Do you have the checkout blues? Every time you head to the supermarket, you’re gobsmacked at how much everything costs? Who knew a lemon would be $1.10? You probably remember when you could buy five for that amount of money. Yet we’re told that inflation is coming down – so how can your household expenditure be going up? Are you doing something wrong?

Today we’re exploring the recent movements in our cost of living and how retirees, in particular, are affected. And, most importantly, what you can do if you feel you’re going backwards.

The reason we’re exploring this topic is that according to recent research, there has been a fundamental shift in retiree sentiments. For years the main concern that retirees have held is that ‘they don’t have enough’ or ‘they will last longer than their savings do’. (We’ve written many times on these topics). But the most recent findings by financial services company, Challenger are that retirees are now most worried about the rising cost of living, with over seven in ten (72%) Australians aged 60+ reporting that this factor has had at least some adverse impact on their financial security. And just over one-third (34%) admitting that the impact was significant.

This compares with fewer than half (40%) who are worried about running out of money in retirement.

Some brief definitions:

What do we mean when we talk about cost of living?

According to the Australian Bureau of Statistics (ABS), this is the expense Australians incur to buy the goods and services that are necessary to maintain a certain standard of living.

Does the Consumer Price Index (CPI) measure cost of living?

No. The index is the main measure of inflation. This means that it measures changes in the price of a basket of goods and services which are representative of spending by households in capital cities. The following 11 categories of goods and services are measured quarterly. They are also (more recently) being measured monthly – with a plan for the monthly index to become the standard measure in line with other OECD countries. The inflation rate is the percentage change in a basket comprised of these goods:

- Food and non-alcoholic beverages

- Alcohol and tobacco

- Clothing and footwear

- Housing

- Furnishings, household equipment and services

- Health

- Transport

- Communication

- Recreation and culture

- Education

- Insurance and financial services

Is there a retirement-specific cost of living?

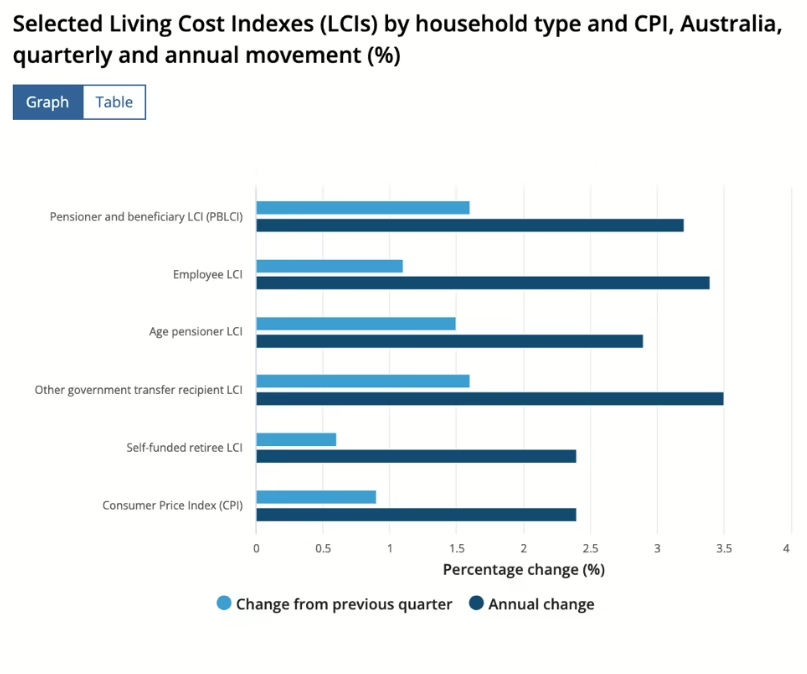

Yes, the ABS also measures more specific baskets of goods for different cohorts. These measures are called Living Cost Indexes. The following table from the ABS shows the different, most recent CPI changes for Pensioner and beneficiaries, Age Pensioners and Self-funded retirees. The differences are largely due to housing costs.

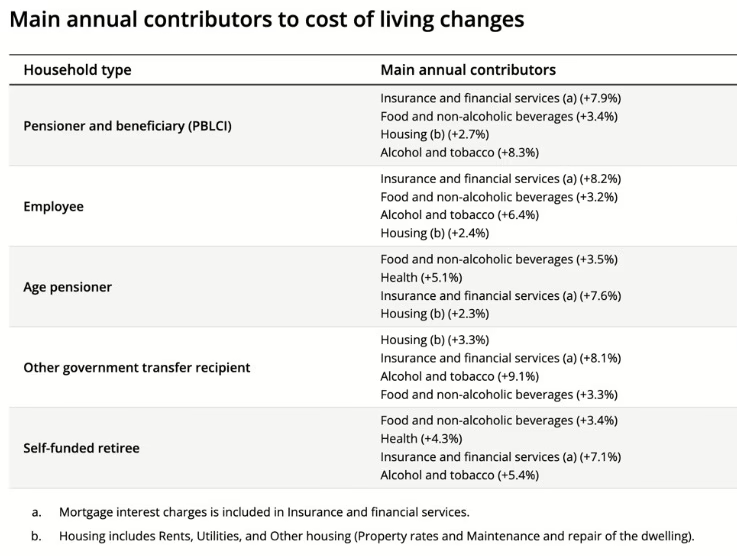

And here’s a table which shows increases for the different households related to items which have added most to cost of living pressures.

So you can see that for most older households, despite annual inflation being recorded in a CPI of 2.4% (March 2025 quarter), the costs of insurance and financial services were up around the 7-8% mark, food was about 3.5% higher and health costs were up by 4-5%. In a nutshell, the CPI is measuring the degree of price changes, but the base prices rose most rapidly post-Covid and some are still steadily increasing. Many of these items are a significant part of a retiree household expenditure.

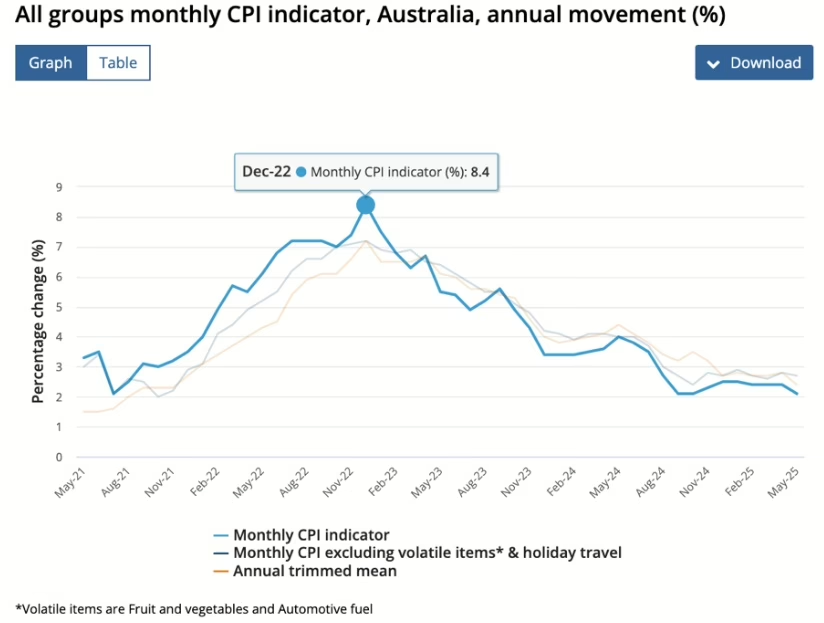

The following table shows the monthly peak of price increases in recent years, as we came out of the Covid pandemic. This was in December 2022, with a monthly spike of 8.4% – compared to the most recent data for May 2025 with a monthly increase of 2.1%

It’s little wonder that some retirees feel as though they are heading backwards. So it’s reassuring to understand it’s not YOU, it’s the overall price increases over the past 3-4 years that is causing so much financial stress. We have never returned to so-called ‘normal’ prices (pre-Covid) – and that is unlikely to happen anytime soon.

What can you do?

People in retirement are generally living on fixed incomes, as opposed to wage or salary earners who can hope for income increases to offset the effect of higher prices. But ‘people in retirement’ do not form an homogenous group – financial situations vary greatly according to home ownership, Age Pension entitlements and sources of private income. If you are on an Age Pension, you will be partly compensated for price increases by indexation of the base amount of your pension and increases in supplements. You will also benefit from indexed changes to the limits for income and assets. But this may not be sufficient to cover ‘lumpy’ items such as annual home insurance or major medical bills

First step – head into the shed!

No, not for a garage sale. This is my new favourite metaphor, shared by author Oliver Burkeman in his book Meditations for Mortals. He talks about the need to confront reality – and likens this to heading into the shed where something scary is lurking. And that’s what we are talking about here. If you feel that your income is not sufficient to cover your outgoings, the first step is to understand how much you are spending and what you’re spending it on. This link takes you to the Moneysmart ‘track your money’ article which takes just three minutes to read.

From recording or tracking spending to reviewing it is a very easy next step. What did you spend in the past week or month that wasn’t planned? Is your spending total higher than your income? Is the gap a worry?

Benefits of knowing how much you spend:

- You are no longer one of the 70% quoted in the Challenger research who is worrying. You have taken action by entering the shed and uncovered the facts of your household financial situation

- This will most likely lead to a greater sense of control. Even if you have a shortfall, you at least now recognise it and can act immediately to try to stem the flow.

- This new sense of control means you can choose what to change and in doing so, ensure that next month’s budget will look healthier – even if by a small amount such as the cost of a discontinued streaming service, cheaper fuel purchases or a change to your home insurance.

What else can you do?

Retirement Essentials advisers report that many of their customers tend to underestimate their spending in the early years of retirement. It’s not so much the ‘fun’ items such as travel, new cars or home renovations that catch them unawares, but more so the price of recurring household essentials. Knowing ahead what the first 12 months might look like and how you will fund it has been a great relief for many of our members. You can calculate this information yourself using the free Retirement Spending Simulator if you have already become a member. Or if you prefer a guided discussion, the Retirement Forecaster Advice Consultation allows one of our experienced advisers to step you through your future retirement journey needs.

As we’ve said previously, this tool is not quite a crystal ball, but it’s very close, sharing a practical and useful indication of how you will cover your outgoings across the course of your retirement.

Now aren’t you glad you braved that shed?

Do you, too, suffer from the checkout blues?

If so, what are your strategies to counter ongoing price rises?

There does not seem to be anyone actually looking at pricing all round and then actually doing anything about it . Petrol has been rediculous for so long and HOW can you change the price of fuel already in the ground by so much in a day ?

Fruit and veges is all over the place and no rhyme nor reason why bananas change 50cents from day to day. Electricity … When do we stop this crazy procession of this save the planet.

Australia make bugger all these days and soon the way we are going we will be buying everything in.You know as I do we have the resources but the Government is hell bent of seeing us close it all down for the sake of WHAT ?