With Consumer Price Index (CPI) and Pensioner Beneficiary Living Cost Index increases (PBLCI) now published, we are able to predict the most likely increases to the Age Pension on 20 September 2024.

We believe this pay rise for retirees will be $26.54 per fortnight for singles and $41.17 for couples. It will affect almost three-quarters of older Australians.

How have we reached this conclusion? By using the three key components of indexation which consist of:

By checking on this data, we can fairly accurately predict the indexation weeks before it comes through. Based upon the latest Australian Bureau of Statistics (ABS) updates our calculations suggest a 2.6% increase to the base rate of the Age Pension.

Here’s how this works, using each of the above benchmarks:

Consumer Price Index (CPI)

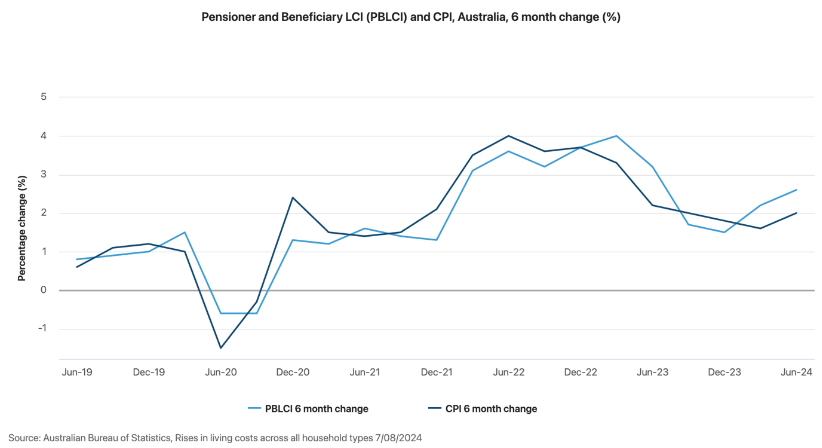

This is a measurement of selected consumer prices over the past month, six months and year. The increase that is used for September indexation is the same for both CPI and PBLCI, the six months change between December 2023 – June 2024. During this time the CPI rose by 2.0%.

Pensioner Beneficiary Living Cost Index (PBLCI)

Living Cost Indexes (LCIs) measure the price change of goods and services and their effect on living expenses of selected household types. The PBLCI measures the living costs for Age Pensioners and other ‘government transfer’ recipient households, i.e. households that source most of their income from government pensions. Over the indexation period (December 2023 – June 2024) the PBLCI rose by 2.6%

Average Weekly Ordinary Time Earnings (AWOTE)

This index measures the six-monthly movement in the average weekly ordinary time earnings of full-time adults, seasonally adjusted.The couple Age Pension payment must not fall below 41.76% of AWOTE. Even though the six-month period December 2023- June 30 2024 is expected to show a 4% increase in these earnings the couple Age Pension payment will remain above the 41.76% ratio of average earnings, so this measure will not be relevant unless AWOTE increases by much more than expected.

So you can now see how these sums work. The PBLCI, at 2.6% is higher than the CPI at 2.0%, so it is the main index upon which rates will be benchmarked. As noted, for the same period the AWOTE is not expected to be relevant.

Will other payments rise?

Generally speaking, 20 September only sees increases to the base rates through indexation. Deeming Rates are frozen until June 2025, so these will not change. Other supplements could be adjusted, but that is unlikely. Asset and Income test thresholds changed on 1 July, so they may not move again in the short term. Commonwealth Rental Assistance may be reviewed, but this is up to the relevant government minister.

| Per fortnight | Single | Couple combined | Indexed Single plus 2.6% or $26.54 | Indexed Couple combined plus 2.6% or $40 |

| Maximum basic rate | $1020.60 | $1538.60 | $1047.14 | $1578.60 |

| Maximum Pension supplement | $81.60 | $123.00 | $81.60 | $123.00 |

| Energy Supplement | $14.10 | $21.20 | $14.10 | $21.20 |

| Total | $1116.30 | $1682.80 | $1142.84 | $1722.80 |

If you would like to check your own Age Pension eligibility, you can do so using Retirement Essentials free Age Pension Eligibility Calculator. Or if you need to learn more about ways of maximising your own entitlements, then working with one of our consultants in a scheduled appointment will allow you to ask all your questions and find the best solutions to suit your needs.

Is this indexation the best way to keep the Age Pension at a realistic level?

This method of Age Pension indexation is applied twice a year, on 20 March and 20 September. The government maintains that it is the best way to keep the Age Pension ‘real’ in terms of inflation, cost of living and movements in wages.

The actual increase will be announced towards the end of August or in early September but we expect they will be very close to what we have forecast. We will update you once they are official.

Do you agree?

Or is there a better way?

And how will this expected increase affect you?

You figures are incorrect the Couple amount is $1538.60 not $1583.60 as you have in the spread sheet. You should correct this error

Hi Noeleen, thanks for the spot check, the table has been updated 🙂

The new total is still wrong, its $41.17 per couple not $41.17 each.

Thanks for double checking Garry, I thought it was just a typo but the math was also incorrect. Updated now.

My aged pensionon September 20 was exactly same as previous on 6th September $1,116.30. Why??

Hi Margaret, the increase takes effect from 20th onward, meaning the payment you receive on the 20th is not impacted because it is for the fortnight prior to the increase taking effect. Your next payment will be higher.

good

Surely in this environment the Age pension should be looked at every 3 months to ensure the cost of living equates to the current climate. It is 2024 and high time our elected representatives give some thought to change this antiquated process.

Agreed!

Agreed

is the carer’s allowance receiving an increase similar to pension increase?

true , more realistic

Hi

why is it so? How do they work out a couple can live cheaper then a single person. I disagree. your expenses and what you like to buy during your working life is so much different once you are on the aged pension and especially if one person of a couple is a carer. You do get a carers pension of $153 a fortnight but in saying that you are only getting a fortnightly pension that is drastically and still lower then a single pensionioner. In saying that even with the carer payment it still doesn’t equate to the single pensioner payment. Carers can be on up to $80 an hour. We work our life till the pension age but pay our taxes seperate and not as a couple but when it comes to retiring we are only paid as a couple. That’s not equality that is double dipping on a couples taxes. It is just not fair life is hard enough. Just my thoughts.

Yes I agree as prices increase monthly sometimes weekly.

The Canadian government reviews and alters pensions as required every three months….

No need. It’s enough. Can’t ask too much as we are doing ok. Just think of all the poor countries suffering badly.

agree, in Canada everyone pays taxes until the day they die, even pensioners, no such thing as a work allowance

Did you know everyone in Canada pays taxes until the day they die … lucky Australian retirees can avoid this and enjoy a reward at the end of their working life

Really? I thought aged pension receivers do pay tax in Australia??

Will the disability support pension get income rise as well ???

Hi Steve it is possible but we specialise in Age Pension so aren’t fully across other pensions and their changes.

not sure if grateful or not

when it goes up

rent/village fees goes up, my HCP goes up when they recalculate my contribution, then its combined with my income etc and my Centrelink goes down!

Thanks for the information.

The work bonus should renew to the max of $7,800 or $12,100 each July.

They told me it doesnt. The govt should look at it . Its the only way us pensioners can work alittle and help the employers who are looking for workers. And get the money moving around for Aust.

Send this to the revalent Dept so they can fix NOW !!!

Totally agree with you Perry!

In respect to other allowances increase, wasn’t there a 15% increase for RENT ASSISTANCE that has not been passed on yet from the budget awaiting for the indexation to kick in in September.

I believe the increase in rent assistance in the May federal budget was 10%, which does not appear to have been taken into account in this article. That would mean maximum rent assistance would go from $188.20 a fortnight to approximately $207.02 a fortnight.

Hi Frank, thanks for the spot check! I can confirm that the current maximum amount of Rent Assistance you can receive is $188.20 as per Centrelink’s website HERE.

why is my second pension that i receive classed as income, which then decreases my Age Pension?

Hi Wendy, Centrelink assess regular payments received that are not drawdowns (such as withdrawals from bank accounts or superannuation pensions) as income.

Work bonus is useless to us, my husband is disabled and non verbal, I am his full times carer so can’t work, we are on a normal couple part pension. The work bonus is not helpful in our situation.

Agree with Perry – the work bonus should reset each year. The once only reset last year whilst welcome doesn’t help any of us who work and earn more than the work bonus covers. I work two days a week in the disability industry. We need more staff. But I lose a lot of my pension.

Hi, I just want an age pension card, no money, at present. Can you help?

Hi Edna, the Age Pension and Pensioner Concession Card go hand in hand, you cannot apply only for the card.

It is about time the Old aged Pension, becomes a RIGHT. More would be available to all if we set a realistic assets test AND working rights, to become eligible.

If we are able to contribute, by way of working – subject to reasonable limits, our pension should not be affected

Volunteering in MANY needed occupations should attract a “Volunteer Supplement”, at a rate commensurate with the savings we achieve, within the federal budget.

e.g., Should you volunteer 30 hours per fortnight a payment of $10 per hour would supplement your pension by $300 per fortnight.

There are many “synergistic” ways we can contribute to our beautiful country, get paid some, and the net result to our nation “could” be many millions of Dollars.

Our politicians often think “Punitively instead of Positively.

Wish I did not retire

why don’t DSP pensioners get an increase?

The 10% increase Rent Assistance supposed to fall due on the 20th September according to this article.

https://www.servicesaustralia.gov.au/sites/default/files/2024-05/budget-2024-25-living-arrangements-3.pdf

My Centrelink app shows my payments up until the 27th September and it shows no changes to my payments.

Disgraceful Senior’s are stealing everyone on Centrelink CPI ?