We were delighted to receive some great comments to last week’s newsletter, as well as some really good questions. Two that stood out were in response to Amanda Hardy Lai’s article, How much is enough for a comfortable retirement?

Having read Amanda’s article Linda asked a very logical follow-on question:

‘How do you calculate how much you need in retirement funds once you are 70, 75, 80 or older?

(It’s) anxiety provoking not knowing whether you have sufficient funds left in pension funds to survive to an advanced old age after you retire. Please can you do an article on that giving some actual figures for Australians in their seventies, eighties and nineties compared to what you would need at 65?’

And Maree endorsed Linda’s question with one of her own, commenting:

‘Really good question Linda.

It would be great to get actual insight on how much 70, 75, 80 and older people spend per year, what their situation is e.g. their health, where they live, home or care home, whether they had any unexpected expenses that they didn’t plan for e.g. major home repairs, health issues, replacing major appliances and how/if they managed to do all this and continue living a comfortable retirement.

Did they have enough to do any overseas travel, how often, did they go on holidays within Australia, how often?’

Spoiler alert

Let’s tackle these questions by beginning with a spoiler alert.

There is no one simple answer to how much ‘retirees’ need or spend in retirement. Just as there is no simple answer to how much you should spend on a holiday in Queensland. It depends, always on your goals, expectations, current income and how long you plan to be there.

But just because there are no generic answers to questions about retirement affordability and spending, that doesn’t mean that individual retirees shouldn’t be seeking spending guidance for the ages and stages mentioned above by both Linda and Maree. They have raised really useful questions.

Defining the parameters

There is some careful thinking needed to ascertain your own most useful targets. These are the four different aspects of this task that will help you to personalise the ‘how much is enough’ question into one which gives you some more concrete information:

- Checking industry standards

- Checking Age Pension entitlements

- Assessing your current situation

- Accurately costing your goals

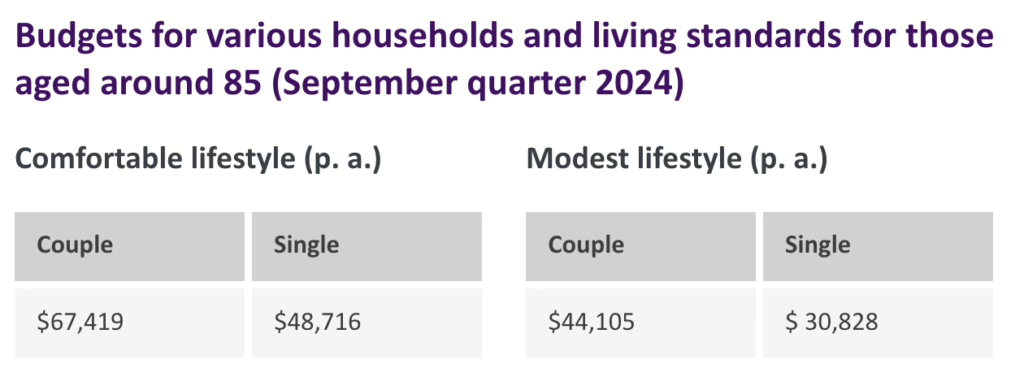

Using industry standards

As Amanda mentioned last week, the Association of Super Funds Australia (ASFA) provides a quarterly retirement living standard. In her article, Amanda referred to the ASFA targets for those aged 65-85. But ASFA also offers separate targets for those aged 85 and over. These targets are very general as they assume all retirees have a home without a mortgage, when we know about 20% of retirees have a mortgage and up to 20% do not own a home. But they are worth checking as the spending targets are adjusted for the different set of needs associated with those in the later years of retirement. Checking these numbers will give you a benchmark which can be adjusted to your own situation if your housing arrangements vary from full home-ownership.

ASFA retirement living standard for 85+ Sept 2024

Checking Age Pension entitlements

You will most likely receive an Age Pension at some stage.

We mention this a lot in our weekly newsletters, but it’s surprising how many people continue to assume that starting retirement as a self-funded retiree is the way they will end it. This is far from the case, with 80% of Australians in their 80s receiving at least a part-Age Pension entitlement. As well as being a guaranteed form of income (for those who qualify) Age Pension payments can be a game changer as it means that your remaining super will probably now last much longer. But projections which combine income derived from the Age Pension (including likely indexation increases) and different rates of withdrawals from your super are necessary to see how your different rates of spending will affect the longevity of your savings.

For this reason, Retirement Essentials designed a Retirement Forecasting Tool which can help you estimate different spending scenarios throughout retirement. Our forecasts paint a handy picture of how much you can safely spend, your likely mix of income from super, investments and the Age Pension, and a snapshot of how likely it is your money will last the distance.

Assessing your current situation

Next it’s useful to take a step back to better understand your current situation.

First consider your current age and use this tool to explore your expected longevity. It’s difficult to do the sums on funding a full retirement without a suggested ‘end’ date. Using a longevity calculator means it’s relatively straightforward to project how many years you are likely to live. And thus you can forecast the way your assets, savings and any government entitlements might combine to support your needs as you age.

We’ve previously mentioned the five pillars of retirement a few times. These are

- Age Pension entitlements

- Superannuation

- Work earnings

- Other assets

- Home equity

So there are a few levers at your disposal. Home equity is often a ‘top-up’ for the later years, so it’s worth understanding the ways your home can be used as a source of funding if the need arises.

Costing your goals

Lastly, have you attempted to put a cost on your various retirement goals. Maree mentions overseas and domestic travel. But how long is a piece of string? When planning for future income it’s necessary to set so-called “SMART” goals (Specific, Measurable, Achievable, Relevant, and Time-Bound). In fact, applying this filter to all retirement goals is the best way to more accurately define your money needs. How many overseas trips? Travelling Business? Premium? Economy? For weeks, a month or more? And spending how much a day? Knowing planned travel budgets, your current essential household expenditure and other planned discretionary expenditure is necessary to achieve a workable annual budget for your retirement in the early years and then the later years. It’s also important to understand the role of work in your retirement and how much work income you might receive.

Separately, as covered in two recent articles on Aged Care, Aged care costs explainer: Who pays and when? and Aged care fee changes in 2025: What you need to know, it’s also important to think about whether you will continue to age at home or whether you may need residential care at some stage. What is this likely to cost? Some of the answers are in the articles highlighted. It’s helpful to be aware of these kinds of expenses when projecting how much income you will need as you age.

In summary, it is not possible to share useful yardsticks for what older Australians spend at particular milestones (70,75,80). They spend in a similar way to younger Australians – which means some spend a lot, some modestly and some live below the poverty line.

While there are some target spending levels as mentioned, these are not necessarily going to be relevant to your own particular situation. Your own retirement asset mix of home ownership (less any mortgage), private savings, and super balance, combined with any work income and Age Pension eligibility will determine the likely range of income you are able to generate.. You may also find the MoneySmart Budget Planner a useful tool to more accurately estimate how much you need to spend to live a comfortable retirement.

A guided Retirement Forecasting Consultation with an experienced adviser will take much of the guesswork out of the questions ‘how much is enough’ and ‘will I run out’ by exploring your own particular situation. A personalised forecast can help you make more informed decisions about money in retirement. Work with Nicole, Amanda or Andrew to gain clarity about your retirement income needs and how they vary as you get older.

For broad planning purposes, I suggest a 5% reduction at 70 from what you planned as 65. You could reduce that by a further 5% for each five-year block.

Naturally, review every 6-12 months and relax or tighten the financial belt or your plan accordingly.

Many people ( especially single females) are only retiring at Pension Age or latter. No such thing as “early retirement” for them. The years 70 – 80

are the years when many such women (with good health) will continue to spend or spend more because now, free from “ work obligations” to pay off single income serviced mortgages &

freedom to live with more time than the common 4 weeks Leave per annum, they “ go for it”!

After 80 travel insurance becomes a prohibitive obstacle for some.

70 -75 + is now “the early years of retirement”. Increasingly so for men too.