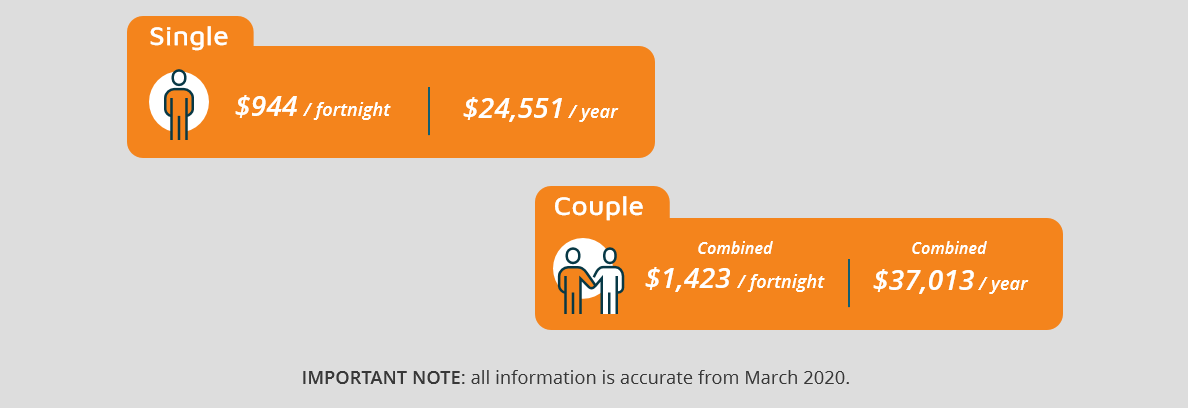

Centrelink have now announced the changes to Age Pension income and asset thresholds plus payment rates.

For senior Australians receiving the full Age Pension this translates to an additional $7 per fortnight for singles and $10 per fortnight for couples combined:

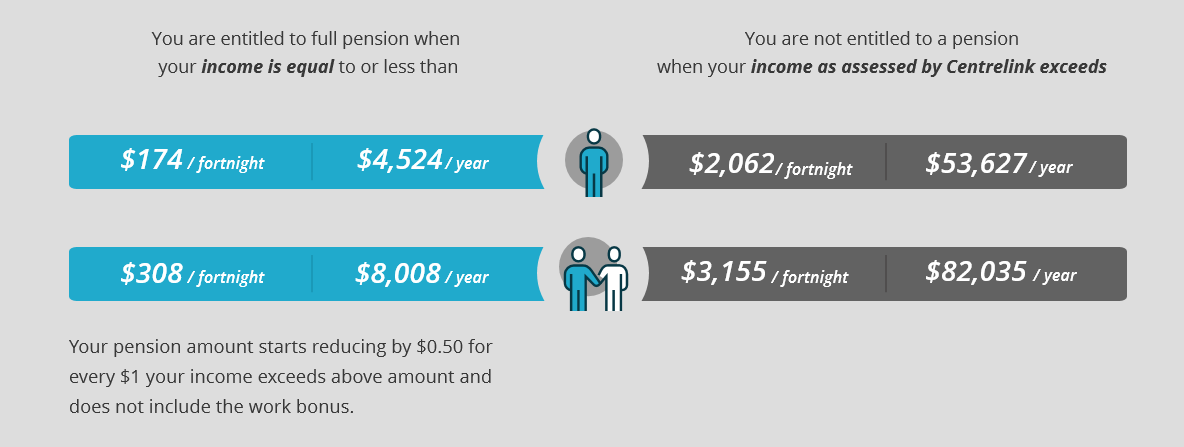

Centrelink determines an applicant’s Age Pension payment rate by assessing their income and assets independently, this is referred to as the Means Test. The Means Test ensures the Age Pension is provided to those who need it most.

Our Age Pension Calculator has now been updated with Centrelink’s new income and asset thresholds plus the new payment rates. You will be able to quickly find out your entitlement based on your current financial situation. Click here to re-check your Age Pension eligibility.

In case you’re wondering, the new Means Test thresholds are as follows:

Income Test

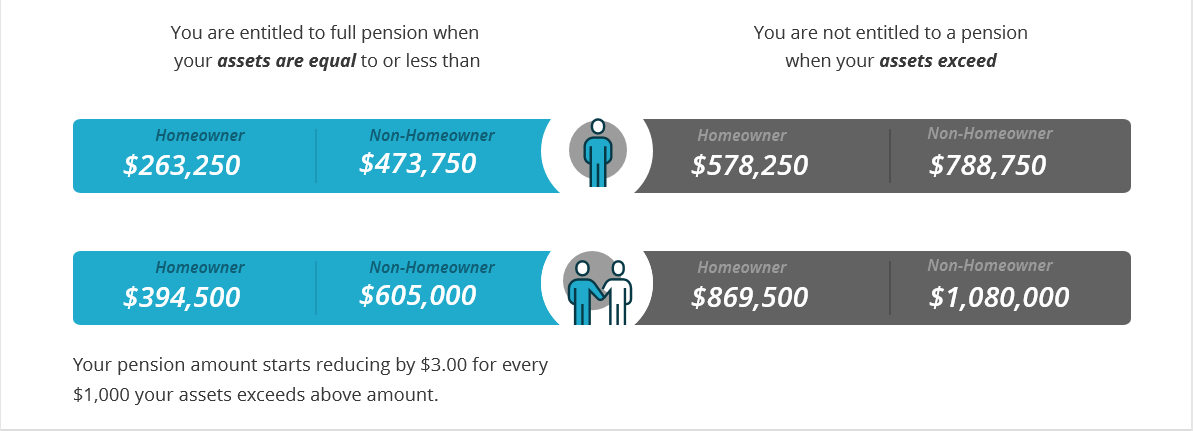

Asset Test

If you are eligible for a payment but haven’t lodged your application yet – stop delaying. You are missing out on your entitlement, which will only be back dated to the date that you lodge your application, not from when you became eligible.

Retirement Essentials makes it easy for you to complete your application plus we work with Centrelink to get your application processed quickly. Go on, give us a try. We’ve already helped hundreds of senior Australians get their pension the easy way and we also offer a money back guarantee.

Retirement Essentials also offers an easy to use online application service if you would like a helping hand with applying for your Age Pension. If you have any questions simply call us 1300 527 727. Our friendly Age Pension Specialists are waiting to take your call.

I’ll gonna be 66 onSept 8 and im receiving carer pension but not full pension.Do i have to fill up form for age pension

Stay on the carers pension, it has far more benefits financially. There are payments you get on a carers pension that you DON’T get on the aged person as a carer … eg. July every year you get a bonus on carers pension. This is NOT paid to you if you are on an aged pension and caring for someone . If the person you’re caring for passes away, you get a bereavement payment… etc etc.

I’m 70 in June retired on pension..

How will this affect my PENSION….

Also if l was to withdraw some of my Super will

It have any affect too…

Will it be $1.70 each like every other time? And how much raise will politicians get?

Colleen you are spot on.

I’m 73 and agree with Colleen and Clasina, not even enough for a coffee. and i just wonder how you intend taking the extra money you are paying the people who havent got jobs, never had jobs but got extra payment every fortnight during caronavirus. Do they just get the higher rate. Dont get me wrong the payment ti pensioners was appreciated but we wouldve gone under without it. Everything is so expensive during this time. Lets see what happens with job search……

I will be of retiring age in Sept. What forms do I need to have?. And can they be submitted now, as I’ve been told it takes a long time for it to be processed.

Hi Helen,

Unfortunately you are not able to apply until you are under the allowable threshold so you would not be able to apply now in anticipation of your retirement as per Centrelinks rules. You can begin preparing documentation early but do keep in mind that statements from your bank/superannuation/etc will need to be up-to-date as of when you do lodge.

Please feel free to give our Free Online Eligibility Calculator a go now and again when you do retire.

I am wishing I had the U.S pension as I worked after my 68 birthday.

Do i need to do anything just retired and receiving the age pension. Taking out what is left of my super.

Sheryl

I am just retiring at 80yo. What pension will I and my 77 yo wife be entitled to having worked from the age of 14yo

I think it is time that the rate of pension paid to married couples is brought into line with he rate paid to singles and de facto couples claiming to be single. I think that $220.00 a fortnight less for couples is a bit rich. An Aged Pensioner is n aged pensioner and all should be treated equally.NO MORE DISCRIMINATION against married couples . Max Jackwitz

Singles and Couples have similar fixed costs..Rent.Electricity Rates.Car running costs Etc. They are not double for Couples who are MUCH better off than two Single Pensioners.G

Singles still have to pay the same rent, electricity, water, car expenses etc as couples, why are we discriminated with the amount we get compared with couples…

Singles are discriminated against. I pay same car rego, same electricity, same petrol & insurances. Married couples get $400 odd more fortnight than me plus i pay rent (govt housing thankfully) get $700 pr frt. to pay for everything. Don’t they live as a couple? Every married couple i know, live on one pension & save husbands. Try & save on a single pension!!

Better of just living in a duplex ,being divorced 1A 1B can visit each other or chat over fence —— ummm may sell our house and buy a duplex

Good comment Thompson Colleen

I have been trying to get an answer to this question for the past 5years. Not a politician of any persuasion will even acknowledge the fact. All working Australians pay the 7% tax from commencement of work.

Married couples have to pay double for all essentials double single rate would be very well received by couples

No they don’t. They do not run two cars, or have two electricity bills or water rates, or council rates. They do not use twice as much petrol or pay two car licences etc. etc. The sing

E pension is supposed to be 66 percent of the married couples pension. Each increase to pension increases the gap. You never hear of a married couple having to ration their food for a fortnight, or going without their happy hour each afternoon.

What is the age for males to apply for pension?

66 years of age at the moment. It’s the same for males and females

We’re is THE 3 TRILLION DOLLARS WE OLDER PEOPLE PAID AT 7.5% OF OUR WAGES INTO OUR PENTION FUND THAT HOWARD AND KEETING STOLE FOR INFRASTRUCTURE BUT IT DISSAPPEARED TO WERE

PLEASE ANSWER.

What a joke give it to u in one hand an take it back with the other so they want us just cark it ok

I’ll try not to spend the increase all at once…?

Hi there Hugh

We have an easy to use online application service which you can access via our website – http://www.retirementessentaials.com.au or if you have some questions you’d like answered before you get started please give us a call on 1300 527 727.

Wow,$10 per fortnight increase for married couples,yet they still allow fuel companies to rip double that plus more every time you fuel up.

Oh great a whole $5 a week what a joke ! Pensioners are living below the poverty line. Wake up governments if not for us pensioners you would not be where you are! Not only is the pension not enough to live on, the government makes it so very difficult to make ends meet by having a little job. What’s the problem not allowing someone to work a bit ? The pension should be at least $500 a week to be in line with a living wage!