The problems with cash:

Are you missing out?

One of the biggest mistakes in retirement income is to think that you don’t have enough to ‘worry about’. So you do nothing. It’s ironic, as those who say this are also likely to report that running out of money is their greatest retirement fear.

It’s hard to have it both ways. In reality, the less you have, the harder you need to make that money work. But Retirement Essentials’ member data tends to suggest that many retirees are getting very poor returns on their savings.

Here’s what’s happening.

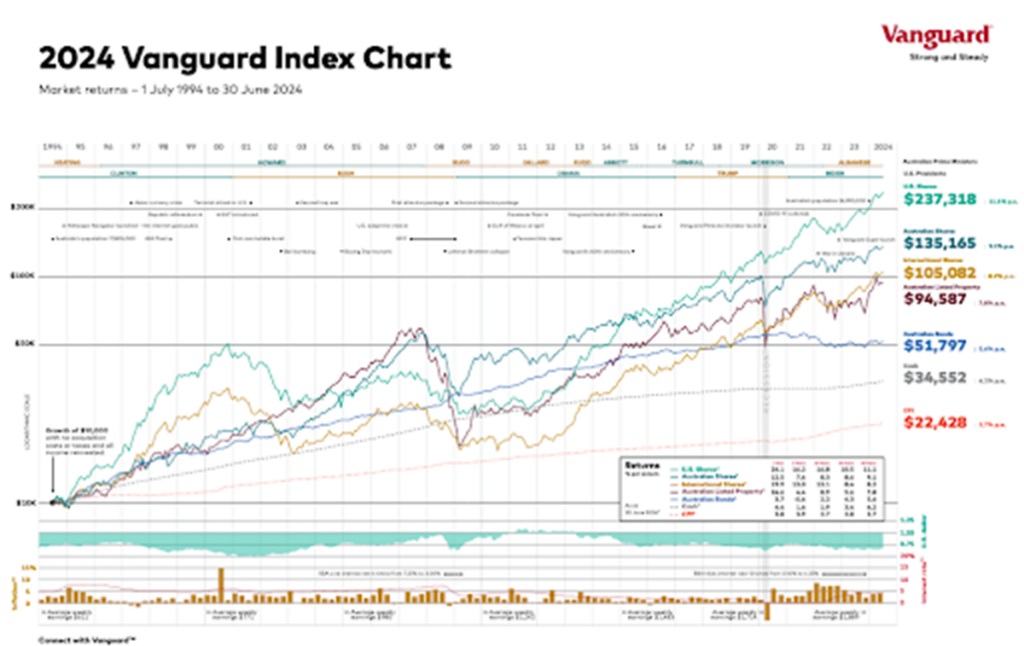

About 30% of our retiree members are holding all their savings in cash. The most recent Vanguard chart comparing investment earnings has just been released. This 2024 Vanguard Index chart shows the performance of different asset classes over the past 30 years

The most gains were in US Shares with an average return of 11.1% over this period. Next in line were Australian shares with an average return of 9.1% per annum.

These two were followed by International shares (8.2% p.a.), Australian Listed Property (7.8%), Australian Bonds (5.6%), then cash (4.2%).

By way of comparison, average Consumer Price Index (CPI) increases were 2.7% over this period.

According to Retirement Essentials’ director, Jeremy Duffield, there are three main reasons why too much money invested in cash may not be the best strategy. These are:

- For the 31% of members who hold all their savings in cash, there is no diversification whatsoever in their portfolio. As the performance of different asset classes may rise or fall, the eggs in one basket strategy means your earnings are restricted to the return on cash.

- As evidenced by the 30-year Vanguard chart above, cash is the weakest performer compared to other major asset classes, including Australian Bonds. So choosing to place all your savings in an investment which is highly likely to perform worst over the long term seems to be a contrary way of managing life time income needs.

- There are cash accounts and cash accounts. Some – such as term deposits – will require you to invest for an agreed time but pay a higher interest rate than others. These others may pay very low or no interest – for instance transaction accounts can pay as low as 0.5% compared to some term deposits accounts currently paying 6% for 12-month deposits. So there is a lot of variation in the return on cash depending upon which type of account you have.

Why people prefer cash

Cash is tangible. Assuming it is in a government guaranteed account, it is guaranteed to be accessible (up to $250,000) whenever you choose to withdraw it. This can be comforting for many people. But as inflation forces prices higher, the value of your cash is eroded. If you had $1000 in cash on 1 July last year, it was only worth $962 on 1 July this year, when 3.8% inflation over the 12-month period is applied.

Can you have the best of both worlds?

Having a diversified investment mix is the solution for many people. This can be achieved by choosing a balanced or growth setting for your super account. One major super fund’s ‘balanced’ setting, by way of example, has a 20% mix of cash and fixed interest, the rest being international shares, Australians shares, private equity, property and infrastructure. It is very easy to check your own funds settings to see what they offer for growth or balanced returns – and important to do so.

But this refers to the money you still have in super. If your funds have already been withdrawn in a lump sum, then it’s worth checking the current return on any cash deposits. You can also do some ‘rule of thumb’ comparisons to see if that money was moved to different investments or back in a super account (subject to conditions), how it might perform

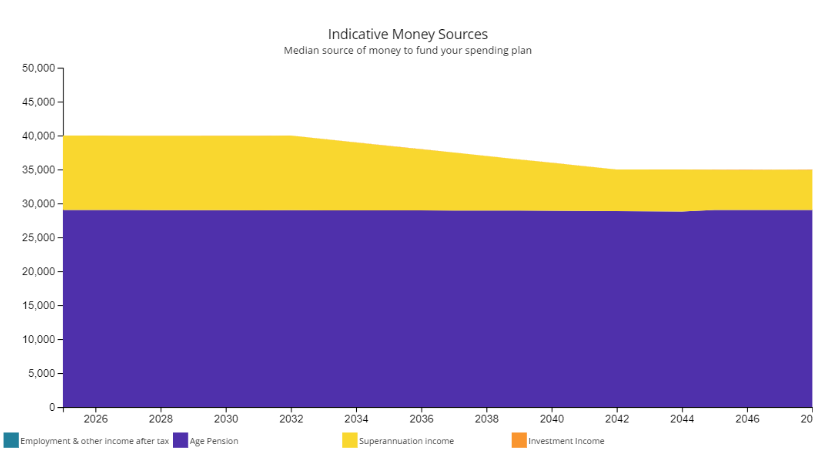

The table below offers a ‘compare the pair’ scenario using Dianne as a case study. You may recall that Retirement Essentials’ adviser, Nicole Bell, recently did some projections to show how 67-year-old Diana could live quite comfortably on a mix of Age Pension entitlements and super top ups.

Here’s a quick recap

Dianne has the median female super balance of $201,233 and no other financial assets.Assuming she is not working, she can spend $40,000 per annum earlier in retirement, reducing down to $35,000 per annum from age 85 onwards, there is approximately an 85% probability there is still some wealth remaining to continue to maintain her standard of living beyond age 92. The $40,000 income is achieved with a full Age Pension of $29,023 and a top up of $10,997 per annum from her super. The following chart from the Retirement Essentials’Retirement Forecaster shows how this works.

The superannuation returns in this case study were based upon Retirement Essentials’ ‘Market Risk Level 5’ setting, which has slightly more growth than defensive assets.

Over to you

No one can or should tell you how and where to invest your retirement savings. But there are two ways of ensuring you are less likely to miss out:

Firstly, by understanding the returns on investing in different asset classes and educating yourself on what an ideal mix would look like for your savings and your time frame.

Secondly, by doing the necessary calculations or projections to see how much your savings currently return and if this amount could be increased within your risk tolerance, by remixing the assets yourself or by choosing an investment setting with more growth in the mix.

How much cash do you believe is necessary within your investment mix?

If you wish to explore your own risk tolerance, Or you may wish to do some projections as we did for Dianne, but factoring in inflation, super pension payments and other drawdowns over the years. In this case a Retirement Forecaster consultation will help you compare your own options, guided by one of our experienced advisers.

Yes interesting detailed analysis on cash v super mix portfolios,

I retired last Christmas contacted our Qsuper/ART fund manager for them to provide a current balance projection from now to when our funds of $380,000 me 68 the Mrs 67, investing in cash hasn’t in the mix

I have certainly noticed that superfunds are absolutely cheating their customers of interest income on cash investments and in other ways. The answer lies in the government forcing them to pay reasonable returns. I would also like government to police the superannuation sector. It is almost impossible to contact AFCA.

Super at the moment is like Petrol prices in reverse. It goes down very quickly and ever so slowly claws its way up only to drop again.

Cash interest the other hand is a joke the only winners are lenders.

Diversification is key to earning a reasonable return. I have a mixture of cash and shares.

Made sure the shares were generally fully franked to maximise returns.

Mine is in a self-managed super fund whilst my wife’s is in an industry super fund.

The difference in returns is enormous, and I am a conservative investor.

At the moment I am contemplating joining up with My Aged Care. However, upon looking at what the Government gives the provider for each client and what the client pays for each service, I am starting to wonder whether this is also something that needs to be investigated. For instance, I am told that the government forwards $40,000 per year for each client and on top of that the client pays for a service, say for cleaning. For cleaning, it would mean $86 per hour, which is a hefty fee considering cleaners can be hired for much less. On top of that, a ‘management fee’ is charged. This is approximately $250 per fortnight. This, to me, seems ridiculous. Just what management is required to arrange for a cleaner one a fortnight for say 2 hours? Surely the management could come out of the hefty $86 per hour? Besides this, an amount is forwarded out of the $40,000 from the government to the provider for the cleaning and the management as well. To me, it seems there is ‘double dipping’. I was wonder whether Retirement Essentials might be interested in writing a piece about My Aged Care and providing services to pensioners at home and how the costing can be justified. To me, paying $86 per hour for a cleaning service is very expensive. Speaking to someone at a provider is like dealing with a car salesman. They sprout all the sales gibberish but they don’t address the fact that the charges are very high or give a valid reason why, despite them receiving a huge amount of money from the government for each client.

Thank you.

(Please do not print my name should you publish an article on this subject.)

With regard to anonymous about the charges charged by My

Aged Care. It seems to me the elderly pensioners living at home are being ripped off with excessive prices charged for any of the care that can be provided. Seems to me it’s BIG business looking after the elderly and heaps of aged care providers are making huge profits on the care provided at a enormous expense to the pensioner in need. About all the government does is pay the $40K grant per annum and wash their hands of anything to do with the fees and charges being taken from the grant by greedy providers. Something is not right here and the looser is the pensioner being taken for granted.

We know the admin fees are outrageous yet somehow the government doesn’t. Yet it’s our tax dollar. Total fraud. $86 an hour for cleaning not going to the cleaner we the tax payer are being taken to the cleaners. Rest going on lavish life styles. Total FRAUD when you multiply by X the number of clients!!!!

Needs full open investigation years ago, should never have been privatized. The rich get richer poor get forgotten and services get tick box accreditation for piss poor service provision