The Retirement Income Review: Will there be changes to the treatment of the family home?

The Federal Government is currently assessing the report of the Retirement Income Review and their response could have big implications for Age Pensioners. The review is looking at a number of factors that contribute to what is sometimes described as the three pillars of our Retirement Income System. Assistant Superannuation Minister, Senator Jane Hume, has emphasised in The Australian recently that a good retirement outcome is not driven solely by one’s super balance, It’s about the other pillars as well: the Age Pension and voluntary savings outside of super, including the home.

The idea that the family home should be included in the system in some way is not new. Some people have multi-million dollar homes yet can still qualify for the Age Pension. Many people have strong views on whether this is fair. Chris Richardson from Deloitte Access Economics has argued that while the politics are terrible there is a good case for the home to be included in the assets test. Other people who have worked hard to pay off their home will have a very different perspective.

The Productivity Commission Report ‘The Housing Decisions of Older Australians’ also raised the possibility of the home being included with a proportion of the value of the home being exempt e.g. the first $600,000 in value but then the value above this to be included in the test. The argument for this would be that people with very high-value homes could take advantage of schemes such as Reverse Mortgages or the Government’s Pension Release Scheme.

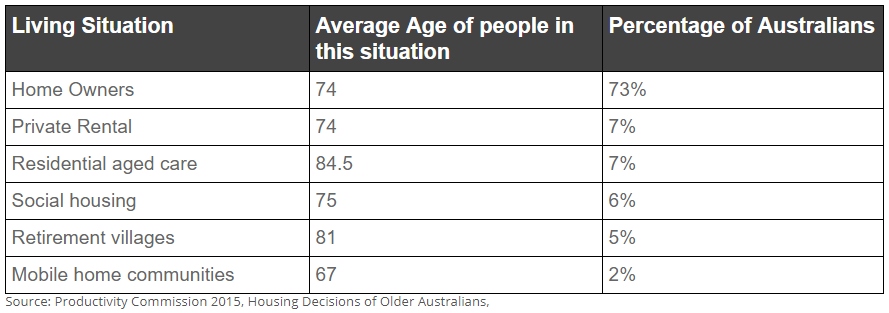

Most Australians over age 65 still live in their own home – see the table below – so any changes to the treatment of the family home could affect a lot of people.

Living Circumstances of Australians over age 65

We don’t yet know what the outcomes of the Retirement Income Review will be but we can definitely expect some changes to the superannuation system and possible changes to the Age Pension. It’s unlikely there will be major changes to the treatment of the family home right now but the possibility is there. We will keep you informed as soon as we know more about the review. In the interim please tell us what you think by commenting on this post.

why don’t they just take all pensions away from people that get more than the pension sum from their investments or own super that would safe a lot of money and be fairer

Yeah well that was well thought out.

Yeah that was well thought out.

You mean, why do they not just do away with thecoension and let all older people die ? That generation has made Australia to the rich country you profit from, spoiled brat.

If you sre receiving more than the pension amount, by your own investments, you wouldn’t be getting the pension anyway.

Hi Michelle. You can earn more than the age pension amount and still get the age pension. Your pension reduces by 50c for every $1 you earn so for example a couple could earn up to $82,243 a year before losing their pension entirely.

My personal situation is that my husband and I will soon be reaching retirement age and would like to think that we would qualify for the aged pension. (Considering we have never taken 1cent of welfare our entire life….

We are currently paying off an investment property as well as our family home.

As the aged pension assets test stands at the moment, we must include the equity (the portion we own) of the investment property into our assets test. Which would be an estimated 80,000.

Consider this example: Joe Smith down the road owns a lovely home valued at 1.5 million dollars, he has 250,000 in super , other assets totalling say 30,000, so based on our current testing system Joe easily qualifies for the “full aged pension. Thus when he dies can leave an inheritance of 1.5 million dollars to his children!!!!

On the other hand we have our situation which is, our still unowned Family home is Valued at 290,000.

Now lets say we have 80,000 equity

in our investment property,

290,000 in super, plus other assets worth 50,000. Unlike Joe Smith, Under current assets test we would NOT qualify for the Full aged Pension and unlike Joe Smith, we would only have 370,000 to leave our children, not 1.5 million!! Of course the family home or part there off SHOULD BE INCLUDED IN THE AGED PENSION ASSETS TEST!

What is the situation if I married 30 years ago but house was already paid off by husband who still pays all the bills? Do we jointly own despite this? I’m sure he thinks the house is his only.

hi. the family court would say at least half of it is your asset should you seperate.

The probate court would most likely give you a fair share of its value should he die and not leave you anything. So it seems that you do have a share in that home due to your living there with him for 30 years.

Why ? Sounds like she only lived in it rent free for 30 years. Perhaps she needs to start paying back rent..

We pay taxes all our working life so why are we still taxed when we retire on a subsistent pension. Our politicians are immorally greedy and don’t set a good example. Why shouldn’t there be a little left over for our children when we pass on

Agree entirely Will Turner. What is so frustrating is that the government are constantly tinkering with retirement incomes and it is not fair to do so for the baby boomers who are on the verge of retirement

Your own home should not be included. We have worked hard for this all our lives. It’s better to be it work ing your whole life and get pension

There are two trains of thought…one is that we paid taxes and some of that should have gone into an age pension..that used to be the way it was. Some 30 years ago, superannuation, privately and employer funded got the big push..and now it’s compulsory.

Paul Keating also raided the pension fund..spent it on something or other to ‘benefit’ the community I expect.

The other train of thought is that if you have been lucky enough to be fit and healthy enough to work, to save and especially we baby boomers, buy a home for much less than people can today then you should use some of that good fortune to maintain yourself in old age. The system is after all “well-fare”..to help those who cant help themselves.

Unfortunately too many see it as a system to rort as best they can for financial advantage. The system is also wrong, when honest people downsize and try to finance themselves, taking no well-fare money, and the government wants to take away their income, demanding that they use up some of their assets- the Labor party tried that on last election..it will be a situation raised again. Well, people in big expensive houses can use up some of their assets also.

I bet Paul Keating received a healthy pension and wouldn’t be living in a house worth $600,000 or less. That amount would eliminate just about all pensioners living in the Sydney areaor any capital city. If the private home was assessed that would mean nearly all pensioners would have to sell their homes, uproot from the community they’ve lived in for most of their lives not to mention their supportive families, and move many kms away in order to get a house under the $600,000. Then what do they do when their house suddenly reaches the ceiling limit? Move again I guess.

Well said, it makes you wonder why we bothered to scrimp and save to pay our houses off, we didn’t get all the benefits that are given now, we worked hard and paid our taxes, and this would be our thanks, it’s like we don’t count once we get old, this is a disgrace.

I have worked my whole life and have my home paid off with sacrifice and long hours at work

My relative has been on pension all there lives and in housing commission home why should I be punished because of this politicians still get pension for life and other perks how is this fair

I SHOULD HAVE BEEN A BLODGER

It is absolutely insane that the home is not included in the assets test. You have multi millionaires eligible for the age pension currently. At the same time others are struggling to feed themselves. Homeowners, who might find themselves subsequently inelligible for a full or part pension could obtain a loan from the government to be recouped upon their demise from the sale of the family home. There is no imperative for the full value of the home to be left for subsequent generations when their parents have been supported by other taxpayers, who may not be as well off.

I take it your not a home owner.

Agree 100% with Lewis, and yes, hubby and I are home owners…downsizers who now fully self fund and proud of it..our income is about the same as many on a part pension, if not less. There must be some way to balance out all assets, including the home because too many use this to rort the system, when in fact they could support themselves to a much greater degree.

Of course those homeowners didn’t work hard to be in that position and the fact that they may not bludge on the age pension system doesn’t entitle them to be left alone in their self-funded retirement. You want my home? Come try and get it!

Supported by other taxpayers? It was a social contract, we paid tax all our lives b.c to support our elders on the understanding we in turn would be supported.

Death tax by stealth!

Not happy jan!

If this doesn’t show accurately that this is a case of ‘us and them’ I don’t know what else would.

I’ve just been reading about MP’s salaries and pensions – paid for life unlike we retirees who have a super until it runs out.

Now they want to take money from our children which they would receive as an inheritance while MP’s live the life of Riley on public money. Double standards.

No I am not happy.

Hi Susan. Thanks for your comments. There are certainly some passionate views on this subject. It is unlikely there will be any major changes to the treatment of the family home right now but the possibility is there as people are talking about it.

All you non home owners are the same, anyone who has more than you, you want to penalise. Wake up we worked hard for over 50 years and saved to get what we have. We sacrificed a lot, did you?

My sentiments exactly this Jan is furious I worked since I was 14 even as a single mum with two children I studied and I worked full time for 35 years and paid taxes I still have a mortgage on my home.

Every country provides pension for their citizens without question when they reach 65 .

Why is it in Australia when the politicians are incompetent they steal from the pensioners?

It’s a despicable act it’s criminal.

When they work much less and when they retire, with the pension they receive they never have to worry for the rest of their lives.

Have some compassion and respect for the people who worked and paid their taxes most of their life.

Bouquets and hats off to you Jan!

However, this is not quite correct: “Every country provides pension for their citizens without question when they reach 65.” Australia is not one of them, as I can attest as a 74 year old, drafted (read forced) and decorated Vietnam Vet, paid almost 50cents in every dollar in taxation for years and now have received no pension ever or war service pension, because I chose to live in Bali. This is how one of many Aussie citizens are valued and honoured, while the ‘pollies’ line their pockets at the expense of the people they are supposed to serve.

I too am a tad furious!

Try getting an age pension at 65 in Australia

Yes it is 66 in this country. We have also seen some people think it is 67 and they have deferred applying which is a big mistake. It is going up but not yet and is 66 until July next year when it moves to 66 1/2.

You’ve said that very well. I wonder if the politicians would have THEIR homes assessed for the assets test if it was brought in. How many of them do you think would live in homes under $600,000. It would be interesting to see what would happen if their pensions were bound by the same regulations, as they should be.

There is some justification for considering some portion of the family home value when considering assets for pension qualification. However an ” across the board” asset threshold for their residential home would be catastrophic for some senior citizens.

If they have a history of living in a high value suburb an asset threshold of say $600,000 (to use your example) could force them to sell and move to an unfamiliar area. This can have a very detrimental affect on senior citizens physical and mental wellbeing and move them away from established support structures.

If the residential home were to be introduced into the asset calculation two factors would have to be allowed for. Firstly, $600,000 or the median house value in the area, whichever is the greater should be used as the asset value reference point . Secondly, any new policy should not be retrospective. Retired senior citizens do not have the flexibility to restructure their financial retirement plans.

I think exempting say the first $1.0M of the family home is appropriate. The excess above this should be included.

I agree, it’s ridiculous to argue all people who own their own home are wealthy, and I would say those with average homes under $700k would fit into this category.

And with little super to qualify for the aged pension, live very modest lives with little chance of overseas holidays and other luxuries.

If the value of my home is to be included, then I would want it to be the value I paid to purchase it, indexed by the the annual Govt declared deeming rate or less.

Otherwise, there is no way of establishing a current value.

Since it has never been included before, I see no reason for starting now. It is not a usable asset except as a reverse mortgage which are currently not very “user friendly”.

I have Self Funded my Retirement and draw no Govt Funded Retirement Pension of any type.

Why can’t australians own their own pension, by paying for it from their wages at the start of working life. Then no one can take it away from them. The ability to top up their pension when they are forced out of work should also be available. The pension along with superannuation would ensure pensioners live a decent life and not on the poverty line.

It is a sign of a careless community with no long term vision when aged pensioners are attacked. They have been young and have contributed all their working lives, to take from them is like taking from a baby. Just think what will be available for our young people when it is their turn to grow old! Nothing much – if we keep going as we are-continually taking from those who have already contributed all their lives.

Fully agreed.

The suggestion follows neoliberal ideology which places the economy above the individual. Many scholars forecast the death of this ideology following the pandemic

Won’t happen, too politically sensitive & don’t forget the ” gurus” who make these decisions own a house/ houses as well. They have to justify their existence by scaring people, the housing equivalent of Covid19, just relax everyone.

I am seriously concerned about the whole concept of penalising people like me who for decades have worked hard and lived a modest life so that I can have a comfortable retirement. The prospect that the pension is equalised with people who have wasted much of their income and saved little for their retirement is very unfair.

Owning my own home in retirement has meant that there have been many sacrifices so that I could pay the large mortgage. Working long hours is only part of it. Not wasting money on frequent eating out, not owning owning fancy cars and not indulging myself with other extravagances was acceptable because of my long time goal.

If they bring in this change I will be gutted. All the work and sacrifice over the last 30 years will have been in vain.

Political parties know they will lose elections if they decide to torpedo the elderly who have planned their retirement based on the basic retirement income rules. The ALP lost the last Federal election against a LNP in crisis because ALP pushed for removal of negative gearing.

I think the situation where one person in a relationship cannot claim a pension because the other is still earning needs to be looked at. Section 24 allows discretion but I don’t know how often it’s used. If you spend your life working and possibly remarry late in life to a younger person, penalties apply.

Hi Malcolm. You can claim a pension if your spouse is still working, even if they are under age pension age. The key test is whether as a couple your combined income and assets fall under Centrelink’s maximum thresholds. You can check our eligiblity calculator to see for yourself if you are eligible but make sure you fill in everythin as a couple

To my way of thinking if you work all your life, paid your taxes, saved your money bought a home paid it of after many years, and think the hard part is done the government comes along and changes the rules they should not be looking at your home as a asset . Do we sell and move don’t think so .Might be a good idea to start a Pension party and have some say in the decision’s made.

In the end the kids or beneficiaries get the money when sold and most kids these days will retire early and have more funds from their parents estate.

What a ridiculous idea, being that most houses these days are over $600,000;if they use that as a base. So you work hard at paying off your house so you can have a comfortable retirement and the powers to be want to penalise you for it. Let’s hope that doesn’t happen.

I have lived in my eastern suburb of Melbourne home for approximately 40 years and through no fault of mine the cost of housing has skyrocketed in this area.I have done nothing to cause this and I continue to live in my humble abode because of it’s convenience to amenities and services. My primary source of income is my age pension. Other than this I only have a modest savings account. What have I got to live for if they include the artificially created value of my home ( or part thereof) in the assets test.

Well Frank, the cold hard ivory tower economists could give a monkey about our situation.

Politicians should be means tested before they get their hands on a lifetime pension if they are planing that for us , I’m self funded don’t have an fancy lifestyle after working bloody hard for 50 years ,just plain greedy .

The super rules and ongoing entitlements concerning politicians needs to be looked at- their super should be no different to ordinary citizens and they should receive a pension -if at all- that matches the number of years of so-called service to the community- this idea that they could make more financially working in the private sector and are sacrificing their futures for the good of the community so super and perks must be sky-high as they are currently to compensate is an absolute furphy- most of them are pariahs and bloody incompetent and only got into politics to feather their own nests.

Dead right, how can politicians be so blatantly greedy while penalising the aged community tax payers who help keep them in a job? They like to think they work harder than anyone else and deserve a larger helping than the rest of us but aged people are not that stupid and know that is BS.

Most politicians are multi millionaires but of course they will be exempt of the draconian laws they set up to squeeze the blood from the retired.

The whole idea of superannuation was to save the country from paying pensions to all the baby boomer’s, this has happened, the government has many self funded retired people drawing on super so they are saving billions of dollars, what are they moaning about?

My house is worth about 6-700K and I have laboured all of my life, we are not all born equal and have always earned only a moderate wage, yet politicians will get a pension that will be far more than I could ever earn per year but they will want to take more money from my pension.

Where you have a home worth $1,000,000 or $1,000,000 in the bank. You still have a million dollars of wealth. You don’t need the Age Pension.

If you own a house worth 600, or 1 mil You still need money to live a decent lifestyle, for those who have worked hard to prepare their future lifestyle shouldn’t be punished for doing so.

and when it comes to the time we need care… Going into a quality aged care home will take a massive chunk of our asset. I think their the winners.

How can they possibly include the value of the Family Home as an asset? How can the value of houses in different regions be equally compared? You cannot eat bricks and just because it may be in a high value area and worth over $1 Million say, you can’t just downsize out of an area and pocket the savings. You may have lived in that area for over 50 years, have close family nearby, be child-minding grand children (for free as well!!) – whatever!!

This is just plain ridiculous – That house has been paid for post-tax and is not an asset you can cash in, it is your home that you worked for!!!

The inheritance tax of real estate should be adjusted to cover the pension component. A pensioner is a pensioner, not a street beggar that he should be assessed as having fixed assets accumulated during his hard working time for a comfortable living. A few dollars as pension for a small period till he lives after pension age is not such a great obligation by a democratic government having ‘Citizen’s Welfare” as its policy. Already the pension rules of 10 years period and much more restrictions is making an old, weak retired man much in trouble. Why not government stop retiring a person who wish to work more and he will not beg for remnant under label of Pension. Yes when he expires, the beneficiaries heirs should be considered as lottery holders and then government can levy 1/3 or 1/2 value of fixed assets as Inheritance tax. The situation makes the difference. Have apathy with a old, unemployed, unhealthy and weak pensioner

All Australians are not treated equally by the Government. The median house price in a capital city is much higher than the median house price in regional areas. Excluding the home from the assets test means that people in capital cities can leave their children a bigger inheritance because a person in a capital city people with the same total assets as a person in a regional area can receive a full pension but the person in the regional area may receive no pension because their assets are in asset tested investments due to lower regional median house prices. The family home should be exempt for the median regional house price and then balance included as an asset. To compensate for this inclusion the Upper limit ofd the Asset Test should be increased by the median regional house price. In addition the Asset Test Upper limit for non home owners should be increased by the regional median house price. A Fair outcome for ALL people

Pension entitlements should not be asset tested or income tested. Pension entitlement should have a direct corellation to the amount of tax you paid in your working life. At the moment Fred who worked at the same job for forty years dutifully paying his income tax each week & struggling with the left overs to pay off a mortgage on his house gets less of a pension entitlement than Joe who never worked, went surfing everday & got rent assistance from the government for forty years. Oh & then there is Fred’s neighbour Bill who has always rented, had a new car every two years, owns a boat & has steak & seafood dinners at the club three or four times a week, instead of paying off a home, he too gets more pension entitlement than porr old Fred. Further to this there is any number of young people who have chosen never to work & live on wealfair, they use our roads, footpaths, electricity, water, railway, hospitals etc.. but have never contributed a cent of income tax but they too will also get not only a bigger pension entitlement than Fred but they will also get rent assistance. So given the above is it not obvious that Fred should be penalised for working hard & being thrifty all his life?

Nailed it Thadius, thank you. We are dangeroulsy hurtling towards a system which doesn’t encourage hard work and savings. Why bother if you are just going to be penalised at the end of your working life. Politicians and economists you really need to get out more and talk to real people and stop looking at how you can clinically fix a system which has been broken for decades.

Everyone has vested interest. If you have a house you support not to count and if you do not have a house, you will support to count the house when calculating the pension. As a fair comment, some people worked hard to buy a house and sacrificed their income to pay-off the house mortgage. They do that with the expectation that the pension will count the house. If government wants to change, they need to have a referendum and this decision should take effect for the future generation only. If this happen, the next generation will stop buying house and live in rental house and pay to the rich investors to become richer. This what the conservative government wants.

I am receiving a pension from comsuper i.e,DFRDB so that cuts heaps from the old age pension. If they include the house as a taxable income i will loose the majority of my old age pension and still pay tax On my air force pension .why are we getting punished at both ends of the spectrum.

Just pay everyone the pension, we have all paid for this during our working days.7% of all income tax was supposed to be put in the retirement fund, but this fund seems to have disappeared into consolidated revenue.

Think of the cost savings, no centrelink forms to fill in and be checked.

The age pension is not welfare, it is a fund that you as workers have paid into

Some countries such as New Zealand do this.

The point that you seem to miss here Mark is that yes many have worked & paid taxes all their working lives but however NOT ALL have worked & paid taxes.

So many people have never worked or paid tax and still get the full pension while others who have worked hard, paid their taxes, been thrifty are now lucky if they qualify for a PART PENSION.

There are so many anomolies, some couples both always worked & paid taxes and are lucky to get a part pension.

Other couples where only one member worked & paid taxes & will qualify for a full pension.

Other couples who both have NEVER worked or paid taxes also get a full pension.

The only fair way is that everybody should be entitled to a pension pro rata based on the amount of tax paid in your working or non working life with the proviso that the base pension or lower scale be paid to the non contributers & a higher entitlement paid to the contibutors to our government assets and services.

Where is the incentive for people to work hard. This change will impact the majority not the higher minority.

This needs to be better thought out. People who have worked hard all their lives are being punished

Most homes are of low value. Its only the very rich meaning mostly the asset rich who should be considered. Im battling to pay the bills now. Id have to sell my home. Super has lost most of its value. So Im back to C pension only. It would theref o be a disaster

Where on earth can you find a reasonable home these days for $600,00.00? Does that include land value, who and how is responsible for this valuation? Of course it will go without saying that none of this will impact on any politician no matter what happens to ordinary Australians they will all be strangely exempt. Their pensions are an absolute disgrace anyway and that is the first item regarding pensions that needs a complete overhaul before anyone else.

Agree wholeheartedly. The politicians won’t need to worry. It’s everyone else who has worked hard to put a decent roof over their heads in a capital city in this country who will end up being ripped off.

Stop the discrimination! Just pay all old folks a pension as they do in New Zealand. It;s a fair and simple system.