Better than you thought?

The Australian Tax Office (ATO) quietly released some statistics end June. I say quietly because this data is really interesting. And useful for individual retirees keen to understand their overall financial standing.

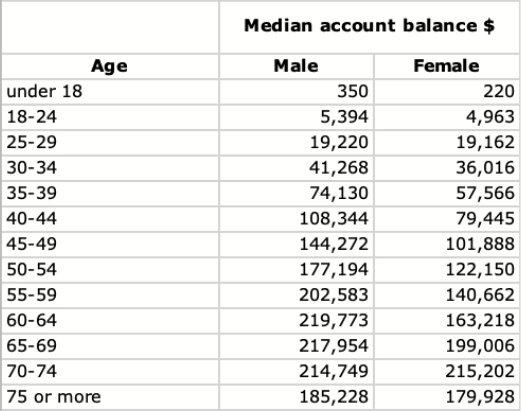

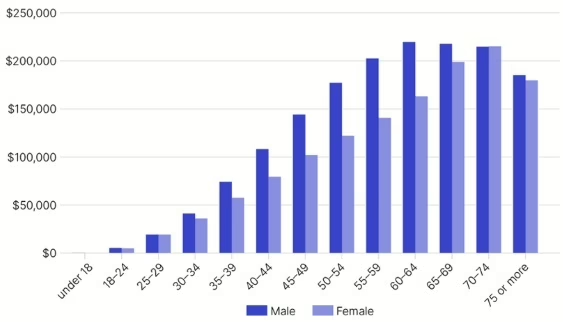

The data is somewhat ponderously called the Individuals statistics for Taxation statistics 2022–23 and is buried in amongst a lot of other statistics on tax paid in Financial Year 2022-23. Reproduced below are the two pieces of information that matter most: a table of median super balances by age and gender and the same information represented in a chart.

I have chosen to highlight the median balances (as opposed to the average) because median amounts offer a much more useful benchmark than averages. That’s because the average super balances can’t help but be skewed higher by the 135+ people holding more than 10 million in their super account. One individual has a balance of 534 million! So using averages is just not useful. As a refresher on high school maths, a median amount represents the middle value in a set of numbers, with half (in this case, super accounts) being lower, and half being higher. So it’s the midway point and that’s what makes it such a useful yardstick.

Here are the most recent individual balances, published in late June 2025 by the ATO.

Taxation Statistics 2022-23: Median super balance, by age and sex, 2022-23 financial year

*In above Chart 12, statistics include individuals with an account balance or current year contributions greater than zero ATO, Table 5

Why should you care?

This simple table allows you to compare your own individual balance to those of most other Australians. So if you are heading towards Preservation Age (generally 60) then you can see that those in a similar age range (55-59) are holding a median amount of $202,583 in their super if they are male, and $140,662 if female. If combined, this amounts to a couples’ joint super savings of $343,245.

Should you be aged between 70 and 74, the male median balance is $214,749 and the female balance is $215,202. (Yes, it’s surprising that a female median balance is higher – but this only happens in this one age range). If you are aged 70-74, you will know you can apply for an Age Pension (as you are over 67). Should your own super balance be similar to the median, it’s well below the asset test limit for singles and couples (whether homeowners or not). If you have other assets, or still receive income, then that will need to be included in any assessment as well.

What does this mean?

The critical point here is that the age range with highest combined balances (age 70-74) if assessed by Centrelink on super alone, are still likely to get a full or part Age Pension. Yet these super balances are a LONG way short of the so-called ‘comfortable’ savings target in the ASFA Retirement Standard – that of $690,000 for couples and $595,000 for singles. As you can see from the ATO median amounts, the decade of ‘situation normal’ Australians between ages 65-74 are sitting in the middle range on about $200,000 – $218,000. Unless they have other assets of very high value, their super nest eggs equal about one third of the amount suggested by ASFA for singles and less than two-thirds for couples, combined.

So if you are rating your own retirement savings based upon the above suggestions for a ‘comfortable’ lifestyle, you may be disappointed in your perceived performance to date – even though you shouldn’t be. The so-called ‘modest’ savings target is $100,000 and this assumes you will have income of around $52,583 for couples or $33,386 for singles – about $3000 (singles) – $6000 (couples) above a full Age Pension entitlements.

It’s not what you have…

…but how you manage it

The main takeout from the recently released data is that individual Australian super balances are actually much lower than most of the media hype about retirement targets leads us to believe. If you take the time to compare your own savings to the median amount for your age and gender, you may be surprised to see you are not that far off. Or maybe you’re even further ahead! But whatever your super balance is, that’s not going to totally define your retirement income trajectory. As we’ve reported over the time, there are many, many different ways to maximise the savings you have achieved. These include:

- Timing your switch from savings to withdrawal to maximise tax benefits

- Using couple status to ensure you align your assets and retirement decisions appropriately

- Maximising Age Pension benefits

- Using special contribution rules to add to super in order to increase the amount held in a tax-free environment.

- Ensuring you use Age Pension work rules to your greatest advantage

- Keeping gifting within the limits

And there are many more other ways to make the most of what you have. In summary, understanding the difference between average and median savings is helpful so that you don’t have unrealistically high expectations of your own savings performance. And seeking support to ensure you do maximise your own potential retirement income makes a lot of sense.

What’s your opinion?

Were you aware of these ATO balances which are published annually? Do they provide a useful guideline for your own situation?

Making the most of super is a very frequent trigger for booking a 55-minute guided Retirement Advice Consultation. Priced at $395, it’s an invaluable opportunity to ask questions, explore options and test your decisions.

I live in Canada age 65, I lived in Queensland and WA. For 20 years how do I apply for the centreline pension please?

Hi Christian, greetings to you in Canada. The good news is that Amanda Hardy Lai has written a terrific article on this topic and it will be published in our newsletter next week. soo rather than sharing an incomplete short answer, keep your eyes on your inbox for a detailed explainer on Tuesday/Wednesday Canadian time, warmest Kaye

This data captures the Super investments but does not take account of money that retirees have outside Super. I know people who distrust the Super regime. If they have 50% in Super and 50% outside that makes a difference to their true retirement income and lifestyle. It could be that retirees fit your exception ie “unless they have other assets of high value” in this case the asset being investments and savings outside Super

Hi Vicci, thanks for your feedback. Yes, you are right, there are many retirees with investments outside super. The statistics for different retirement assets tend to come from different regulators or departments (ASIC, APRA, ATO, ABS etc) so a wholistic analysis is very difficult. But as the super system matures, super has become an even more significant aspect of the retirement funding proposition. It’s really up to individuals to look at these statistics as a benchmark of a single, albeit important, measure and to consider if there are insights in this comparison that will help with their own planning and future projections, warmest, Kaye

Does the super balance reflect only what is in super? Most retirees over 70 have converted super to pension.

So does that mean the over 70s have this super in addition to their pension money?

I would like a comparison for what average Australians over 65 have in pension plus super.

Hi Linda, congratulations on raising such a great question. When I wrote the article I made the assumption that this data referred to both accumulation and decumulation accounts. But as this was an assumption, I have asked the ATO – and they agreed your question is a good one, so they will get back to us with a definitive answer – which I will then share with you, warmest Kaye

Hi Linda, thanks for your patience, we can now confirm that the ATO states: all accounts, regardless of whether they are in accumulation, pension, or other phase are included. warmest Kaye