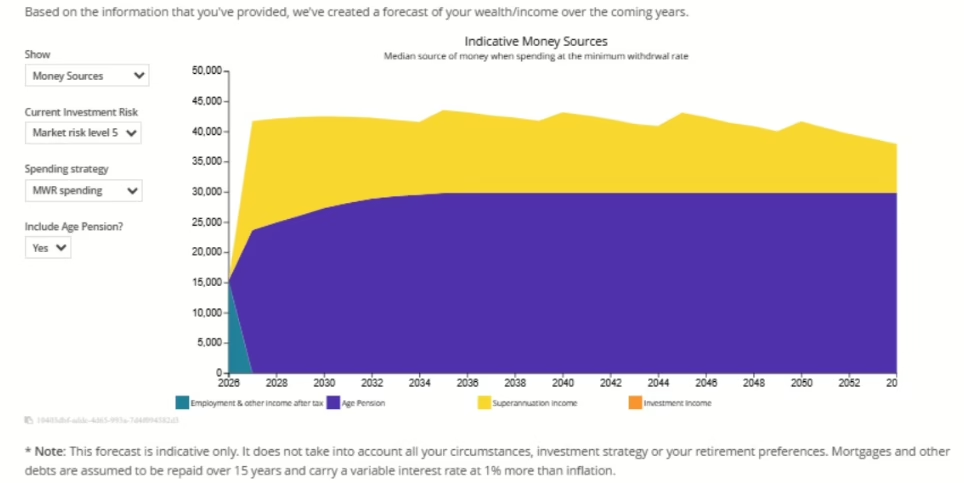

And here are the results that Steve could see when he included a little further information (super savings $350,000, cash balance $10,000 and a $40,000 car) in the Safe Spending Simulator.

It shows that Steve will be eligible for a full Age Pension (currently $29,874 per annum, including supplements) at age 67, as long as his annual work income doesn’t exceed $11,800. By drawing down super of about $25,000 per year from an Account-Based Pension, he will have a total income of nearly $55,000 as well as a Pension Concession Card (PCC) to help with medical bills, medicines, energy costs and some household expenses.

The chart shows that – even without his earnings from part-time work – his combined income stream is likely to last throughout Steve’s retirement journey – until he is 90 at least . He was surprised by this as his own initial calculations predicted that his super would only last 11 or so years. But what he hadn’t factored in were the annual returns on his super savings which mean that these savings will go much further than he expected. The Age Pension is indexed twice a year to keep it in touch with real wages, so that too was an aspect of the maths he hadn’t been able to forecast, by including likely inflation across his retirement journey. It’s these more detailed calculations that make the simulator so useful and much more reliable.

These calculations were all achieved by Steve within about 15 minutes. So the Safe Spending Simulator, based upon his likely longevity, reveals a huge amount. Knowing this has reassured Steve that his plans to step back from full-time work in two years are both realistic and affordable. He could also have viewed more detailed scenarios which included his planned work income had he chosen to do so, guided by an adviser, in a Retirement Advice Consultation.

But wait, there’s more!

You may recall that Steve has a mortgage of $75,000 on a home whose market value is about $975,000. He is currently paying $4200 per annum on an interest-only loan, so this mortgage is not going to reduce, although the value of his home is likely to increase. But having a fixed-interest loan may mean his repayments become difficult to manage when his super reduces and he eventually lives on a full Age Pension alone, assuming he is still alive at age 95. He wonders if he should use some of his super to either reduce this mortgage now, or to at least start to pay some principal plus interest on a monthly basis.

There are pros and cons to decisions around using super to reduce a mortgage. Steve is not alone wrestling with this as more and more people now head into retirement carrying some household debt. The good news is that there are quite a few strategies that will enable Steve to manage his mortgage while keeping his income as high as possible.

But that’s a story for another day!

The main reason for sharing Steve’s situation is because his lack of certainty about retirement timing and future income was able to be resolved very quickly, based upon the simple calculation of his expected lifespan, combined with his personalised safe spending simulation. That’s retirement sums made easy, in a nutshell!

If you are a member of Retirement Essentials you can access the above calculators (longevity and Safe Spending) by logging into the portal here.

You may wish to project your longevity and safe spending on your own. Or you can do so in a guided Retirement Advice Consultation, where you will be able to compare different spending scenarios, include more specific detail and talk to one of Retirement Essentials experienced advisers on the options you have to fully maximise your income.

And for those interested in understanding more about the factors which influence our lifespans, this previous article explains some of the dynamics which influence Australian longevity.

Have you ever used a longevity calculator?

Was it helpful in determining the income you are likely to enjoy across your full retirement journey?

Calculating longevity for couples is slightly more difficult – would you like to know how we do this?