Do you ever wonder if you’re spending too much – or not enough in retirement?

You’re not alone. Many retirees tell us they feel unsure about what’s “safe” to spend. Others are reluctant to touch their savings at all, even when they know they’ve worked hard to build them up. It’s easy to understand why. Once the regular pay cheque stops, even day-to-day spending can feel like a risk.

But the truth is, you don’t have to keep guessing – or stressing. With a little structure, a clearer view of your numbers, and some smart forecasting, you can take control of your budget and start making more confident choices.

Why it’s so hard to judge your retirement spending

Retirement comes with new freedom – but also new uncertainty. Without a regular income from work, it’s harder to judge how much you can afford to spend. You might worry about:

- The cost of living going up faster than your income

- Running out of money and relying solely on the Age Pension

- Unexpected future costs like aged care or unforeseen medical needs

- Wanting to leave something behind for loved ones

- Not knowing how long your money needs to last

- Finding it hard to even do the sums in the first place!

With so many unknowns, it’s no surprise that many retirees are cautious – and sometimes more cautious than they need to be.

Analysis by the Association of Superannuation Funds of Australia (ASFA), using data from the Household, Income and Labour Dynamics in Australia (HILDA) survey, shows that even among older Australians who still had superannuation in their later years, balances remained relatively high. For the top 10% of retirees age 80 and over with super, the average balance was $375,000 (median $117,000). This suggests that some retirees could afford to spend more from their super, but may be holding back out of fear and uncertainty.

A simple budget is a great place to start

Before we talk about forecasting, it helps to have a clear picture of where your money goes right now. Many retirees are surprised when they tally up their actual expenses. Some overestimate what they need for day-to-day living, while others underestimate just how much goes on things like gifts, home maintenance, or travel.

Creating a simple retirement budget, perhaps using a notepad or spreadsheet,can be eye-opening. It helps to start with these key categories:

- Essential costs – groceries, utilities, rates, health

- Discretionary spending – dining, entertainment, hobbies, family gifts

- One-off or future plans – travel, home upgrades, car replacement

- Income sources – Age Pension, superannuation, other investments

Once you know what’s coming in and what’s going out, the next step is understanding how sustainable your spending will be.

That’s where retirement forecasting comes in.

What is retirement forecasting?

Think of it as a financial weather report for the years ahead.

Retirement Essentials forecasting tools, including the Safe Spending Simulator, help you see how long your money might last, based upon different spending patterns. It’s not about predicting the future exactly – but about exploring what if scenarios to help you make informed decisions.

You can test:

- What if I increase my weekly spending by $200?

- What happens if I travel more in the next five years, then scale back?

- What if I downsize or access my home equity later?

- What if markets perform better (or worse) than expected?

These kinds of projections can help turn a vague budget into a practical and realistic plan.

A member’s story: “permission to spend”

Linda, 68, approached Retirement Essentials seeking clarity on her retirement spending options. She had around $250,000 in superannuation and $250,000 in shares and cash investments, and was currently drawing about $30,000 per year to cover her living costs.

While she was living comfortably within that amount, she wanted to understand whether she could afford to increase her spending and enjoy a more active retirement lifestyle.

Using the Safe Spending Simulator, our adviser helped her to explore two scenarios:

Scenario 1

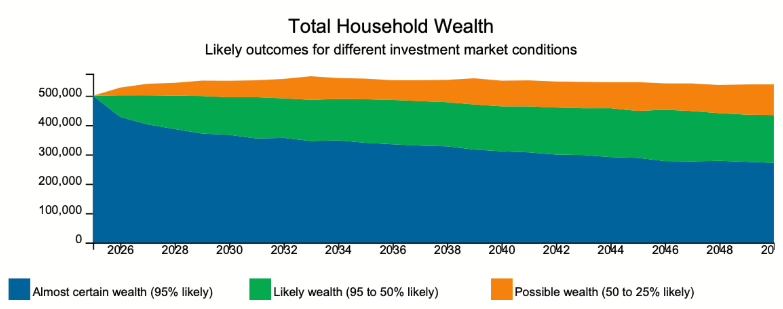

Maintain current spending. If Linda continued spending $30,000 annually, projections showed she would likely have over $400,000 remaining at age 95.

Scenario 2

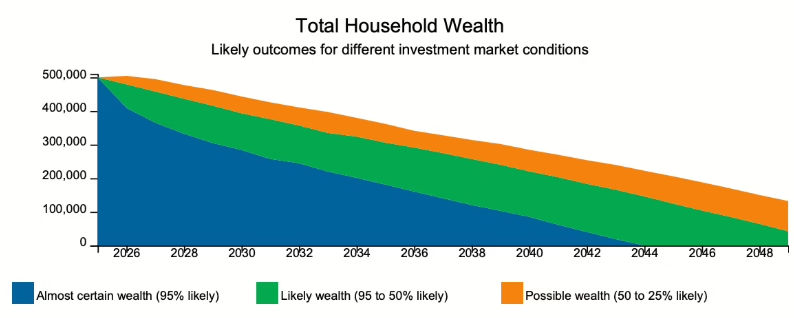

Increase spending. If she increased her annual spending to $52,000, her financial resources would likely be close to depletion by age 95.

The modelling provided Linda with clear insight into the trade-offs between lifestyle and longevity of funds, helping her to understand her safe spending boundaries and how to adjust them over time as her needs or priorities change.

After reviewing these two options Linda chose a plan, like goldilocks, right in the middle. She adjusted her spending to $41,000 per annum – much more than her current drawdowns, but not as high as the option that would run her money close to nil.

Why it’s worth reviewing your plan each year

The only thing that’s certain is change! That means that your needs, goals, and lifestyle will shift over time. So, too, will things like interest rates, government thresholds, and your health. That’s why Retirement Essentials advisers recommend doing a simple personal financial review every year – and using a forecasting tool to sense-check your spending decisions.

This review doesn’t have to be complicated. Just taking time to review your income, expenses, and goals can help you feel more in control.

And if you’d like support, Retirement Essentials experienced advisers are here to help you work through the process.

What’s your next step?

If you’re not sure whether you’re on track – or whether you could afford a little more comfort or joy – now’s a good time to review where things stand.

To help start the conversation, ask yourself:

- Have you ever held back on spending in retirement – not because you couldn’t afford it, but because you weren’t sure? What helped (or would help) you feel more confident?

- When was the last time you reviewed your budget or spending plan? If so, did anything surprise you when you crunched the numbers?

If you’d like help with the next step, try the Safe Spending Simulator by logging in online or book a Retirement Forecaster Consultation to work through your numbers with one of our experienced advisers.