Is this really happening?

The other night I saw an ABC TV report by business reporter, Daniel Ziffer. I normally find Mr Ziffer’s work to be both informative and interesting. So when he spoke of a ‘generational divide’ in Australia’s spending habits, I was all ears.

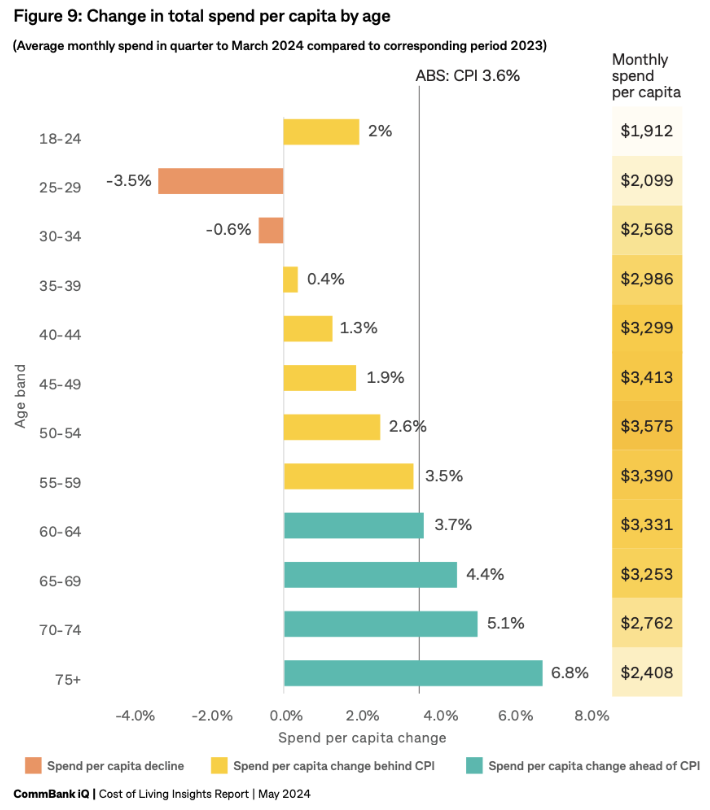

The report was based upon data from the May 2024 Commonwealth Bank Cost of Living Insights research. This report draws from spending patterns of seven million Australians and shows, amongst other findings, the differences between age groups. To cut to the relevant excerpts from the chart below, the report shows a shrinkage in spending for 25-29 year olds by 3.5% (or $2099) over the past 12 months, contrasted with increases for most other age groups, particularly those aged 65-69, which were up by 4.4% (or $3253), peaking at 6.8% (or $2408) for those aged 75+.

Mr Ziffer interviewed various people including boomer ‘Murray’ who said:

“I’m retired, I own my house, and I’ve got money in super. So it’s all looking good for us, but not so good for other people who are struggling with mortgages.”

Fellow boomer, Bruce, agreed, even suggesting that he might personally be contributing to inflation:

“(my spending) may be at the detriment of the cost of living going up … Because if you got (sic) money, you spend it. So, yeah, that doesn’t help inflation.”

A local retailer, Paddy, added to the debate, noting that:

“grandparents are throwing their credit cards across our counter”.

Spoiler alert – where do you think Mr Ziffer went to film these ‘everyday’ retirees? Why, a ski resort in the Victorian High Country of course. Why the people who can afford this expensive sport would offer sober analysis of baby boomer spending remains a mystery to me? Why not go to a regional shopping centre or a bowls club or a volunteer hub?

It took economist Nicki Hutley to look more carefully at the Commonwealth Bank data and comment:

“Boomers aren’t spending as much as the generations below them who are more likely to have mortgages and children living at home. If you’re young your income is low because you just started [working], if you’re lucky enough to actually have a mortgage, it’s going to be a huge one. So all of those things factor in together.

With low taxes on assets, compared to income, and with housing harder to secure, the end point is obvious.

It’s just tough to be young, and it always has been.”

So how does this strike you?

Do you, too, see a generational divide with older Australians enjoying the good life while younger people exist on bread and dripping?

That scenario just doesn’t ring true for me. For the decades that I have been writing about retirement income and demographics, I’ve noticed how non-homogenous the so-called generations are. There are rich, poor and in-between at every age and stage. Which makes me wonder if Daniel Ziffer’s report was simply a form of broadcast ‘clickbait’ and therefore best ignored. Or if it was a less than subtle attempt at sparking a generational conflict with some ‘boomer bashing’?. It certainly veered into sensationalist reporting. But it does raise a great point. What, exactly is the nature of spending in retirement?

And, at your current rate of spending, will your money last?

It’s useful to recall that one of the main findings of the 2020 Retirement Income Review was that many retirees are too frugal and die with their savings left to the next generation. In short, those in retirement didn’t spend enough. Four years down the track, it’s fair to wonder if the idea of leaving the kids an inheritance is fading. What many retirees find difficult is working out what their own particular ‘sweet spot’ is.

How do you get it right?

Getting spending right in retirement is critical. It is arguably the more important half of the great retirement balancing act – saving and investing enough to maintain a comfortable standard of living, while spending at a rate that means these savings last the distance. The sums are far from simple. Yes, you may have a clear idea of your spending needs. And a clear idea of your financial assets. But how these assets will combine to create an income stream which complements an Age Pension, perhaps with other income or wages feeding in, can be very complicated. That’s when forecasting tools can be invaluable, particularly in a consultation with a qualified planner who can help you compare your own ‘what if’ scenarios.

And one last thing…

As Nicki Hutley points out, even though younger generations are spending less than they did a year ago and older Australians are spending more, in actual dollars, the highest spending occurs between ages 40 and 59. Yes, younger people will be facing the very real challenges involved in raising a family and buying a home. Older people may have already fought these battles. But where is the research that reveals how much of the savings of retirees is being spent on their children and grandchildren?

Now wouldn’t that make for interesting reading?

Do you relate to the Commonwealth Bank data on spending increases for older adults?

Are you shelling out an extra $2500-$3500 as the research suggests?

Or have you had to cut back?

I am a pensioner struggling with a mortgage and cost of living increases and have cut back my spending. My housing costs are half my income. I’m definitely not spending freely!

Hi Jacoba, thanks for your feedback – yes, you make a strong point – the notion that all people of a certain age are all in the same situation is both inaccurate and unhelpful. Housing costs are taking a big bite out of many people’s income. warmest Kaye

78 yr old female pensioner. widow. I have sufficient Super to be comfortable. I worked p/time until 76.

Own home which is aging as I do, and we both require additional maintenance. I now pay more for help in the garden and medical. I have children and grandchildren (10) and they all get b’day &;xmas presents. I probably spend as much as when I worked.

my husband is 70 and I am 67, I have stopped working, but my husband still works in our small business. we have a morgage, we have collateral in our home and want to down size. we don’t have any super. we both get a small pension from the UK and I get a small pension from Australia. we need to downsize and buy a home without a morgage so that my husband can retire. we would have a small amount of money left from the sale of our home, but we would be living off the pension and the money left over would be for emergencies.

we live well, but cheaply.no holidays. we are certainly not fuelling inflation. we consider ourselves to have a good life. we own our vehicles, but they are getting old like us. we are good cooks and,although we enjoy going out now and again, I would rather cook for my family and friends at home. due to the housing market situation, we are nervous about selling our home, as we will struggle to find one to buy. I get very frustrated, hearing about pensioners that own their homes and have thousands in super. it’s definitely not like that for all of us.

Hi Sandra, thanks for sharing your thoughts – yes, we do seem to hear a lot about ‘lifestyles of the rich’ when it comes to retirees – but that doesn’t seem to be the case for most Australians – they seem to continue to budget carefully – hopefully living well, but certainly not extravagantly

Yes I’d agree there’s a divide. It’s partly generational helped by Keating’s superannuation initiative but there’s no question the rich have got richer in Australia. Wages have flatlined for those working in services that contribute to a healthy functioning society vs shareholders of commercial entities who do nothing towards its success or failure have gained mightily. Management and board members even more so. Joyce is a case in point. He destroyed an icon of Australia and walked off with millions. On the issue of income vs land tax my house has tripled in value. Have the improvements I’ve made contributed to that? Hardly and I can never understand why the Medicare levy stopped when I retired! In my 3rd age that’s when I will be drawing on it the most. Negative gearing, capital gains and trust benefits need an overhaul (ended)? and vacancy and land taxes introduced. I’m sure those in the know could equalise the divide. It’s just that they’re in the top group so have no incentive to do so.

Why wouldn’t we spend more?

The latest proposal regarding age care is also designed to ensure that any inheritance left will be significantly less than what it would be under the current rules.

Our generation has scrimped and saved for our retirement and we are hopeful that we can leave something to our children,this now under threat by government.

I suggest our younger generation spend spend spend , if they don’t it will go to the government

Harry, 100% agree, we the Retirees busted our Ar%^ to get what we have, we went without for so many years to have what we have now.

The younger generation have to be made aware we didn’t get here through great handouts.

They bemoan the 5-6% mortgage interest rates; that was normal in our days AND don’t forget Paul Keatings gift of mortgage rates 19% in Dec 1985 or Fraser’s interest rate of 21.4% in 1982 (Source: SMH).

To the younger generation, you do not need new motor vehicles every couple of years, big 4wd for the weekend romp; concentrate on reducing your mortgage for a few years then you can have all you toys.

Maybe the younger generation should take responsibility for themselves instead of trying to find someone to blame.

I have worked all my adult life and a some of that time in two jobs to support my family as a single parent. I did not go on overseas holidays or spend money on myself. I lived very frugally and everything I have is because I worked for it.

I am still working at 71 years of age, so don’t assume all the baby boomers have loads of money they can through around and at the end of the day the next generation will get anything left from my life.

I’d love to see a program where they experiment by take different generations and give them a pensioner’s budget for a six month trial and see how well they manage their cost of living expense’s. Both with and without mortgage’s. Walk a mile in my shoes!

Now that’s a show I would gladly watch daily.

Yes Susan – you are right – back in the day a federal politican tried this and couldn’t make ends meet 🙂 very sobering!!!! warmest, Kaye

Well said.

This is just ridiculous! The only thing that fuel inflation is government spending and the printing of money. While the US dollar tanks, so does the Aussie dollar as well, why? Our economy is not in a good place. Housing is unaffordable in Australia, with interest rates rising no wonder younger people are spending less. Add to this the costs of food, fuel etc. I’m surprised the housing market hasn’t collapsed! The over the top amount of immigration figures this government are bring in is the real problem, a small population cannot absorb these numbers, as well as ruining the place for the rest of us.

Young people are spending less?? Oh please!

Look around they are line up every weekend waiting for their $20.00 smashed avocado toast and coffee. $20.00 on breakfast is not spending less. Avocado at the supermarket $3.00, bread for a loaf $4.00, coffee at home do the math they aren’t spending less.

Younger couple acquaintance’s both with and without children complain about rent and the cost of housing. However all have been on overseas trips some annually, some bi-annually, a week, two weeks here 4 weeks there. How can you travel to the States, Japan, Bali and Europe. And then expect to afford a new house?

Seriously! They are spending less!!!, not from what I can see.

I’m just retired, worked hard, went without to own my home. No over seas trip ever. Drive a 23 year old car that I will have to replace as I can’t get parts for needed repairs.

The younger couples I know each drive label 4 wheel drives BMW, Audi nothing but the best on high purchase I’m sure. But still struggle to make ends meet, even pay for TV. Makes you wonder why they can’t make ends meet. One of the wives has her heart currently set on the new IPhone. Sure they are spending so much less and doing it real tough!

Ask how many turn off their heaters in order to eat. Zero!

“older Australians enjoying the good life while younger people exist on bread and dripping”?! I think the generational divide is not always seen in an objective way, more emotional reactions or ‘knee-jerk’ thinking. In a way the implication is that seniors are just spending for ‘fun’. Do the actual figures on increased spending show all the significant fees and costs associated with living accommodations etc? Increasing medical bills, prescriptions and general help as one’s health declines with ageing? Needing extra help when one is not on formalized/subsidized schemes? Children and Grand children as noted by Nicki Hutley? Did the “Cost of Living Insights” factor all this in? Yes — life at all ages is expensive and increasing, not least of all the costs of growing old!! Paying to be cared for in a bed versus paying for a roof over one’s head.

I work comfortably with younger colleagues BUT have noted a “derangement syndrome” prevails (not just about Trump!) but also selfish boomers who own all the good realestate. This attitude is emotional & illogical and can only result in yet

another class war.

The people interviewed do not say what they are spending their money on. We are expected to infer that they are being frivolous (well, so what? They probably deserve it!) Most older people would have older homes which require upkeep and renewal. For instance, I had a plumbing bill of $7000 one month after I retired! The recent proposed increases to aged care costs are also of concern. How are retirees meant to exist without a nest egg?

What was the plumbing bill of $7000 for ??

Generalisation is the enemy of intelligent comment. Just about every pensioner / boomer I know has very different circumstances and those can change very quickly at our age as two of my friends found out recently when a partner had to be put into care with dementia. Basically at over 70 it’s too late to do much about ones circumstances unless you inherit or win Lotto !!!

As a baby boomer I don’t worry too much about being attacked with the blame stick. While they are attacking me, they are leaving someone else alone. Blame while not being constructive is an outlet for peoples’ frustrations. It keeps them occupied until they have time to look in the mirror.

Well said Bevan!

I note all the above and have only just gone into an aged pension which I am thankful for. Previously i had 6 casual jobs, 1 for a couple of months others one day a month and also a volunteer. However I had an accident and have a broken wrist. Being on the dole is very difficult. Most of my friends Older women, are not in a position to spend big, while they may own houses, have money none are not very well, mostly are very sickly or their husbands are sickly and they are the carers. Also there mostly only 60 years so they have years to go. I was with a women’s group about 7 years ago and there were lots of Older women, living in cars, and couch surfing because of elder abuse. There own families were living in their homes, and threw them out. So there is the hidden and invisible side of Older women and homelessness. So possibly research needs to go to community or neighborhood community centers to talk to this group. This applies to older men and women. So not all is good for Baby boomers.

Totally agree Patrice – some olde Australians are doing it very tough.

I am 81, fit and without debt. I worked until I was 77 and I admonish Ziffer for attempting to cast me as a free-spending boomer and cash-flinging villain. I have always been careful, not frugal, and have endured a lifetime of mortgage payments including levels of interest which would choke Gen Y to Xers in their lattes. The old story, much repeated and true, is that in which my generation saved throughout our lives, brought up families, paid mortgages, bought stuff with savings not credit and now we are able to relax and spend down our hard earned, we are criticised for it. Go figure.

Hi Brian, I think you have hit the nail on the head – there is a massive difference between careful and frugal … undortunately for some, frugal is the only option. But surely being careful is just commonsense when you have to manage savings over a long retirement journey?

Brian & Kaye Totally agree.

I’ve just read all of the above comments. I have now been retired just over two years after finishing work at 66.5 years. I was fortunate to start work in a company that had a superannuation scheme back in 1974. Then, when Paul Keating started Super I also Salary Sacrificed knowing I needed to top up my Super if I was ever to have a reasonable retirement. Two children and a wife who worked, living in an average (but nice) three bedroom home. Never been on an o/seas holiday except once prior to marriage and always frugal with money. On paper my Super looks healthy but not knowing how long you might live means dividing the amount by up to 20 years isn’t a lot per year. Already I have forked out for medical expenses due to some health concerns. We hardly ever go out but live comfortably at home. Renovated the home 5 years ago so we wouldn’t face that worry in another ten years or so. My daughter has a very good income and should be OK but my son who is in IT is struggling even though you would think a job like that would mean he should be OK. From my perspective this whole current situation is solely due to the ridiculous cost of housing be it a person buying or renting. It is NOT the interest rates ( I had 17.5% back in the 1990’s) it is solely the cost of housing and rents. Governments of both persuasions have and continue to support foreign ownership, negative gearing and advantageous capital gains tax concessions coupled with insane levels of immigration. I own my house but don’t care if it halved in value after a massive housing crash if it mean’t sanity would return to our country. This could all be fixed very quickly with the right policies but there are too many politicians and landlords who will not end the gravy train. I urge people to very seriously consider who they vote for at the next federal election but have become too cynical to believe anything will change. If voters could show the same passion about who runs the country as they do about football then things could quickly change. The average man has only ONE ability to make a difference and that is their vote. Use it wisely. There are people in politics who can make a difference. It’s a shame that Australia will have to face a calamity in a few more years for the majority to finally wake up.

I think Ziffer was having a laugh. SKI is often used for “spending the kids inheritance.

Very interesting article. My 48 year old son and his wife earn upwards to $200K per year. They have 4 children. They rent and cannot save for a home deposit. My daughter in law has decided living life now is better than scrimping and saving for a home that will have them forever in debt. They could open their own department store with all the clothes they own. I no longer assist them financially and need what I have left to fund my ageing.

Mr Ziffer seems to have cherry picked the group he surveyed and fundamentally fails because he does not know what inflation actually is. It is not rising prices which are a reflection of inflation not cause.