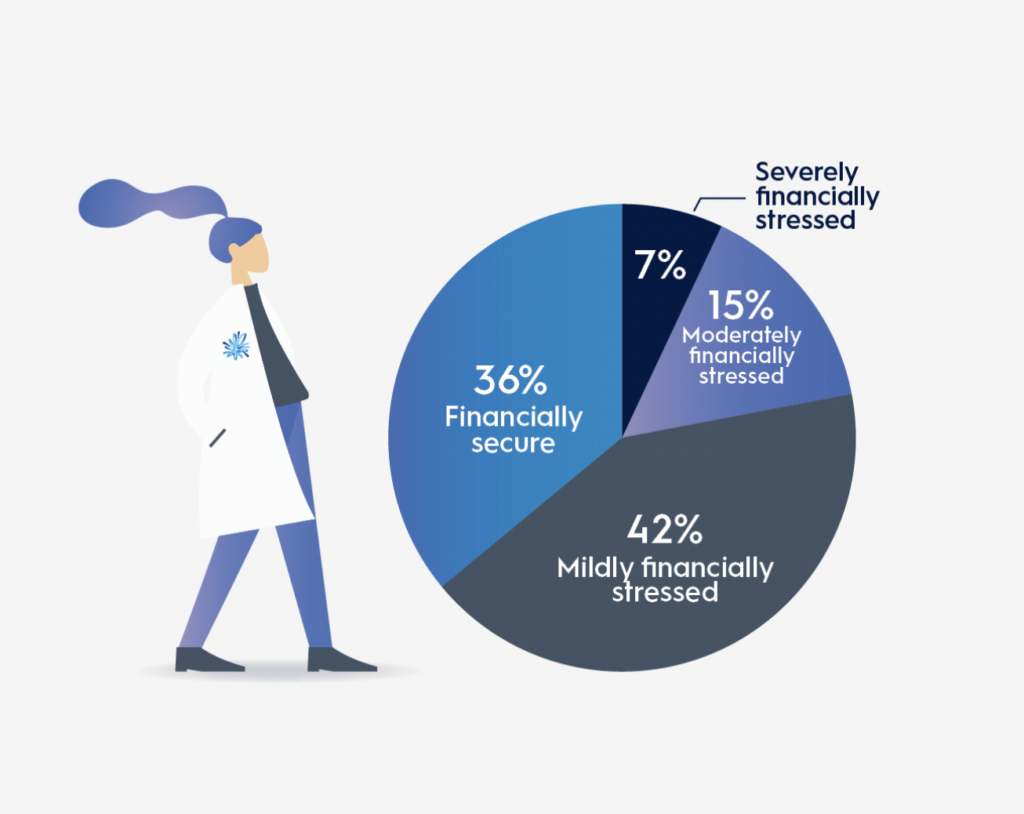

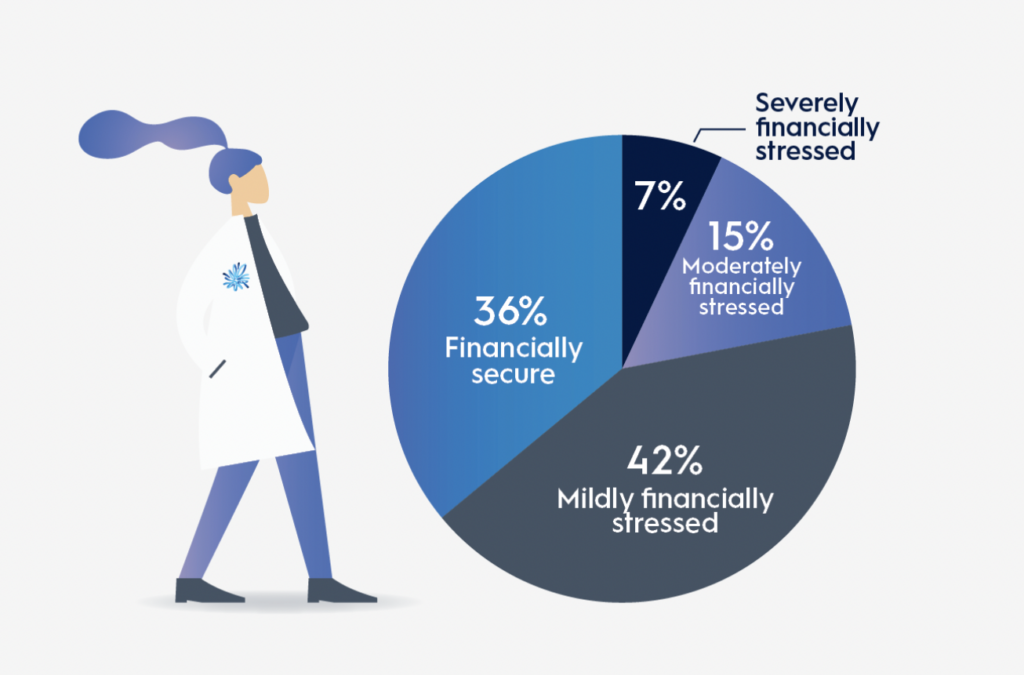

Source: AMP Financial Wellness Study 2022

New financial wellbeing research has revealed an increase in stress and uncertainty about retirement income. The findings, released by wealth management group, AMP, are the latest in the bi-annual Financial Wellness report, based on responses from 2000 participants. The 2022 report finds:

- Almost half of Australian workers don’t know how much they will have or need at retirement

- Women are significantly more concerned about retirement than men across the key measures of retirement concerns: not having enough, working longer, not being able to maintain the desired retirement lifestyle. 70 per cent of women are concerned they won’t have enough to retire, compared with 56 per cent of men.

- Two in three respondents aged over 65 are concerned about having too much debt

- More than one in five don’t believe they’ll achieve their desired standard of living in retirement with cost-of-living pressures increasing concerns

- A growing portion of Australian workers are worried they won’t have enough savings for retirement, with a $200,000 gap between how much they expect to retire with and what they think they will need. Most expect to retire with around $400,000 in their nest eggs, but believe they’ll need closer to $600,000.

Concerns about retirement have also escalated more broadly, with those worried they will not have enough to retire increasing to three-in-five Australians, up from two-in-five in 2020.

Says Ben Hillier, AMP General Manager, Retirement Solutions:

‘Heightened by increasing cost of living pressures, this fear of running out stems from a basic lack of understanding – an awareness gap – of their finances and the retirement system. Many pre-retirees also feel like they’ve left their retirement planning too late.’

Okay, there’s the bad news – the trend on retirement confidence is certainly heading in the wrong direction.

But the benefit of surveys such as AMP’s Financial Wellness 2022 is that they serve as a warning to those most at risk, alerting them to take action.

The good news is that you don’t need to have a negative kneejerk response to this information – rather you can use it to your advantage, by taking a three step approach and:

- Auditing your current situation

- Projecting how close this is to delivering your current retirement income goals, then

- Resetting your goals and recalibrate your financial strategy to meet these newer goals.

What’s required to do this?

Firstly, you need to fully understand your assets and liabilities as well as your current and likely future income streams.

Next, it is important to project your spending needs for the next five, 10 and 20 year periods.

Do the results mean that you, too will be significantly short of your target income?

It’s critical to recognise this situation if this is what the numbers say. Most people are not as stressed by the reality of their finances as they are by fears that they will run out. Fully understanding your projections puts you in control. It won’t make money appear from thin air – but it will give you a clear sense of where you are and enable you to change tack in ways that will help

The last step is to consider the strategies that you have at your disposal to recalibrate in order to maximise your future income. This may involve a resetting of goals, which is a good thing as they will be based on realistic projections, rather than hopes or fears.

In order to project your spending and consider the tools available to forecast your income and potentially enhance it, it may be useful to speak to an experienced adviser. You can access one-on-one consultations to discuss your retirement income planning needs and review your goals with qualified support.

How do we budget our spending for 5,10 or 20 years when the government keep changing the rules eg investment property values, superannuation rules and now looking at franked dividends. We try to save something for retirement, but get cut off at the knees every time.

The whole of Retirement scheme and the way the system works needs an overhaul. I am absolutely disappointed that Centrelink has refused to honor my retirement by paying me my pension.

I am off the opinion that once a person reaches age 67, he or she is entitled to their pension, and if this doesn’t meet the requirement, then at least a pension payment must be made on reaching age 70 and beyond. I cannot survive without working for at least 20 hours per week with the present economic situation and Centrelink wants me to work and earn only $320.00 per fortnight. This is absolutely absurd!