Many people want to supplement their income with a bit of paid work after retiring from full time work. So, we can think about working – after full time work– as the (optional) fifth pillar of retirement.

For our clients over 65, we find that a good-sized minority are still getting employment income. That declines a bit over time but there’s still plenty of people working into their mid 70s and later.

You would think that getting a bit of employment income would be a “no-brainer” add-on to your other sources of retirement income. Unfortunately, it’s not that simple. Our retirement Principle #11 is : Working during retirement can add to your retirement income…but you need to understand the interactions with the Age Pension.

Through our eligibility calculator, we find that the top reason people in their late ‘60s/early ‘70s aren’t eligible for the Age Pension is they’re still earning (too much) employment income.

And people who have cut back on full-time work still find their employment income has big impacts on their Age Pension payout – thanks to the Age Pension rules, namely, the Income Test.

How the Income Test bites

As I recently heard an ex Federal Senator say, “in Australia, the government pays older people not to work.” What he meant is that the Age Pension discourages working and earning beyond a certain level.

The Income Test kicks in to reduce the amount of Age Pension for people earning above a threshold level of income. A single person can currently earn income of $5,512 per year (plus the Work Bonus if applicable) before the “taper rate” starts to kick in to reduce the amount of Age Pension you receive. For every dollar of income over that level, the Age Pension reduces by 50 cents. The maximum a single person can earn before losing the Age Pension completely is $63,559.

For couples, the taper rate kicks in at $9,672 pa (plus the Work Bonus) and the maximum a couple can earn before losing the Age Pension is $97,177.

The Work Bonus

The Work Bonus adds to the amount you can earn. It allows a $300 credit per fortnight (or $7,800 per year) for employment income…and then adds another $4,000 bonus once off.

So, how much can a single full Age Pensioner earn per annum before moving to a part-Age Pension?

In the first year a single can earn up to $17,312:

- Firstly, there is an income-free threshold for the Age Pension. This is $212 per fortnight or $5,512.

- Because you are eligible for the Age Pension you are allowed a Work Bonus credit of $300 per fortnight or $7800 across the year.

- And then there is the work bonus of $4000.

However from Year Two onward, it is only $13,312 because you only get the $4000 bonus once. After that has been used, you are only entitled to $300 per fortnight, which is $7,800 per year (plus the above income free amount of $5,512).

What about couples?

Q. How much can a couple who are full Age Pensioners earn per annum before moving to a part Age Pension?

In the first year a couple (presuming both are Age Pension age and earning income) can earn $33,272:

- Couples have a higher income-free threshold of $360 per fortnight or $9,672 combined

- Presuming both are eligible for the Age Pension then you are each allowed a Work Bonus credit of $300 per fortnight or $7800 across the year.

- And then there is the one off bonus of $4,000 each.

For couples, it is important to note that although the income-free threshold is combined between the two, the Work Bonus is applicable to each member of the couple specifically. If your partner is not of pension age then they will not earn any Work Bonus of their own and you cannot use your Work Bonus to offset their earnings. The other scenario is that both of you are pension age but only one of you is earning income, you will both accrue your own Work Bonus balance and cannot combine them to offset the one income.

Is working worth it?

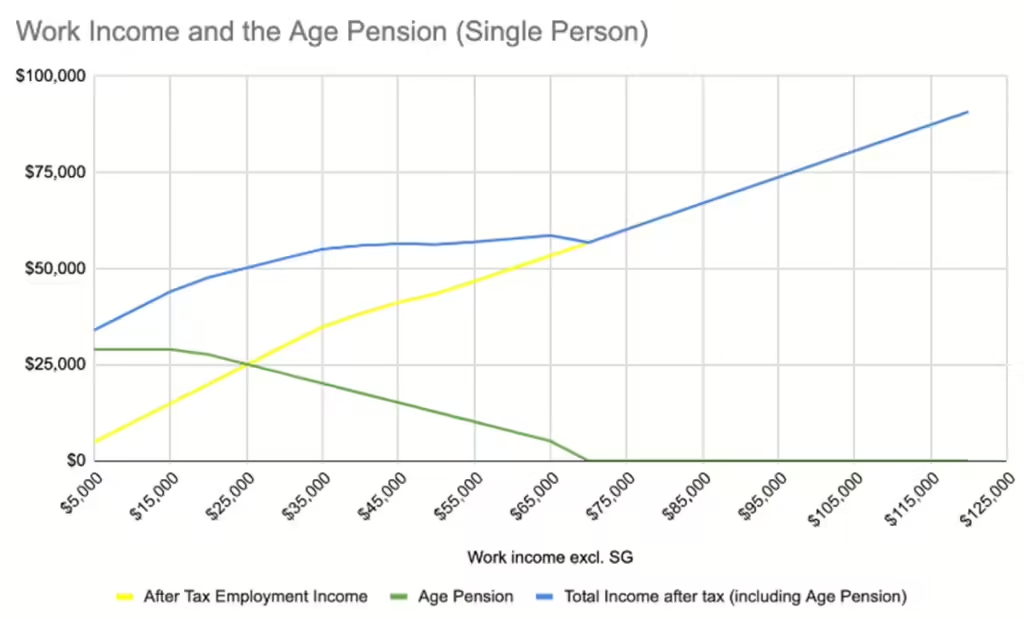

Let’s take a look at how working impacts the Age Pension through a graph. Here we show the impact of work income on the Age Pension and also total income and total income after tax, using a single person in this example.

You can see how rapidly the Age Pension declines with work income. Once the threshold level set by the Work Bonus is breached, you start to lose the Age Pension at 50c for each extra dollar earned. (In this example we show the full first year Work Bonus.)

If you’re able to do so, continuing with some employment adds to your income level, but the taper rate on the Age Pension severely impacts the extra value to be derived from work income. As you face choices, and have resources available from superannuation saved over years and decades, many people decide that working more than a part time job just isn’t worth it any longer. Our advisers can help people make these decisions by forecasting what their retirement income and assets can look like under a range of different scenarios.

Of course, for many people working isn’t just about the money. It’s about the sense of self worth and purpose that work can provide, or it’s about the social connections that you might get from working with colleagues or interacting with customers. Again it’s a very personal decision…but talking it over with an adviser often helps.

Income free threshold, Work bonus Credit, Plus $4k bonus credit, surely not everyone understands this and are afraid to work just in case they’re caught out

Surely there is a simpler way , i’m led to believe even Centrelink can’t work this out.

I know i’m completely lost.

Very useful, do you have a similar graph for a couple with 1 person working with no Work Bonus included?

Certainly looks like earning more is not worthwhile between $25k and $70k in that example.

I’m totally lost with all these numbers, some are per fortnight, some are per year, none mention when a year starts or ends ( calendar, financial or anniversary). I’m told when you go on a part aged pension, it all starts there and what has been paid in the past is ignored.

I plan to apply for aged pension ( being 74 and still working full-time) – but earn too much. So I plan to start on Jan 1st 2025. My salary then will be 4/5 of my current salary and under the limit. If I look at my salary from 1st Jan to 30th June – I’m well under.

Its all too confusing and even a chat with Centrelink financial person didn’t clear it all up.

Situation: Couple, me working partner not, I’m 74 she is 64, No shares, No investment property, Savings minimal as we bought a house ( cash ).

Thankyou for this. I’m a registered nurse, aged 73, working in a high paced environment, and currently working two day per week, six hours each, $50 dollars an hour gross salary, and without additional penalty rates. As much as I would like to keep working for a few years yet, though perhaps dropping the hours a little further, I can see that the salary I currently get will stop most likely any money I could receive via an Age Pension. This, despite the other few assets I have.

Not quite on topic but I earn 10-20K per annum for consultancy work but the new tax rule about counting every hour in a diary has proved really tedious. I have a paper diary but I get busy or distracted and do something else having started a job and forget to log what I was working on and when. Does anyone else have this problem?

A friend is considering renting out an empty house, income after costs would be approximately $12,000 pa. ($300 a week minus rates, insurance, agents fees, maintenance, etc so more like $250 a week)How would this affect his age pension?

I work 10 hrs per week

Gross $680

I enjoy my work as it is stimulating but also carry financial responsibility for others in the family

I am 75 and husband 82 but is not working and is very unwell and has very costly medical needs to be met

Eg chemist $400 plus per month and 7 specialists costs

I need to keep going as I also have a very unwell son with kidney failure who cannot work full time

I would like to know what amount I could reduce my part time hrs to so my working is adding to our income

I am trying to understand your graph – apologies !

My partner and I are both aged pensioners.

We both work intermittently (particularly myself) in mental health services

Between us we might earn $400 in one week, $100 the next or nothing!

I am totally confused as to how that works and find the “explanations” leaving me more confused

I am still not clear on whether our earnings are calculated fortnight, monthly or yearly!

No one including Centrelink seems able to provide me with a clear and concise explanation

As an aged pensioner and a qualified primary teacher, I would like to work part-time casual relief. Unfortunately for me it would not take long to reach the so-called “work bonus” and thereafter pay a minimum 50% penalty plus tax on the pension or incur a significant Centrelink overpayment. Additional costs include running a motor vehicle to get to school locations which are usually in suburbs not easily accessible by public transport. All this of course is a significant disincentive to go and perform a challenging role in a time of growing teacher shortages.

For those willing to work, the so called “Work Bonus is a poverty trap for those who could use their much needed skills in caring professions like teaching or nursing but are subject to these harsh financial disincentives that the “Work Bonus” imposes after a relatively low threshold. Why would it be so hard to let aged pensioners follow the New Zealand model of allowing pensioners to work and pay an appropriate amount of tax. In a time of cost of living crisis, aged pensioners get nothing but empty rhetoric and had no access to recent tax cuts. A reduction in the punitive, arbitrary 50% financial penalty payable by aged pensioners who want to work would be a start. Ps my training in early years Phonics will now just go to waste and the children will miss out as well. When will sanity prevail?

Most people who are on a full aged pension and still wish to work, want to know how much they can earn before it affects your pension, and is the amount you earn calculated as gross or net . If it’s Gross how does that work if you have to purchase products to perform the work you are doing ( eg A Painter

Just asking )