Mark, 65, and Sophie, 63, are both looking forward to retiring in two years. Mark, a long-time chef, and Sophie, a retail assistant, realise that their super balances are modest, reflecting part-time shifts, casual work and caring responsibilities. They would like to ensue that they have explored every possible option to maximise their future income. Here’s how Retirement Essentials advisers helped step them through the choices they have.

1. Start with a clear picture

Mark had $140,000 in super and Sophie had $65,000. They owned their home outright but were mindful that ongoing living costs, occasional travel, and possible health expenses could stretch their savings.

They were also unsure how the Age Pension would work, especially since Sophie was younger and still working. That age gap created some opportunities.

2. Use the ‘Younger Spouse’ rule

Because Sophie was under Age Pension age, her super wasn’t counted in Centrelink’s assets test yet. This meant that for now only Mark’s balance and their other savings will be considered when calculating his Age Pension.

If they received an inheritance, which was a possibility for them, adding it to Sophie’s super could help Mark qualify for more Age Pension once he turned 67. Planning together like this can make a real difference to retirement income.

3. Boost super before retirement

With Mark earning $85,000 and Sophie $46,000, they had a couple of smart contribution options:

- Salary sacrifice

- Mark could redirect part of his salary into super. Instead of paying his top marginal tax rate of 30% plus Medicare on income above $45,000, these contributions into super are only taxed at 15%.

- By sacrificing $19,800 Mark would be contributing up to the $30,000 concessional cap (including 12% employer contributions of $10,200), he could save about $3,366 net in tax.

- As long as Mark has unused concessional caps from previous years, he can then use the “catch-up” rules to sacrifice even $12,000 more, bringing his total net tax saving to over $5,000, and bringing his income down to just over $45,000.

- Sophie could sacrifice $1,000 a year, bringing her income to $45,000 and saving her about $495 in tax.

- Spouse contribution splitting

Next financial year, Mark could shift some of the contributions he’d made from his super into Sophie’s super account, which not only evens up their balances but could also help improve Age Pension outcomes later. - Government co-contribution

Because Sophie’s income is under $47,488, a $1,000 after-tax contribution earns a $500 government co-contribution. This one is easy to do as the tax office automatically pays the top-up to her super when her tax return is processed.

Key takeaway: Even small contributions and tax savings add up.

4. Understand work and the Age Pension

If Sophie stopped working when Mark retired at 67, he’d initially qualify for a higher Age Pension straight away. But if Sophie kept working another two years until she turned 67, she’d keep contributing to her super and they’d draw down less from savings. In the long run, this would mean more wealth overall.

Key takeaway: Timing your retirement and work decisions can make a big difference.

5. Bringing it all together – the combined effect

By following through on all their contribution strategies, Mark and Sophie could:

Add $50,020 to super in just one year (from salary sacrifice, employer contributions, after-tax contributions and the government top-up). Save nearly $6,000 in tax and still have enough take-home pay to comfortably cover their $70,000 annual living expenses.

What does their retirement journey look like now?

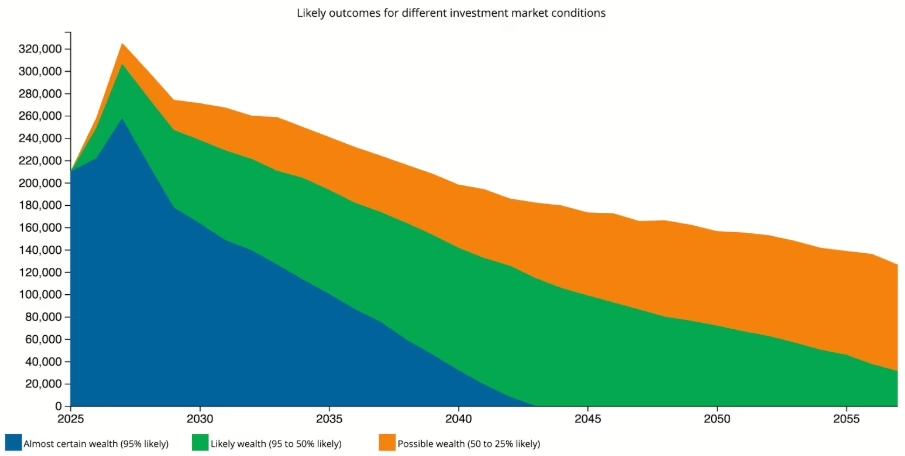

When they modelled different scenarios in the Retirement Forecaster, Mark and Sophie could see they’d be able to spend around $60,000 a year for the first decade of their retirement, then adjust their spending levels down to $52,000 in later years – and still have enough income to last to age 95.

For Mark and Sophie, looking at the bigger picture in the long term gave them some peace of mind for their future. They could enjoy their early retirement years knowing they had a plan to adjust later, without fear of running out

Even modest balances can go further with the right strategies. By planning together, couples with different ages and incomes can take advantage of opportunities that might otherwise be missed.

Work, super and the Age Pension all interact, so the timing of contributions, retirement and part-time work makes a real difference. And for many, professional advice can reveal practical steps that build both confidence and financial security.

Have you already questioned…

- Could coordinating super balances with your partner improve the overall Age Pension outcome?

- Should you keep working a little longer, or retire earlier and rely more on the Age Pension?

- Which contribution strategies (salary sacrifice, spouse contributions, co-contributions) make sense for your income?

? Why not book a Retirement Advice Consultation with Retirement Essentials to explore how your super can work harder for you and secure a more comfortable retirement.