How did your savings perform?

In news just in, Australian super funds have had a third strong year with double digit returns.

The financial year-on-year returns were published by superannuation research house SuperRatings late last week. SuperRatings estimates returns on the median balanced option to be 10.1% for the year to 30 June (and 1.4% over the month of June).

Australian funds had strong momentum across the start of the financial year but endured a ‘rollercoaster’ second half according to the research house. This is borne out by a return of 8% to 31 January, but since the Trump Administration tariff changes on so-called ‘Liberation Day’, returns fell as low as 0.8% before rebounding and finishing the year at 10.1%.

Says Executive Director of SuperRatings, Kirby Rappell:

“We saw exceptional volatility in returns over the year, particularly following the announcement of US tariffs in early 2025, however the benefit of staying the course was once again proven as a quick rebound has resulted in the third double digit return year over the past decade.”

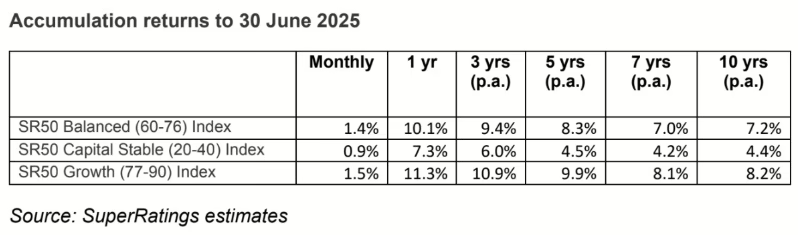

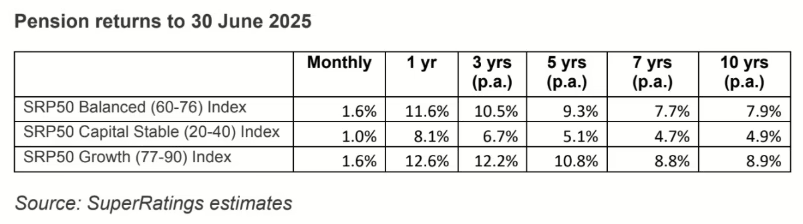

SuperRatings measures returns across all Australian super funds and categorises the funds into Accumulation (savings mode) or Pension (decumulation or drawdown mode). These subsets are then further categorised into three different levels of growth asset exposure:

- the Balanced option will have between 60-76% of total assets invested in growth assets,

- the Capital Stable option will have between 20-40% and

- the Growth option will have between 77-90%.

Here is how the accumulation (savings) funds performed over the past month, the past financial year and in previous years.

And here is how decumulation (pension accounts also referred to as accounts in drawdown mode) performed.

What is the longer term superannuation performance?

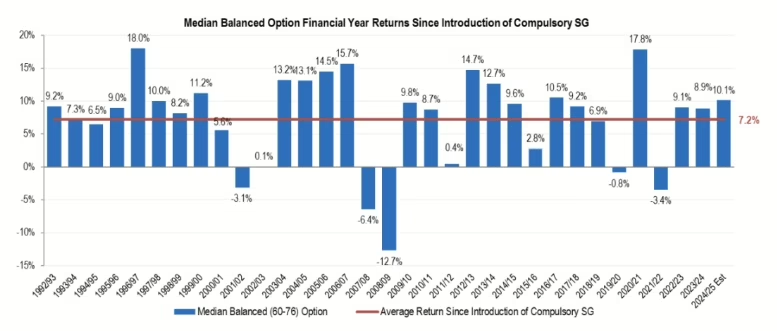

Here’s a handy chart which shows a snapshot of super returns since compulsory super was first introduced in 1992. As noted by SuperRatings:

“Despite the increased noise, members can take comfort in knowing their retirement

savings continue to grow, with one dollar invested in the median Balanced super

fund just before the global financial crisis now worth approximately three dollars.”

Source: SuperRatings

How does this affect you?

Or to put it another way, should you care about these returns? And if so, why?

There are so many reports on financial market results that they can seem like wallpaper after a while. But not these results. In a time of hype and uncertainty, the year-on-year super returns are a factual measure of Australian super funds’ performance against which you can review your own annual returns.

Your super savings may be in accumulation or decumulation accounts. Assuming you do have money in super, it’s well worth considering the investment setting you have chosen or been defaulted to. Does it match one of the three used by SuperRatings? Some funds offer a wide range (say eight or more options) but generally speaking they will be aligned to one of the three points on the spectrum above, i.e. conservative, balanced or higher growth. If you are in either accumulation or decumulation, has your fund’s performance matched these returns? Is it much lower? Or perhaps higher? This question also applies to those members who have a Self-Managed Super Fund (SMSF). The results above are market returns – are you doing better, the same or worse? Think of the comparison as you might when comparing the fuel efficiency of your car, your BMI or your grandchild’s year 12 exam results. It’s a way of ranking where you are compared to others using an independent measure. And if you are not doing as well as you would have liked, it’s a great wake-up call to change things.

And what about your savings held outside the super environment? Perhaps you have money in a cash account, a term deposit or you may have privately held share investments. What does you annual return look like from these assets? And when you factor in tax paid on assets not in a decumulation account, how does the net return compare?

Above all, the returns across the past financial year are a strong endorsement for sticking to the course when it comes to investments – and this is a sentiment echoed by Jeremy Duffield in his excellent article on 10 rules for investing, also in today’s newsletter.

We trust you found this short summary of super fund returns helpful, but it may be that you find it hard to compare your own investment returns or to understand whether your super is performing as well as it could. If so a Retirement Advice Consultation offers an opportunity to share your concerns and questions and learn more about how your super could work harder.

SuperRatings is Australia’s longest established superannuation research firm, specialising in delivering research, ratings, and insights on superannuation. You can find out how your fund compares to others here.

What’s your view?

Do you find these year-on-year results helpful? Or do you believe there are better ways of measuring your own super’s performance?