Age Pension income and assets thresholds

Last week we shared the news about the largest Age Pension increase for 12 years. We also mentioned the increase to the Age Pension income and assets thresholds, but these changes were somewhat overshadowed by the extra $38.90 for singles and $29.40 each for couples, effective from September 20.

Yes, this larger than usual increase is definitely helpful for those already on an Age Pension, affecting about 3.5 million older Australians.

But let’s not forget the good news in the threshold changes for many other retirees.

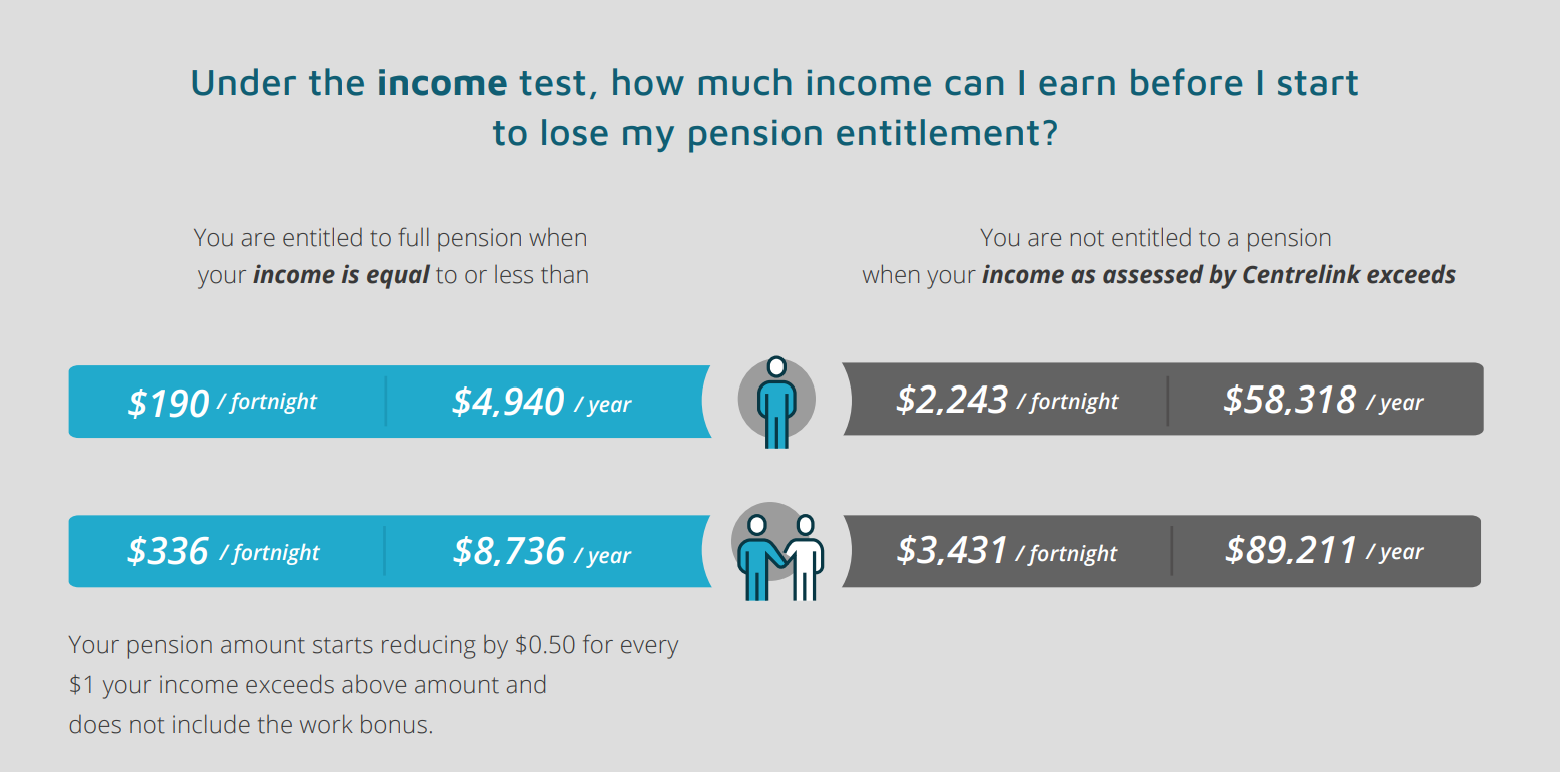

These changes are also significant – with increases in how much you can earn and still be eligible in the order of $2000 per year for singles and just over $3000 for couples (combined).

This amount is not to be confused with the work bonus (moving from $7800 to $11800 during this financial year), which is applied once you have qualified for the Age Pension.

The actual disqualifying income amounts are now up to $58,318 for singles and $89,211 for couples per annum.

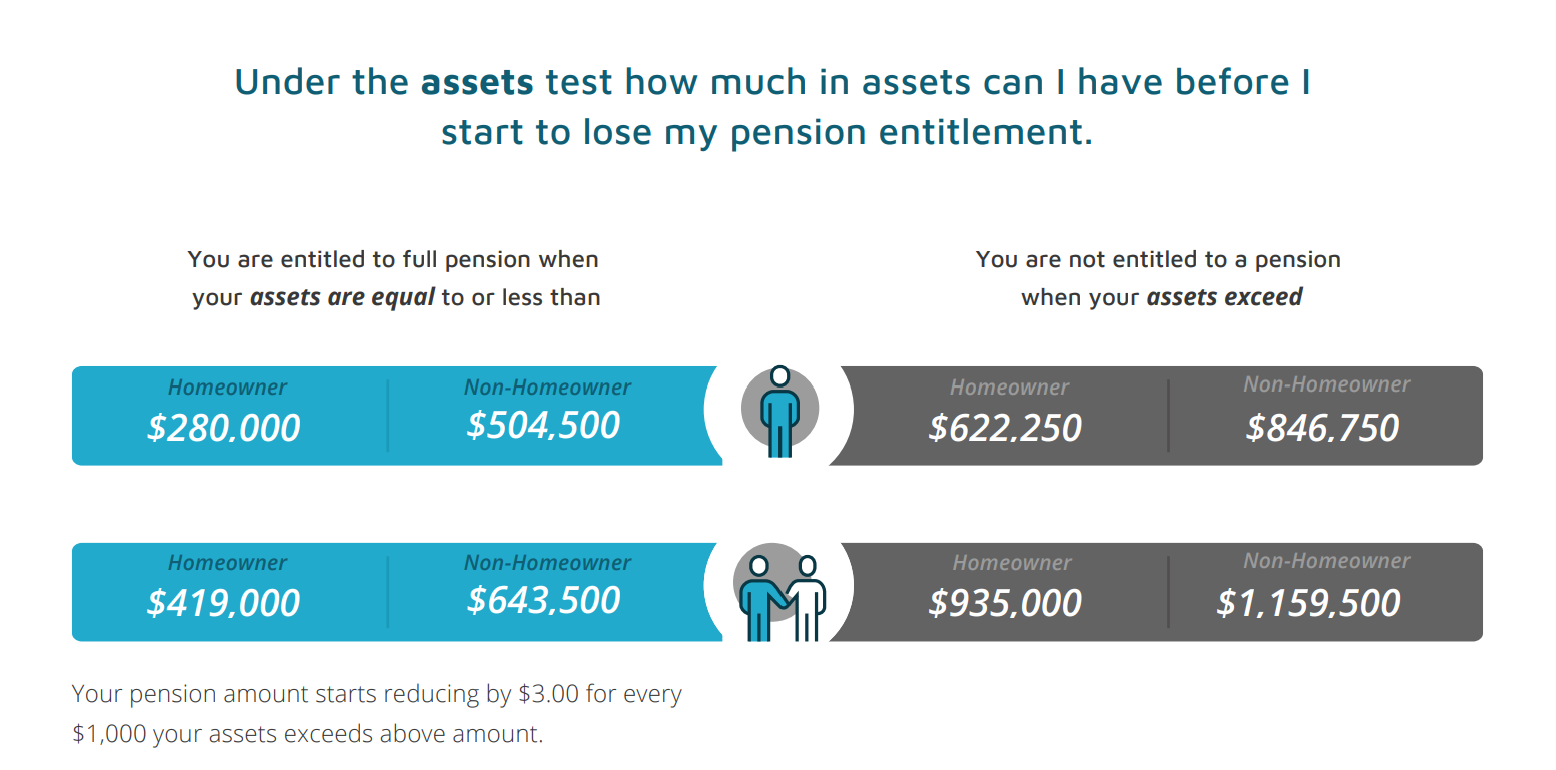

In line with these disqualifying income limits are increases also to the disqualifying assets thresholds.

These have increased by $13,000 for singles and $19,500 for couples (combined).

When taken together, these two new higher thresholds mean that of the nearly 40% of retirees in Australia who are self-funded, many will now be able to qualify for at least a part Age Pension.

This, in turn, means they will also receive pension supplements and a Pension Concession Card.

When household budgets are under more and more strain, every little bit counts, so qualifying for this guaranteed income stream is a huge bonus.

How do you know if you, too, will now get the pension?

We’ve made it easy for you by adjusting our Age Pension Entitlements Calculator ahead of time. You can enter your information and see if you now qualify today. And if you are unsure as to how these new thresholds work, you can easily book an adviser consultation for a one-on-one discussion about your financial needs.

When does the new amount for the work bonus take effect from.

Hi David. We are waiting for the legislation to go through. At this stage it looks like December

Nobody (including Centrelink) has been able to tell me how a Commonwealth Superannuation Scheme (CSC) pension, (which is a Defined benefit, thus having no set value) is determined for the Assets test. I assume that the older I get, the less ‘value’ is attributed to the pension, and therefore I may well qualify for an Age Pension.

Can you advise please?

Hi Angus, with regards to Defined Benefits, Centrelink assess these solely as income similar to the way they assess employment income if you are working. The value is assessed based on how much you receive because as you said there is no set balance being drawn from. This means that the only reason the ‘value’ would be reduced (from Centrelink’s perspective) is if the amount you receive goes down, your age has no bearing.

Can you tell me what is included in the assets required to be included in the total assets of a couple.

Thanks

Hi Grace. All assets with the exception of the family home are included in the assets test. this includes investment assets such as shares and property, cars, caravans and personal assets such as jewelry, white goods etc. Personal assets such as cars, white goods etc should however be valued at garage sale value to , not at replacement cost. This article gives an example

Hi,

We have a couple of questions you could help us with please.

My wife and I have been retired for 10 years – we recently sold our home and deposited the money received in the bank. We are currently living in rental accommodation whilst we look around for another property.

We lodged our change of circumstances with Centrelink and our age pension was reduced accordingly. Our understanding at the time was that we received 12 months grace to find another home before our pension was penalised, however, it was reduced due to deeming of the additional cash in the bank. Is there any benefit of the 12 months grace ?

We have since found out that we qualify for rental assistance.

If after the 12 months period we decide to carry on renting, rather than purchase another home – should we expect any further reduction in our pensions ?

Thanking you for your assistance and regards,

Glyn Church.

Hi Glyn, the benefit of the 12 months is that without the exemption to your assets your pension would likely be reduced more significantly, potentially even cancelled depending on the amount you received from the sale because the increase in your assets is generally far higher then the increase to your income from the deeming. This means that should you choose to continue renting and not buy/build, then when the 12 months expires you will likely see a further reduction to your pension.

Hi Glyn. I have a superannuation fund of approx $1,0100,000.oo. This puts me above tha assets test threshold. I expect to retire and convert this fund to an income stream. I would expect the income to count against the pension. but would the value of the income stream capitol count as an asset?

Hi Peter, it’s Sharon here, thanks for your question. We see this often, it can be confusing. The short answer is the income does not count against the pension if the income stream has commenced since 2015. It’s only different if it’s a defined benefit fund (like a government super fund, these are not common anymore), and your balance before retirement is this amount, before starting an income stream. (Then the asset value no longer counts).

But assuming this is a regular super fund, industry fund or retail fund, then no the income won’t count. The capital value of the balance does count towards the Assets Test though, and then Deeming applies towards the Income Test. I’d be happy to help you better understand what you have, and how to make the most of the great nest egg you have accumulated, to provide the type of retirement you have in mind. A personalised appointment may be helpful for you, and you can book this with me here