Sometimes the best plans are simple and straightforward. Although retirement rules are complex, your retirement investments don’t need to be. You can create a great retirement plan –delivering the lifestyle you want and can afford – with just the Age Pension, a retirement income stream from your super fund (an “Account Based Pension”) invested in diversified funds, and if you have investments outside super, keeping those simple too – a mix of low cost diversified managed funds and bank deposits for liquidity purposes. Let me show you how.

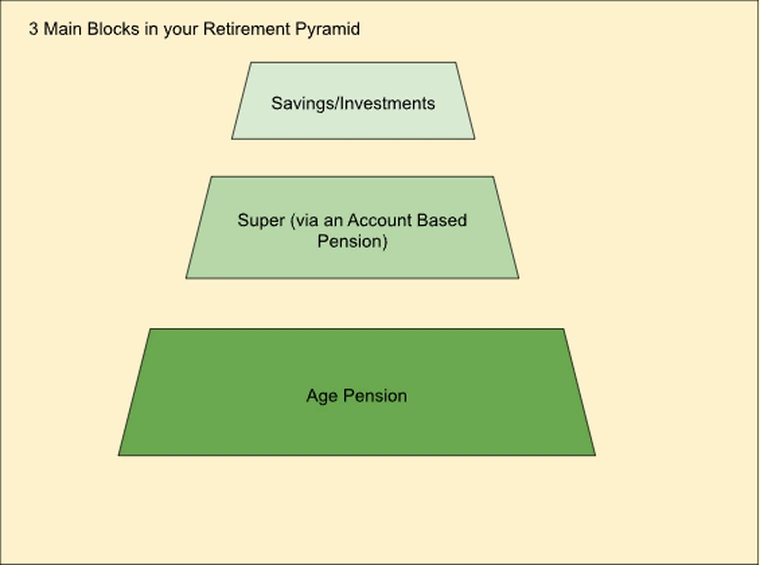

Think about your retirement sourcing like a 3 block pyramid.

The Age Pension is the base. If you’re eligible, that’s great. You’ll get a stream of income, payable fortnightly, that adjusts for inflation every six months. If you’re not eligible now – maybe you’re not yet 67 or your current income or assets are too high – you probably will be one day as you spend down your other assets. 80% of people are eligible for the Age Pension by the time they’re 80.

If you’re on the part Age Pension, it’s likely that it will rise as you get older. When you spend down your assets, like super or savings & investments, your entitlement improves.

Your super is the next major source of your retirement funding. You’ve been contributing and building it all your working life; now it’s time to start spending it down to pay your living expenses. To convert your super into a retirement income stream, you’d typically use an Account Based Pension at your fund. Switch it from the Accumulation phase to the Decumulation phase and start to get your earnings treated as tax free. That saves you paying taxes of 10-15% on your earnings. For an individual with $300,000 in super, that typically amounts to saving of over $2000 per year. The third source is other savings and investments. You may have very little outside super or you may have collected all kinds of investments over the years. Now, the challenge is how to organise them to help you meet your retirement spending needs.

Making the Investment Choice

Now, the Age Pension is dictated by the government’s rules. But you have choices to make for the Super and non super parts. Your super fund will offer you a series of options for your Account Based Pension, with different levels of risks and potential returns. And the choices available to you for non super are so wide as to be mind boggling.

So, let’s focus on simplicity again.

One key to success in investing is diversification – holding a mix of assets that are different, move differently and potentially offset each other’s risks to a degree. So, the mainstays of most super funds are “diversified” funds, containing a mix of different investment types, from Australian to international shares, from Australian fixed income securities to international fixed income investments, property and sometimes alternative assets like infrastructure, private equity, and hedge funds.

The second key is getting the asset allocation right for you – matching it to your goals and to your risk tolerance. In other words, will you have more risky assets in your portfolio which seek growth in value, like shares, or more focus on income producing assets, like fixed income, which tend to have less volatility(and so are often called “defensive”) but also less potential rewards.

A super fund lineup of diversified funds might look like this:

Cash: 100% in deposits with Australian deposit-taking institutions or in a ‘capital guaranteed’ life insurance policy.

Conservative: around 30% in shares and property and 70% in fixed interest and cash

Balanced: Around 70% in shares and property and 30% in cash and fixed interest

Growth: Around 85% in shares and property and 15% in cash and fixed interest

You can get equivalent diversified funds outside of super too. Same investments, just a different “wrapper.”

What’s the right asset allocation for you? That’s why you might want to talk to an adviser. Your choice will influence the return you receive and thus how much you have to spend in retirement…but also how much volatility you’ll see in the value of your investments. It’s no good investing in high risk high reward investments if you can’t tolerate the risk. You need to be able to “stay the course” – and not head for the exits when things get tough in the financial markets as they will from time to time.

Chances are you’ve been investing in a good diversified fund during your super accumulation phase. If you’ve been happy with it – and think the costs of their Account Based Pension is competitive – you may want to stick with the super fund and just switch from accumulating to a retirement income stream through an Account Based Pension. But you may also want to consider whether the risk profile you had during your savings years is still right for you in your spending years. Most default accumulation funds are quite growth oriented…and that may be more risk than you’re comfortable with when you’re depending on it for your income.

The important thing to understand is what you can reasonably expect your Retirement Pyramid to produce for you in retirement…and how long it will last for you. That takes some pretty good mathematics. Our advisers can help you work it out and show you what your forecast will look like.

I agree. As all issues in life keeping it simple as possible is the golden rule for a good life. Only wish that all governments would get on board with this simple homily

Is it generally considered that the risk level of investments should decrease as one ages. For example. The risk level one can tolerate is most likely higher in ones 60 than in ones 70s?