The sad fact about most retirement savings predictions is how woefully out of touch they are with reality.

There’s a reason for this.

Firstly the people offering these projections are generally not living in retirement. Most are still working, earning more than $100,000 a year in salary and quite likely to achieve that mythical $1 million in retirement savings. Let’s say they are theoreticians.

And then there’s the vast bulk of Australian retirees, probably feeling like they are on another planet, but in fact the ones with real lived experience of retirement. Let’s call them practitioners. And most know a thing or two about realistic retirement targets.

This discussion came to a head last week with the release of a new retirement savings target by Super Consumers Australia (SCA).

This organisation is a not-for-profit arm of the consumer advocacy group Choice.

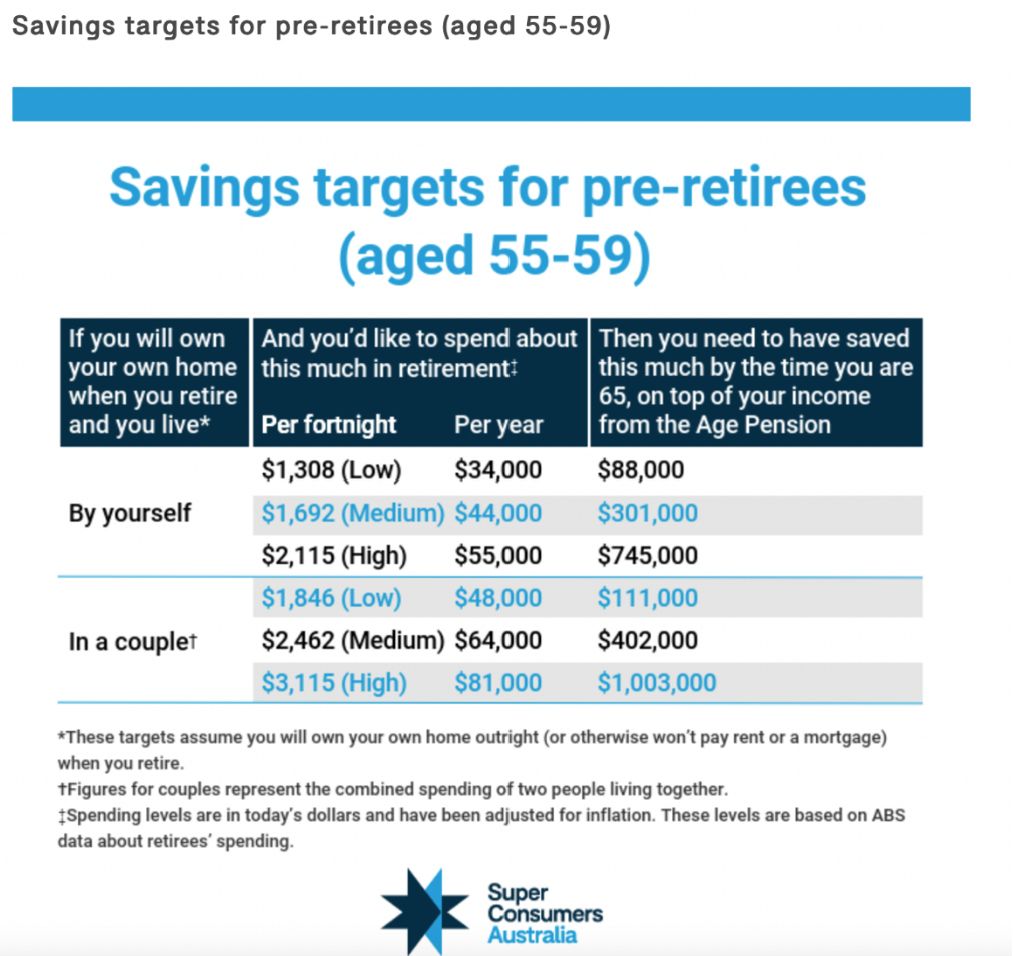

Here are SCA’s new targets:

SCA’s targets for low and medium expenditure in retirement (singles $34,000, $44,000 respectively per annum, couples $48,000 and $64,000) will require lower savings than the previous most commonly used benchmark offered by the Association of Super Funds Australia (ASFA). Also known as the ‘retirement standard’, ASFA believes that those wanting a ‘comfortable’ lifestyle at retirement will need to save $545,000 if single and $640,000 if partnered.

Here’s our comparison of funds needed for medium or comfortable lifestyles as offered by SCA and ASFA:

| SCA ‘medium’ lifestyle | ASFA ‘comfortable’ lifestyle | (ASFA) Median super balances age 55-59 | |

| Single savings needed | $301,000 | $545,000 | Male $162,337Female $109,639 |

| Singles’ annual expenditure | $44,000 | $46,494 | |

| Couple savings needed | $402,000 | $640,000 | Male $162,337Female $109,639 |

| Couples’ annual expenditure | $64,000 | $65,445 |

We’ve added the median superannuation balances column on the right as a reality check.

Put simply, most people do not retire with super balances of $300,000 or $400,000 let alone $545,000 or $640,000.

The median super balances at ages 55-59 from ASFA’s own research show male balances sitting around $162,000 and females at not quite $110,000.

So it can be very unhelpful to even imply that the above target savings are easily achieved when at best, the current Australian track record is to save only half the suggested amount.

And there’s another major concern about taking these projections too literally. And that is that they are based upon living expenses, on top of assumed pension eligibility, and the belief that you are living in a home without a mortgage.

There are a lot of assumptions here. In fact, a rapidly increasing number of retirees are entering retirement with a mortgage – 42% of pre-retirees (aged 50-64) are carrying mortgage debt according to the Grattan Institute. Not quite half, but a significant enough number to need to be represented in the above calculations, one would think.

So where does this leave you when you look at your own nest egg and realise you only have about half the amount that the so-called experts say you need?

You are right where you are and that’s okay.

Most ordinary Australians will not achieve these suggested savings targets in the near term. So you are with the pack, so to speak.

The good news is that the Age Pension is a secure, government-guaranteed source of retirement funding which can provide a solid and reliable base for your retirement spending. If you are eligible for an Age Pension you can also earn an extra $7800 per year through the work bonus, without being penalised and will automatically receive a Pension Concession Card (PCC). And you can use the savings that you DO have, to top up your pension so that you are not living hand to mouth, but able to afford some small luxuries along the way.

You can also review your current or future Age Pension entitlements and consider some of the many ways of maximising these benefits, either before retirement when you have most leeway – or after retirement when there are still many ways to mix your savings, your super and your pension income to achieve the optimum result.

It’s helpful to be aware of the current retirement savings benchmarks. But judging yourself against aspirations that are simply unachievable is very disempowering. The team at Retirement Essentials has many proven strategies to help you make the most of every dollar you have today. A consultation with an experienced adviser can answer your questions about ways to use our knowledge to make the most of what you have. When it comes to knowing the rules, there’s support available.

Book an online consultation now and find out your options to maximise your income – and minimise your stress.

This article is provided by Retirement Essentials Representative Number: 001260855. We are an authorised representative of SuperEd Pty Ltd ABN 88 118 480 907 AFSL #468859. This information is not intended as financial product advice, legal advice or taxation advice. It does not take into account your personal situation, goals or needs and you should assess your own financial situation, consider if the information is suitable for you and ensure you read the relevant Product Disclosure Statement (PDS) if you choose to make any changes to your financial situation. It is always advisable to consult a financial adviser before making financial decisions.

You’re spot on. i’m pleased someone has finally realised that.

If you’re not in that bracket that financial wizards say you should be by retirement, and you constantly see those reminders, you feel a failure, and pressured to work and worry.

Hi Nichole Please give us a report how much do we need when we are 80 to 90 years old

Thankyou for your excellent opinions

Hi Kevin. There isn’t really a magic number as everyone’s needs are different but here are some indications. ASFA estimates a typical 85 year old will spend a little less than a typical 65 year old person. Their figures for an 85 year old single person are $27,000 per annum for a modest life style and $39,0000 for a comfortable life style. For a couple the figures are $39,000 and $60,000 respectively. All those figures assume you own your own home.

For those living a modest life style they will find the Age Pension covers most of their needs. For those wanting a more comfortable lifestyle however they might want savings more in the range of $50-$100k at age 85 to supplement the Age Pension, perhaps even more. Nicole can take you through our retirement spending guide to help you with this if you would like to book a consultation.

Those figures the so called experts say you have to have at retirement are way off the mark and are just so incorrect. If you are lucky enough to own your house of residence, that is huge at retirement as no mortgage is extremely helpful . The major thing is to be able to gain the Aged Pension , especially if you can qualify for the full Aged Pension . It is a regular income which is there fortnightly. To be honest it is not good to have to much cash and assets at retirement because if it wipes you out to receive No or very little pension the money you have, you will find it very difficult to invest it to return the amounts that the Aged pension can give you fortnightly , especially if you can attain the Full pension . Due to interest rates being so low and many not wanting to enter the stock market or invest in managed funds due to volatility return can be much lower than a regular pension .

I am 71, a single woman, leave the workforce last year, and now full-time care for my 94 dementia mother, my only income is $700/FN super and $136/FN Carer allowance. I applied for both Carer payment and age pension but both were rejected as Centrelink told me? Both are exactly the same standard.

My question is Full-time care is a hard job, why is it the same with full-time retirement? Do I have any other option to receive financial support from Centrelink?

Hi Li, I’m sorry to hear of your situation but commend your dedication to providing care for your mother! We only specialise in the Age Pension and Commonwealth Seniors Health Card so I couldn’t say what other payments or options may be available to you. I would suggest visiting your local Centrelink branch to discuss your situation with them in person and seeing what other help may be available for you.