The real cost of living in retirement

Can it be measured?

There is a lot of noise about the cost of living right now. So much so that, even if you are reasonably well off in retirement, you may be starting to question whether your sums are right.

Suffering from financial anxiety can be extremely debilitating. For this reason we’ve decided to examine two different indexes which suggest target expenditures for retirees. There are certainly more than two available, but both of these can be accessed for free and are well-established. We’ll also look at how representative they are when it comes to ‘the real world’ with commentary on these indices from Matt Grudnoff, Senior Economist at The Australia Institute.

The very nature of a retirement spending index means that there will be inherent assumptions and generalisations. This is difficult to fully avoid but does need to be considered if you are using them as a benchmark for your own money management.

How might the following comparisons help you?

They offer two very different takes on what you might need, by category, against which you can assess your own outgoings. Benchmarking is a really useful exercise when it comes to household purchases or expenditure. If a homeowner, you probably enjoy updates on how your house price ranks compared to the median in your suburb. And when planning how long your money will last, benchmarking forces you to confirm how much you are currently spending, alongside the effect this will ultimately have on your savings.

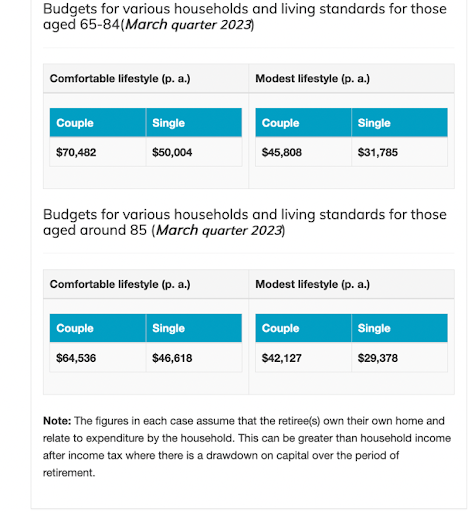

Let’s start with the regularly updated Retirement Living Standard, published by the Association of Super Funds of Australia (ASFA), the peak advocacy and research body for the Australian superannuation industry. You will note this index offers target expenditure for those aged 65-84 and those aged 85 and over.

ASFA Retirement Living Standard

YourLifeChoices Retirement Affordability Index

Next, here are slightly different target indices from the YourLifeChoices – the Australia Institute Retirement Affordability Index.

But first, a declaration of interest from the author of this article. The Retirement Affordability Index was the joint creation of Matt Grudnoff and me (then publisher of YourLifeChoices website) as a way of offering what we believed to be the most relevant spending statistics available for those planning or entering retirement. The data was prepared by Matt, using, as a base, a special data request from the Household Expenditure Survey (HES). supplied by the Australian Bureau of Statistics (ABS). The reporting of actual retiree household spending was then segmented into six retirement ‘tribes’ as denoted in the table below. As with ASFA’s Retirement Living Standard, the Retirement Affordability Index is updated by each quarter’s CPI in order to keep the results as current as possible.

| Couple homeowners with private income | Couple homeowners on Age Pension | Couples who rent on age pension | Single homeowner with private income | Single homeowner on Age Pension | Single who rents on age pension | |

| Total weekly expenditure | $1,676.93 | $968.6 | $819.62 | $957.55 | $536 | $516.9 |

| Total monthly expenditure | $7,266.71 | $4,197.26 | $3,551.68 | $4,149.40 | $2,322.65 | $2,239.90 |

| Total annual expenditure | $87,200.53 | $50,367.13 | $42,620.19 | $49,792.83 | $27,871.81 | $26,878.84 |

Source: Your LifeChoices and the Australia Institute

There are two main differences between the methodology used by ASFA and in the RAI. ASFA amounts are based upon a ‘basket’ of goods, with a distinction between a ‘comfortable’ retirement and a ‘modest one’, for two different age groups as noted above. It also assumes that the retirees will all fully own their own home.

For further context, here is a reminder of the current full Age Pension payments:

Full Age Pension payments as increased 20 March 2023

| Relationship status | Amount (per fortnight) | Annual amount |

| Single | $1064 | $27,740 |

| Couple (each) | $802 | $20,909 |

| Couple (combined) | $1604 | $41,818 |

| Couple (separated by illness) | $2128 | $55,480 |

Retirement Essentials has More information on this.

As there is a clear and significant difference between both the method and the suggested spending targets in these two tables, we asked Matt for his views on why the inclusion of renters was so important.

‘I believe that the ASFA benchmarks are an encouragement for Australians to pump more money into super. The totals needed to sustain the ‘comfortable’ lifestyle for couples is more than a million dollars. That means you are incredibly wealthy. Most people won’t have this and so they can’t afford ‘comfortable’. If everyone chases this target, we will all feel a lot worse off. The vast majority won’t need it. they won’t have it either.

‘The second issue the assumption that you own your own home outright. There is a significant number of people now entering retirement with sizable mortgage debt and many are renting. If you are renting or paying down a mortgage, you will need much more than the ASFA Retirement Living Standard suggests.

‘The thinking behind the development of the Retirement Affordability Index was to look at actual spending by specific types of retirement households (couple or single homeowners or renters, on an Age Pension or private income). So we could more easily separate that top ten percentile and their likely expenditure (very comfortable) from the vast majority who are living much more modestly.

In basic terms, people who retire are far from an homogenous blob. Those who retire in a fully paid-off home and live off their super are able to spend much more than other cohorts. And because the index is based on statistics supplied by the ABS of what retirees say they spend, it reduces any high expenditure by other households, in categories such as childcare, education and commuting expenses.

The most obvious cost of living pain is currently being felt by those on a full Age Pension who rent. Between what they receive in pension payments and their outgoings, there is literally no leeway. This has been exacerbated over time by the freezing of bulk billing payments for doctors. It’s now almost impossible to find a doctor who does this. So protection from Medicare is greatly reduced.

Are there any solutions for such retirees?

‘There are a few things. Firstly, those who do own a home might think about accessing the Home Equity Access Scheme if they are facing an ongoing shortfall. Local charities and foodbanks are useful for those who simply can’t pay for groceries. Of course it is extremely tough for those without a home, rental or otherwise, when they are forced to stay with friends or consider other options.

If you are on an Age Pension you can ask for financial assistance. This may involve bringing froward future pension payments, which, of course, may constrain future spending.

Are retirees currently more vulnerable than other groups when it comes to rising prices?

‘Because most retirees are on at least a part-Age Pension, the fact that it is indexed by either consumer price increases or wages, if increases are higher, there is a level of protection not experienced by many lower paid workers,’ says Matt.

‘But this is actually a two-part question. In absolute terms, yes, many retirees are extremely vulnerable when it comes to increasing prices. In relative terms, they may actually be keeping pace with inflation better than some wage earners. The median salary is about $64,000. Half of all workers are earning less than that. Which gives us a very relevant benchmark for the rest of the population.’

Where do you sit?

The obvious question underlying any retirement spending indices is, how much is enough for you?

If you are happily spending more than either of these benchmarks, and feel you can cover your outgoings, for the rest of your retirement, then you are fine.

If you can’t cover your outgoings, then using the above links to check the category by category benchmarks will help you see if you are way over – maybe in entertainment or energy. Knowing this detail may help you see ways to cut back, or compare, or strike a better deal. As always, your enhanced knowledge give you more power.

We can only ever start from where we are. But here is some extra support that may help if you are concerned about covering your household expenses:

Maximising your entitlements is a great way to ease the squeeze. Working with an adviser you will be able to use all the Centrelink rules to your advantage.

Using the Retirement Essentials Retirement Forecaster will also show you if your rate of spending is a little steep for your savings – and you can play with the levers to reach a ‘sweet spot’ where you can sleep better at night.

Does the data factor in a retiree (single) owning their apartment mortgage free & having body corp fees of over $1,000 p.m. Note this is amount is an increase from $400 p.m. to $1,000 p.m. in one year from the date of purchase.

Joanne. Your body corporate fees are going to be $1,000 per month. That’s $12,000 per year. Seems very high to me. When I was in a 2 bedroom apartment with no gym or swimming pool the strata fees were about $1,300 per quarter. That included a three year loading to pay off a $100k strata loan over three years.

Was that a typo and should have been $1,000 per quarter.

Joanne, you and your fellow residents need to get together and if possible take over the management of the strata complex

The ABS data shown is from 2015-16…considering what has happened in the world since then it’s not really comparable to current costs of living.

Hi Vicki, thanks for joining the conversation. I am sorry if the article did not make this clear, but the ABS household spending by category is refreshed after each census – the actual amounts are updated quarter by quarter, in line with CPI movements, so as current as could be expected. warmest, Kaye

I am a little confused by the comments from Matt. He seemed to indicate that the ASFA figures were overblown possibly to encourage increased superannuation contributions however the RAI numbers (couple, homeowners, private income) is much higher. Doesn’t this seem to indicate the ASFA figures may be a little on the low side?

Hi Mark – thanks – this is a good question. Essentially the ASFA index and the REtirement Affordability Index measure different things. RAI Affluent tribes (homeowners on private income) are similar to ASFA’s ‘comfortable’ designation. But self-funded homeowners make up only a small minority of retirees. Three out of four of the constrained and cash strapped segments miss even the modest description by ASFA, and they make up the overwhelming majority of retirees.

Kaye, Thanks for the reply but I am still confused. If I compare the amount needed suggested by the RAI (Couple homeowners with private income) vs ASFA (Couple, Comfortable) the difference is $17K, with the ASFA amount being the lower. However in the article there is this quote

‘‘I believe that the ASFA benchmarks are an encouragement for Australians to pump more money into super. The totals needed to sustain the ‘comfortable’ lifestyle for couples is more than a million dollars. That means you are incredibly wealthy. Most people won’t have this and so they can’t afford ‘comfortable’. If everyone chases this target, we will all feel a lot worse off. The vast majority won’t need it. they won’t have it either.”

This seems to be indicating that the ASFA are too high, but from what I can see they are substantially lower. To meet the RAI yearly spending figure we would need to have significantly more in super than what the ASFA is recommending. So which is correct?

Hi Mark, I think the difficulty here is that the two indexes are not able to be compared on an apples with apples basis – they view the world in a different way and I think it is accurate to say that Matt and I created the Retirement Affordability index to more accurately define the reality of retirement spending. So here is the reasoning. The RAI does show a higher spend for couple homeowners with private income. This is about 66% (couple v single) of the 30% of self-funded retirees – about 20% of retiree population. The RAI defines six different ‘tribes’. The couple self funded is only one tribe, and not representative of most retirees situation. The people in this category are relatively speaking, very well off. The ASFA numbers refer only to four segments – comfortable v modest. Both assume fully paid home, which is unrealistic. But more to the point, ASFA numbers are based on a basket of goods that retirees are LIKELY to purchase. RAI is based on ABS stats of actual retiree household purchasing behaviour. So for a narrow band of retirees this is quite a high annual amount. It is not a target. It is the experience of a minority of retirees. As we have noted many times, the common experience (67-70% of retirees) is to be on at least a part Age Pension. This then means the more general experience will be to live on a combination of super and Age Pension, around $50,000 per annum for couples and $28,000 for singles who have their own home, whether owned outright or with a mortgage. It’s not useful to treat these household expenditures as targets – they are benchmarks to help people understand what most retirees are spending. The problem has come when ASFA ‘comfortable’ numbers have been extrapolated to income required to support this expenditure as though this is a goal for all retirees – needing a minimum of $660,000+ super when the median is more likely to be less than $250,000. This is a very discouraging for many people. I hope that helps? warmest, Kaye

I agree completely with Matt’s suggestion that the ASFA numbers are issued purely to encourage people to put more into super. The problem lies, not in the amount required per annum for a comfortable lifestyle, but in their statements of the lump sum required at retirement to fund this life style. I had thought that some sanity had been injected into the discussion until I saw a very recent headline from ASFA saying that $2 million would be needed. On examination this figure was based on retirement at 60 and apparently zero earnings on the $2 million despite the fact that the ASFA always trumpeted that their members would give returns above CPI. A simplistic arithmetical calculation shows that with inflation at 4% and earnings at 5% there would be $1.25 million left after 25 years.

Would be interested to be informed where I am going wrong in these calculations or are the ASFA’s “rubbery” numbers based purely on self-interest ?