Part-time work after 60 offers more than just extra income. Many find social connection, a sense of purpose, and flexibility, years before full retirement appears on the horizon. An increasing number of men and women are continuing to work past 60, when super can be accessed tax-free, and beyond 67, when the Age Pension becomes relevant.

Notably, older women are some of the biggest beneficiaries of government super co-contributions. Data from large super funds for 2023-24 indicates that women comprised about three-quarters of recipients, with roughly half of these women aged 50 or older. (Source: Older women’s economic security in retirement, Super Members Council Australia)

Working a little longer before full retirement can also help your money last longer. This approach simultaneously grows your super and delays drawing down from your savings for living expenses.

The proposed changes to the Low-Income Superannuation Tax Offset (LISTO), announced on 13 October, 2025, will further enhance these benefits for low-income workers, making the super system even fairer.

Sarah’s story:

Sarah is 63 and earns $35,700 a year. The money her employer adds to her super is $4,282 through the 12% Super Guarantee (SG). She also adds $1,000 of her own after-tax savings, managing her expenses on a modest budget of $30,000. Sarah’s current super balance is $225,000, and she is focused on maximising her savings before retirement.

Government support for your super

Thanks to government initiatives, Sarah’s super receives two forms of additional support:

- Government super co-contribution: Because Sarah earns $35,700 – which is below the lower income threshold of $47,488 that applies, her $1,000 personal super contribution earns the maximum $500 government super co-contribution. That’s 50 cents for every dollar she has added, which is available each year until age 71 while she’s earning income.

- Low Income Super Tax Offset (LISTO): LISTO adds another $500 to her super. It’s designed to make things fairer, so lower income earners don’t end up paying more tax on their super contributions than on their wages.

Update: Recent proposed changes to LISTO, announced on13 October 2025, will raise the eligibility cap from $37,000 to $45,000 and increase the maximum payment from $500 to $810, taking effect from 1 July, 2027.

Total annual boost to Sarah’s super

In total, Sarah’s super could grow by $6,282 each year from these contributions alone: $4,282 from her employer, $1,000 from her own savings, $500 from the government super co-contribution, and $500 from LISTO. This is before considering the long-term impact of investment earnings on her ongoing contributions.

Working while receiving the Age Pension

If Sarah continues working past age 67, she benefits from the Age Pension work allowance. This allows her to earn up to $300 per fortnight (or $7,800 annually) before her Age Pension is affected by her work income.

The years between 60 and 67

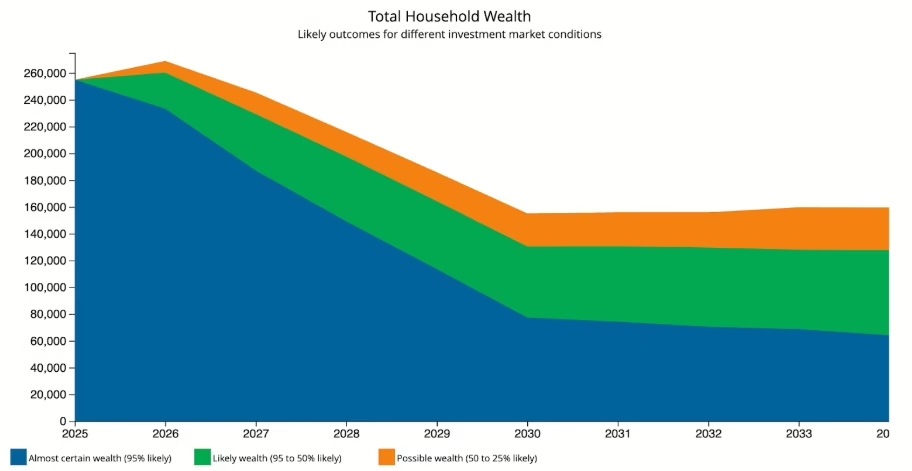

If Sarah were to retire next July at 64, she’d have around $260,000 in super. Over the next three years, she might draw about $30,000 a year to cover her living costs. By 67, she’d likely still have around $100,000 in super and receive the full Age Pension for a single homeowner, currently $30,646 per year.

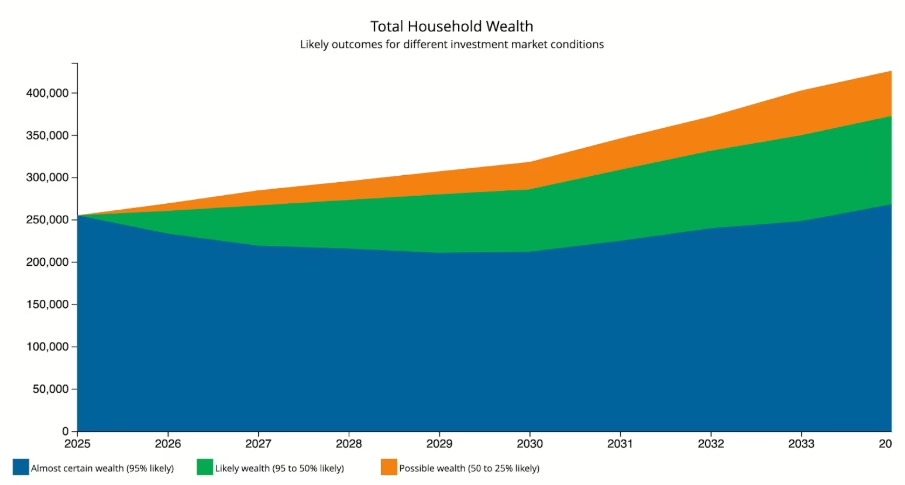

But if Sarah chose to keep working – say until age 71 – her position would look quite different. With her employer’s support and continued contributions, her super could grow to around $373,000. Once she turns 67, the Age Pension work incentive would allow her to earn while still receiving a part Age Pension initially – about $16,000 a year in today’s dollars – giving her extra income and helping her savings last longer.

Of course, not everything is within her control. Her health, motivation and enjoyment of work with a supportive employer, as well as family circumstances all play a part.

Still, Sarah’s story shows how working a little longer, and making the most of government incentives can help you to bolster your retirement security.

Who benefits from government super co-contribution?

When examining who receives support from government super co-contribution, the picture is more diverse than one might expect. Looking at the most recent data from the Australian Tax Office (ATO) about 40% of recipients – more than 133,000 individuals – are single, managing their finances independently. For them, this extra boost can make a significant difference over time.

However, the majority, around 54% (over 180,000 people), are partnered. Interestingly, many of these couples are not necessarily low-income households. Around 65% of partnered recipients have a partner earning more than $50,000, and about 36% have a partner earning over $100,000.

This shows that while the super co-contribution is designed to help lower-income earners, it also supports a broader mix of Australians, including those in households where one partner is still building their super balance after years of part-time work or career breaks.

Ready to explore your retirement options?

We encourage you to explore your eligibility for these schemes. It’s a straightforward, government-backed way to give your retirement savings that extra boost you’ve earned from your own work efforts.. But it’s up to you to ensure that you’re making the most of every opportunity to build the secure future you envision.

To learn more about how Retirement Essentials can assist you with your retirement planning, consider a tailored Retirement Advice Consultation or use our free online calculator to estimate your entitlements.

And if you have no idea where or how to start

Do you make use of the government super co-contribution as a single?

What are your thoughts on that period when you have retirement in your sights?