It turns out Australian retirees are taking very different approaches to their retirement payouts. We’ve always said that in retirement everyone is different. Some new CoreData research shows just how true that is.

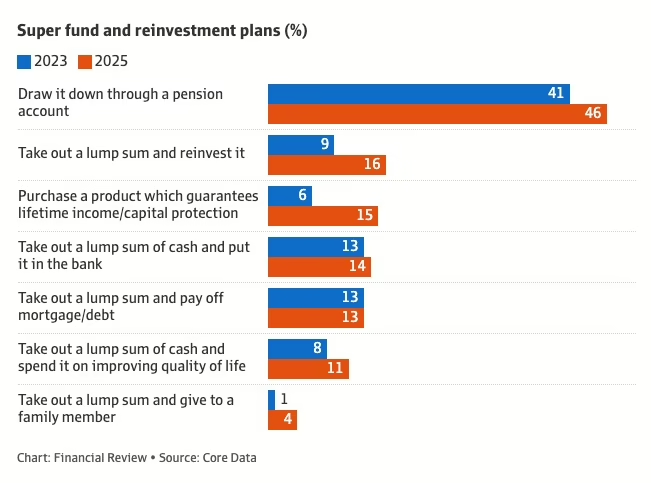

The research found that about 46% of retirees plan to draw down their super money using an income stream, or Account Based Pension, 15% are considering an annuity-style lifetime income product with capital protection, while the rest are thinking of taking at least some of their money out in lump sum withdrawals.

Two things to note here:

(1) Slightly less than half of people are considering drawing their money down through an Account Based Pension, the vehicle designed for the purpose of providing ongoing flows of income (typically fortnightly or monthly) to super members.

That’s surprising since there’s a significant tax advantage on offer with Account Based Pensions – the earnings as well as payouts are tax free, unlike money in an “accumulation” super fund where earnings are taxed at up to 15%, or income earned on investments outside super like bank accounts and shares which is taxed at your marginal tax rate.

Now, that difference in tax can equate to a big difference in returns. Because they pay no tax on earnings, Account Based Pensions typically outperform their accumulation super fund cousin.

When you pay less tax you earn higher returns

Annualised Investment Returns five years through June 2025

| Portfolio type | Accumulation Fund(up to 15% tax) | Account Based Pension(Zero tax) |

| Capital Stable | 4.5% | 5.1% |

| Balanced Growth | 8.3% | 9.3% |

| Growth | 9.9% | 10.8% |

Source: SuperRatings estimates

You might think those are small differences in rates of return…but let’s work it out.

Let’s take the Balanced Growth portfolios. A 1% difference in annual return resulted in a difference of $14,014 on a $200,000 investment over 5 years; that is, the Accumulation Fund earned that much less than the Account Based Pension. Over ten years, or longer, the difference is much greater due to compounding.

(2) There are many different reasons people take lump sums. Some take it out and plan to reinvest it elsewhere; others plan to put it in the bank, or to buy an annuity type product.

This sometimes just reflects a desire for control after all those years of having it locked up in super. Taking the money out of super creates flexibility…but there may be downsides.

Putting it in the bank for instance can be a costly decision compared to keeping it invested via super. We often see people getting very low returns, even zero on their bank accounts. It feels safe but it may not be keeping up with inflation. Most well established super funds have done a solid job managing their members’ money on a diversified, relatively low cost basis over long term periods. We find that about 11% of our Age Pension clients are entirely invested in bank deposits and I worry that they may be missing out.

Lump sum withdrawals also might be used to pay off the mortgage (we find that about 15% of people go into retirement with a mortgage). Others take it for spending reasons, to improve lifestyle, often involving travel or a new purchase like a car.

What’s right for you?

“It’s a complex decision and there’s a lot to consider when people are thinking about how to draw down their super,” says David Kennedy, Head of Advice, for Retirement Essentials. “Our clients tend to want to make occasional lump sum withdrawals to deal with retirement goals they may have involving things like travel, car upgrades, housing modifications and repairs, mortgage reduction, and family gifts. But they also need to figure out how much they can afford to spend each year, where their regular cash flow is going to come from, and how long it will all last.”

When you overlay your spending needs with what’s best from a tax point of view, what makes sense from an investment perspective, what the various rules for super and the Age Pension are, it’s complicated. To sort it out you need strong retirement forecasting tools and some good advice.

That’s where we come in. We help people make these decisions every day — and we understand there’s a lot to weigh up. With the right tools and guidance, you can see how your choices play out over time and build a payout plan that works for you.

If you’re thinking about your own retirement income options, we’d love to hear your thoughts. And if you’d like to explore your options in more detail, a Retirement Advice Consultation might be a good next step.

Join the conversation

- Are you leaning towards regular income, lump sums, or a mix of both?

- What kind of retirement expenses are you planning for — travel, home upgrades, helping family?

- How are you balancing flexibility and certainty in your retirement plan?

- What would give you more confidence — clarity on spending, Age Pension impacts, or how long your funds will last?