More insights from the Government’s Retirement Income Review

Everyone’s different in retirement. And how much you need is really a question to be decided personally.

But we’ve all got a bit of “sticky-beak” streak and are interested in what others think they need. The government’s recent Retirement Income Review did a fair bit of sticky-beaking for us. So, let’s see what they found on the question of what people need.

What do people spend?

Based on ABS statistics, it looks like the median household expenditure for 65-69 year olds is a bit over $700 per week or $36,000 or so per year and a little less for those aged 70-74, and still a little lower for older groups. Couple households on average would have higher expenditures than this and single households lower expenditure on average.

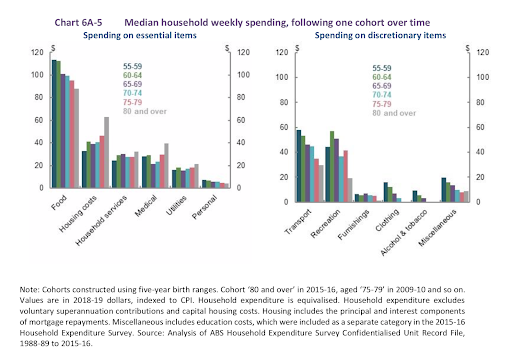

That’s spending on goods and services — not income — and excludes capital expenditures on housing etc. Where’s the money spent? The charts below shows the average weekly household budget items broken into “essential” and “discretionary” items –for each age group. Food and housing costs dominate the essential spending and transportation and recreation are the largest components of discretionary spending.

It’s also fascinating to see how spending changes over time. Overall, spending generally declines somewhat as people get older. The Review says that spending on essential items stays largely the same (adjusted for inflation) over retirement, with big drops in the food category, and rises, but not huge rises, in housing costs and medical expenditures as people age. On the other hand, spending on most discretionary items falls, particularly in transportation and recreation spending.

Is there a standard to aim for?

Another approach to work out how much you might need in retirement is to look at the benchmarks that others establish. The Review reports on some of those. For instance, one that’s talked about a lot is the ASFA (the Australian Superannuation Fund Association) standards. Those were developed to identify how much a person or a couple would need for a modest or a comfortable retirement.

| Modest Lifestyle | Comfortable lifestyle | |||

| Single | Couple | Single | Couple | |

| Total per year | $27,987 | $40,440 | $43,901 | $62,083 |

The Modest standard is designed to be higher than the Age Pension but allow for only the basics. The Review seemed to think that the Comfortable standard was a bit too ambitious, writing: “The ‘comfortable’ retirement standard was originally designed for the top 20% of income earners and exceeds the working-life living standards of 70% of singles and 60% of couples of working age.”

Relative to when you were working?

Standards might be a useful starting point, but of course everyone is different in retirement and faces different spending pressures. People who live in regional Australia may face very different costs from those living in the big cities. And people often seek to preserve a level of spending like they were used to when they were working.

So, the government review lands on “replacement ratios” as a good measure of how much might be needed in retirement. Replacement ratios compare income in retirement to income while working. The idea is that most people would expect to need less income after work because they no longer have:

- all the costs of working

- the taxes associated with their salary;

- the need to save for retirement (eg super deductions).

It’s a concept financial planners have also used for years.

The Review lands on 65-75% of preretirement income as a good replacement target. Someone earning $60,000 in their job might consider $39-45,000 in their retirement to be adequate.

The Review does go on to say that replacement ratios will vary by your level of income. People in lower income brackets need may to get a higher replacement rate….people in very high income brackets may well be satisfied with a lower replacement rate.

What’s “income” anyway?

In retirement, we need to think a little differently about income. It’s not just salary and interest and dividends and capital gains. It’s the Age Pension if you’re entitled. And very importantly, it’s drawing down your super and savings to pay for retirement. Maybe it’s best to think about it as “retirement funding” not “income.” It’s what’s going to pay for your spending.

One of the government’s big concerns highlighted in the Review is that people aren’t drawing down their nest-egg but tend to underspend in retirement. As a result, most often people leave more at death than when they started retirement.

So which of the three methods works best for you when thinking about how much you need in retirement? Would you

- Look at what other people like you spend, or

- Use a budget standard such as the one developed by ASFA (see above), or

- Base your spending in retirement on a proportion of what you spent before retirement.

Tell us what you think by commenting below or by answering our survey question here

When talking about retirement expenditure insurances including car, household, health & contents should be included to get a realistic yearly figure.

Means testing for old age pension is a poor idea. We should follow other countries e.g. UK and pay the pension notwithstanding. How one is expected to exist on savings when interest rates are below one percent beggars belief. Reliance on retirement ‘income’ turns pensioners into paupers automatically under current rates of interest.

Pensions should not be means tested. It’s impossible to earn enough income to exist with bank rate below one percent. Reliance on income from savings turns pensioners automatically into paupers. At one percent one needs capital of $3000000.00 to produce income of $30000. It’s crazy.

You’re right; living on 1% of your capital is not going to work. The government is trying to communicate through the Retirement Income Review the expectation that retirees spend down their capital to make their retirement funding satisfactory — not just rely on interest and dividend earnings. As they spend it down, if they’re on the Part Age Pension, then their Age Pension payments will go up as a benefit of the means testing. The government study found that people aren’t spending down their retirement nestegg but dying with on average 90% of their wealth. That’s not the intention of compulsory super; it’s to create a nestegg for people to spend down and supplement that with the Age Pension.

[“That’s not the intention of compulsory super; it’s to create a nestegg people spend down and supplement that with the Age Pension.”]

Really? Is that officially documented somewhere? Do we know what actual monetary value the 90% represents – $100K? $1M? I suspect that many retirees are are not over spending their nest egg because there is always the risk that investments could go south at any time. Then one also needs to be mindful of the capital required to place one’s partner into a high care facility should the need occur.

The Government has been trying to document that in the “Retirement Income Covenant.” Yes, the major reason that people don’t spend down is uncertainty about the future. But often those fears are exaggerated. For instance, our health and age care systems provide a lot of support for elder Australians (unlike in some other countries). And the Age Pension kicks in to help…so that nearly 80% of people are expected to get some Age Pension by the time they’re 80.

The comfortable range of $62k seems low when you take into account all the bills James refers to. Our health insurance is $5k, car rego and insurance another $4k, and I haven’t even added in power bills or rates.

I agree that the current estimate is too low for a comfortable retirement. Medical expenses are not tax deductible , car insurance , Health Insurance costs are increasing every year and the cost of travel for a comfortable retirement should be estimated. Most of the utilities are

transferring costs for printing to the end user meaning that a computer and printer renewal each 2- 3 years needs to be included. House maintenance costs are increasing very rapidly and this is an essential part of maintaining the House after retirement without the normal cash flow of a Salary

I suspect that at least $20,000 extra would be need for a comfortable retirement

Agree – the ASFA standard seems quite unrealistic to me.

It has always amazed me how my income tax(much at the higher end) was not valued as much as another person paying less income tax, particularly when they are able to get a pension and I am not. Just magic, isn’t it?

Ian

One of the unfair things is the deeming. Why is the deeming rate more than double the best investment rate one can get. The pension is reduced by the earnings if over the allowed earnings but for many they don’t earn what the government estimates. This deeming rate actually prevents many pensioners from getting what they are entitled to.