Last September, for the first time since 1997, Age Pensioners didn’t receive an increase in their pension rates. The reason for this was that both inflation (CPI) and the Pensioner and Beneficiary Living Cost Index (PBLCI) were negative.

One of the reasons inflation was negative was due to drops in the cost of goods and services such as childcare and education, transport, particularly petrol, and recreation. Essential items such as food and clothing actually went up, though not by much. Depending on where you spend most of your household budget you might have found your overall costs increased last year and the freeze in pension rates would have hit you particularly hard.

What is happening with inflation now?

As many of you will no doubt be aware, inflation has started to rise again although it is still low by historical standards. It rose by 0.9 % for the three months to December 2020 and by 1.6% for the three months before that to September 2020. Despite those two big quarterly increases, however, the annual rate of inflation was only 0.8%. Why is that?

Last year the June quarter saw a big decline in inflation of -1.9%. This was in the midst of the Covid 19 economic shutdown which hammered many parts of the economy. That negative quarter is still impacting the rolling 12-month figures which remain very low.

So will pension rates increase in March 2021?

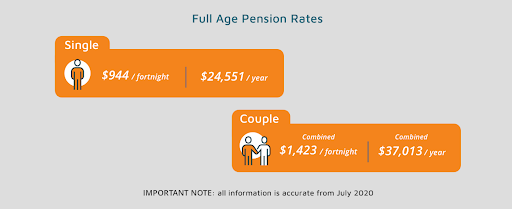

Last March the full age pension rates increased by $7.70 a fortnight for each member of a couple and by $10.20 for a single – excluding supplements – you can check the current rates below. The Government will definitely consider the CPI over the last 12 months when determining the new Age Pension rates and any changes to the asset and income thresholds for the Age Pension. Hopefully, they will also pay attention to the larger increases in inflation over the last six months.

We don’t have a crystal ball but the fact that CPI has risen would indicate some increase is likely. How big that rise will be, and whether they place extra emphasis on the last 6 months remains to be seen.

We would love to hear your views which you can share below. You can also check your current Age Pension entitlements here

as a pensioner Ihave to pay the same prices for fuel and food and also incidentilies as a person earning 100,000 dollars per year. its a bit one sided our super is earning nothing. someone is making a lot of money from covid but its not the pensioner.

I just won’t to say yes pensions are getting a bad deal. We have worked all our working life as most pensions have we have paid our taxes which some of our taxes are been used for jobseekers yes there are some that need it but I believe like in the USA if what ever worked in your life you only get the dole for that long. I know for fact some of those people dot won’t to work why should they they get paid for staying home . If I had that choice grown up but our family worked so let’s think about the pensions they have done the hard yards so now they should be rewarded and just remember some of us didn’t have super for a long wail.

As single age pensioner paying private rent due to no public housing, another $20 per week rent increase is the last thing i needed. Told if you dont like it, feel free to move out. No loyalty for excellent long term tenant. So i am moving out. They plan to put the rent up another $130 per week for new tenant. Greed is good

We get paid the pension for a married couple and report any earnings each fortnight.

Annoyingly now it has to be gross wages received not after tax.

This impacts unfairly with nothing gained by the pensioner in exchange.

Am I correct?

Frank, it always had been gross income to be declared from earnings. I am also on the Age Pension and a former Centrelink employee. Declaring net income was a big problem for staff and customers which usually ended up creating a debt.

I agree, a rise of 7 dollars is nothing, we pay the same for food, fuel ect, it makes it very hard, especially for ones that have to pay rent, not cheap, at least raise it to a decent rate, so people can afford heating and decent food

The Pension rates should increase above the CPI.

the costs for government service all increase above the CPI and do so every 6 & 12 months. So did energy prices plus most food items. Petrol is more expensive.

The last pension increase per fortnight did not go even close to covering the increase across the board

My crystal ball tells me there will not be an increase until at least September as the government has already said that there will be a stimulus of $250 in March.

As GH says pensioners expenses have increased out of proportion to the rest of the community as we do not incur child care fees or education expenses and we probably did not travel too far from home thus saving on petrol costs.

As there is probably going to be a federal election later this year the government will not wish to alienate their voter base by not topping up pensions…that being said pensioners as well as others have received “free” stimulus payments so we can’t complain too much.

Pensions should increase every 6 months, CPI mainly based on previous report but what we are spending is what’s current. Petrol has gone up to $149.95 in my area in some areas went to $155 so how can you based the increase of pension on previous data which is no longer applicable in current situation. Every time I do my shopping food prices had increased. Producers, manufacturer all other businesses will get their loss of income due to work stoppaged as as result of covid19 to compensate for their previous loss is simply to increase the price.

The pension rate is already below the poverty rate and not increasing it because of inflation being negative is wrong as the cost of living for pensioners has increased despite the negative inflation rate. It needs to be increased!

Well the pension is not enough for a couple all i can say i am glad we own our house groceries are so dear petrol insurances house and car plus we pay 200 hundred for our health fund a fortnight which i think8ng 9f pulling out , and yes we have received the bonus package and very happy with it but need at least another 100 hundred a fortnight

No one believes the CPI didn’t go up ,The Government has different formulas for working it out from 1 to 12.They choose which will suit their story. Cheers.

As an age pensioner I find it hard to live..food prices are creeping up..fuel cost sky rocketing..rent is expensive.im through connect housing .I live 40ks from Mackay..so a trip to go shopping is expensive..I’m in a 2 bedroom unit ..I pay jus over $200 a fortnite for rent ..then U got car registration.car insurance.phone bill..electricity costs ..Scott Morrison refuses to increase pension ..while politicians get massive pay increases .and perks..Daryl

How a senior like us will survive , we have real asset more than the threshold but no cash but liabilities used to support our daily needs using overdraft facilities , cards and other kind of loan where not deductible as they were not secured by real asset . At this point in time majority if us want to dispose these asset to survive but no chance due to current market status . So do you think it’s is fair . Yes we’ have real asset but no cash .

May the regulator or policy maker look at this point as I understand net asset should be an outcome of Gross asset – liabilities .

Daryl your lucky I pay $287 a fortnight for my 1 bedroom unit with Access Housing ( community housing ) then like you pay for everything else. Not a lot left over

It is time the Pension rate aid to individuals is made the same as singles and those in defacto relationships claiming to be single. Individulas of married couples have the same expences and in some cases more as they have seperate needs, like medicines, different foods and many other thing to numerous to mention. LETS NOT DISCRIMINATE AGAINST MARRIED COUPLES. Pensioner’s are pensioer’s in my book and all should be treated as “EQUALS”

Max J

I agree. It should be equal for everyone

Pension going up $14 for both of us and Health cover going up $23. Ahhh life is good for some.

I am single. My rates are the same as a married couple. Heating a room with one person cost the same etc. swings and roundabouts.

Sorry Max House rates ,Insurance for house , contents & car don’t double for a couple. Food & clothing would cost more. Single pension is $68 per day.

It has only been in the last 12 months that I have had to request an advance payment on my pension, the stimulus payments in my opinion should have been used as a top up for the pension, I was only able to use the first payment for the reason it was handed out, I.E. to help stimulate the economy, all the other payments went into my car registration (for which I receive a discount but being in QLD I still have to pay the registration component unlike N.S.W. and Victoria, power bill and rates, as for petrol, I have an hours drive there and back to the supermarket which I do once a week, no special outings!

As always individual circumstances of Pensioners vary greatly. I know many Pensioners who, like me, consider themselves well off on the Age Pension for which they are grateful knowing that they are not working and regret not having saved more for Retirement when they were able to.These days our Age Pensions are more than many Self-funded Retirees can earn from their savings. Taking into account all the replies you have received I do not think an increase in the AP is warranted at present and those who think the AP is below the poverty line need to re-work their Budgets, and cut their needs to suit their cloth.There are other benefits available to special deserving cases.

Robert.

We all have different needs, but for us we do manage on the pension. There are no frills in the way we live but I still manage to have a little left each fortnight to put away for the unexpected expense. Neither of us drink, smoke or go out unless it is for shopping. I believe the bonuses we received have been a great help. In NSW there is a Regional Travel Card available through Service NSW to help with travel. This was a great help to us enabling us to travel for medical and not be out of pocket.

I guess the short answer is NO. Unless all pensioners literally form a Pension Party supported by all pensioners, that preference only the existing political party that improves our lot. Nothing short of putting a fire under their seats will move politicians as we all have seen since governments began.

Rental increase $20 per week

Pension increase $0. Rent now 60% of my single age pension. Oh well have to cut back on whatever i can. Probably food sgain

In spite of having been a single parent for many years, then the support for my invalid husband, and finally the carer for my Dad, I am now learning 28 different ways to cook mince.

It’s impossible to be able to afford good meat on a single age pension. It’s a penny-pinching nightmare from one pay period to the next.

Now a pensioner, 69 years old this year, having worked since 14 yrs old 16 yrs starting full time. Please explain why my parents were told by the government at the time that the war is over we need you to have children for the future of the country. All Governments since have known that the Baby Boomer Generation after contributing to the growth of Australia will retire 65 years from then yet we are labeled a drain on society. How dare the current Government treat us this way. We have not had the amount of years to contribute to our super but have had all our life to contribute to this country. Disgraceful treatment.

I have given up worrying or hoping about any pension increase from this government. The fact that they even thought that $7.70 the previous time was acceptable spoke volumes to me. In this country, one of the most affluent in the world, we should not be having to worry about how to juggle the pension every fortnight in order to be able to afford basic necessities like being able to keep warm in winter. Total disrespect from the government.

My pension increase comes in next Tuesday. The whole $2.06. How come you are getting $7.70.

How dare the government tell me because I am married my husband and I are paid a combine pension which is $250 more for a single pensioner and also 2 can live cheaper then one. So here I go double water,clothes,shoes,toiletries,power,food medicines so on and so on. I think all us pensioners should be paid our pensions as single pensioners or all of us should ban together and take the government to court for discrimination against married couples.

Stop paying taxes and they forget about you. simple really.??

We are a married couple who own our home but am finding the rises in the prices at the supermarket, medications, fuel stations and insurances are starting to make it very hard for us to have Any disposable income to have a day out or a coffee even when we are out. If we don’t have money when we need something we just go without until we can afford it. Why has everything gone up so quickly as sometimes we struggle.

It’s alright for these people to say costs haven’t gone up obviously they are on a good income. Living below poverty line is causing a lot of stress for pensioners. If unemployed can get a bigger raise then why can’t pensioners. Time for these decision makers to get in touch with reality

What make it worse is,that couples who are separated but,live in the same household get single pensions,does anybody know what happens behind closed doors!!!!!!!