compound interest isolated on a white background. The time dependence of the money value can be linear or exponential. Time is money.

These three wise men seem to say so …

There are many ways to make money.

And just as many to lose it.

Today’s subject is about a way to make and earn significant sums, sometimes without realising how quickly this can happen.

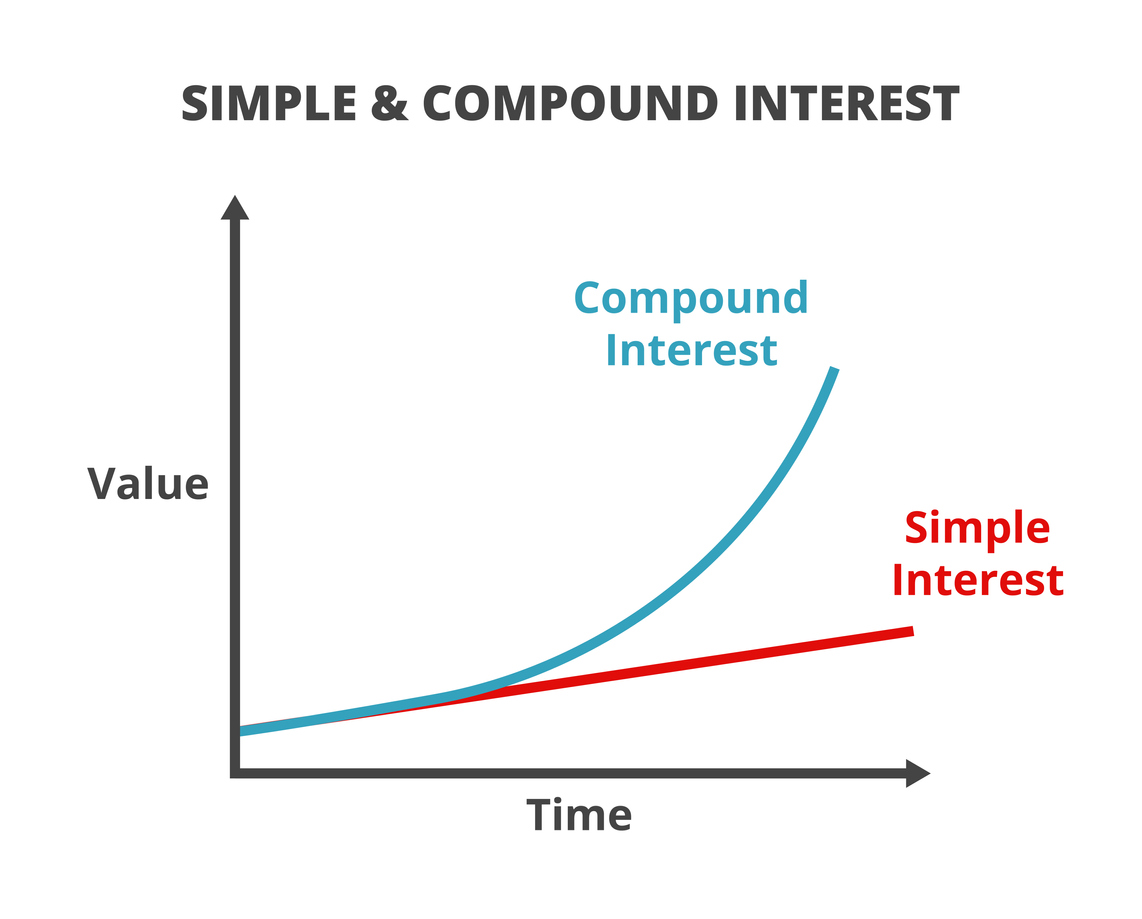

We’re talking about compound interest of course. And how it can, after the magical seventh year, suddenly become an engine of wealth generation.

Equally, when applied to debt, the effects of compound interest can be extremely detrimental.

So who are the three wise men – and why do they love it so much?

This week we’re quoting three highly regarded money commentators, Noel Whittaker, Paul Clitheroe and Scott Pape.

Noel Whittaker ranks compound interest (use the magic of compounding, he says) as Number Four in his ‘20 Commandments of wealth’.

Paul Clitheroe uses a gardening analogy: ‘Just as sun and rain do wonders for your garden, so too compounding returns and lower fees, which help deliver greater returns – plus the right level of diversification – will grow your nest-egg regardless of what markets are doing.’

And Scott Pape – better known as The Barefoot Investor – says that compounding is ‘the simplest and safest way to create your fortune’

If this isn’t enough, Nobel prize-winner, Albert Einstein, described compound interest as ‘the eighth wonder of the world’.

Why do they love it so much?

The first, most obvious reason is that as money men they know how keeping money invested and making interest on the interest is the best overall way to increase wealth. We hear a lot about ‘get rich quick’ schemes and are rightly suspicious. But the power of compound interest allows savers and investors to get richer more slowly. It involves a long term view combined with the ability to not be unsettled by short term market volatility.

How does compound interest actually work?

There are algorithms which explain the way earning interest on interest adds up over time. We think an easier way to understand it is to play with a compound interest calculator and see the sums for yourself. The Australian Government’s Moneysmart calculator works well. But we’ve chosen to use Noel Whittaker’s compound interest calculator as it shows the compounding on an annual basis, which is a really helpful way of seeing where the growth in your capital occurs.

Here’s a quick hypothetical for a member we will call Steve. Steve is 50 years old and starting to think about retirement. The calculation uses a 7.2% per annum return (most balanced super funds have achieved this over the last 10 years) on an opening balance of $10,000.

| Year | Opening Balance | Annual Earnings | Closing Balance |

| 1 | $10,000 | $720 | $10,720 |

| 5 | $13,206 | $951 | $14,157 |

| 10 | $18,696 | $1,346 | $20,042 |

| 15 | $26,468 | $1,906 | $28,374 |

| 25 | $53,049 | $3,820 | $56,869 |

| 50 | $301,679 | $21,721 | $323,400 |

As you can see after 10 years Steve’s money has doubled to $20,042. After 50 years he has $323,400 and the annual earnings of $21,721 are more than double his original investment. Now at 50 years of age it is very unlikely Steve will leave his money invested for another 50 years but the table does highlight just how quickly the money can grow due to compounding. You are earning interest on your investment at the start but after that you are also earning interest on your interest and after that interest on the interest on your interest etc. This is why investment experts, and Albert Einstein, love compounding so much.

As we said Steve won’t really leave his money there for 50 years but most Australians spend 25 or more years “retired” so there is still a lot of time to make your money work for you.

Handy hint

Depending upon the frequency of payments of your ‘interest on interest’ you can earn even more. That’s because interest that is compounded daily increases more quickly than that which is paid monthly, and both are better than amounts paid quarterly. The basic rule is that the higher the number of compounding periods, the greater the amount of compound interest.

That’s the upside of compound interest.

But sometimes it’s not so magic …

Debt and compound interest

Just as interest is earned on interest when saving, so you can be hit with compounding interest if you carry debt. This works the same with a redraw facility where you are removing more than you are repaying. Or with a credit card that is not fully repaid each month, and so you pay interest on the extra amount you failed to cover. More interest is then owing, and this cycle of debt can become insurmountable. The killer part is that the interest rate on credit card debt is currently around 18%. Having an 18% compounded rate of debt is not a smart financial strategy.

The best advice is to fully pay off every credit card, every due date. If that is easier said than done, rather than create a mountain of debt you cannot manage, it is probably best to contact your lender and work out a scheme of repayment with a hold on extra interest charges. This often means relinquishing your access to further credit. It this helps you reduce your indebtedness alongside your financial stress, then that is probably a good thing.

Finally, if you are struggling with debt, getting financial counselling support can offer a really helpful way tackle this situation.

There are lots of great tools and calculators you can use to see how compounding can work for you. In addition to the two we mentioned above you could also talk to one of our advisers if you wanted some help to better understand what your retirement forecast might look like.