Keeping Retirement Simple – Part 6

In previous articles, we’ve talked about how it’s tough to plan your retirement due to uncertainty about future investment returns…and inflation. In Part 3, we showed how the amount you can spend depends on what you earn on your investments. Problem is: no one knows what investments will earn in the future.

So Principle 6 for retirement spending is: You need to be prepared for a range of outcomes.

Surprisingly, most financial advisers act as though they know what’s going to happen in the future. They give you a projection of your ability to spend based on an assumed rate of return over the next 25 or 30 years. It’s a bit of a “pretend game” – let’s pretend we know what the return will be.

But while the assumption used might be a reasonable estimate, actual rates of return will be different…and perhaps by a lot.

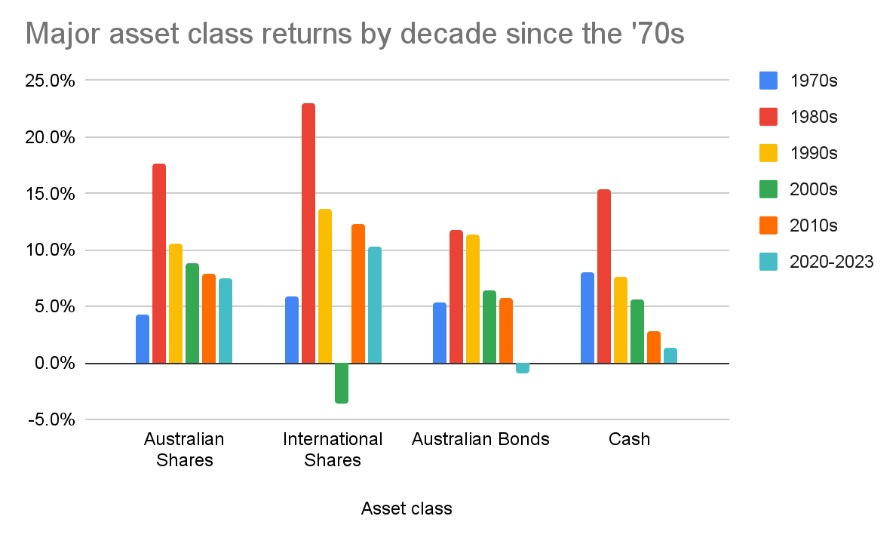

The reality is that investment returns vary significantly, and unpredictably, not just year by year but decade compared to decade. We can see that by showing the returns in past decades. This chart gives the annualised rates of return for 4 major asset classes in each of the decades since the 1970s and the 2020s so far.

Given the uncertainty in future returns, it’s essential for retirees to be prepared for a range of outcomes. You’d much rather retire into a string of healthy investment years that would get your retirement off to a wonderful start. But you don’t know whether that’s going to happen.

The way our advisers help people with this uncertainty is by showing a range of sustainable retirement spending levels, based on different investment market scenarios. We run 1000 scenarios through our retirement forecaster to show the range of outcomes it’s reasonable to expect.

Over a 25 year or longer retirement, you might end up with returns around the average or you might get better than average or worse than average, even terrible, returns. Our forecaster estimates the chances you have of making your spending goals in poor, average and good market scenarios.

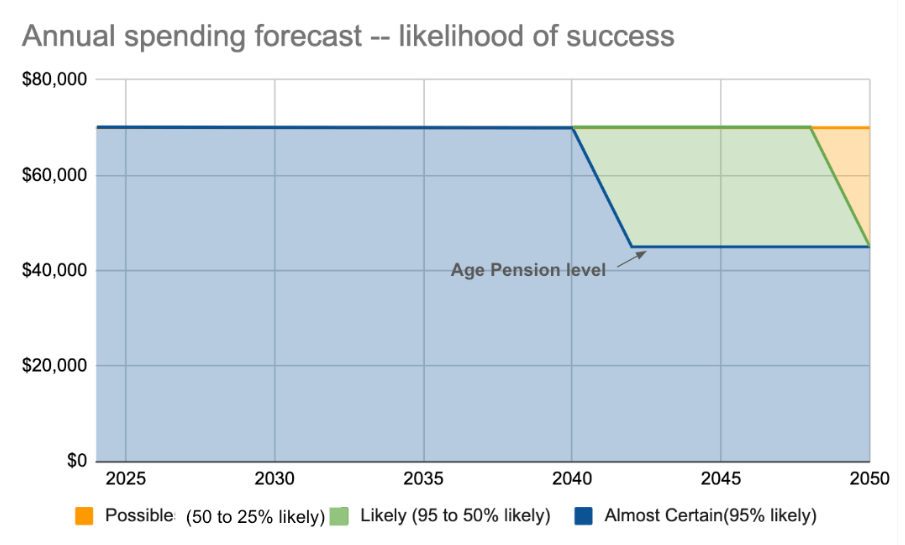

Here’s what the forecast looks like for a couple, both 67, who decide they want to retire and achieve a spending goal of $70,000 per year, and who start with a super and savings portfolio of $500,000 invested in an account based pension using a balanced portfolio(50% shares, 50% fixed income).

The dark blue area indicates what we call the “almost certain” outcome – a 95% chance of the money lasting until 2040 if the couple spent at that $70,000 rate – ie before the couple would be left with only the Age Pension. That covers most poor market scenarios.

The green area above shows that in average markets (up to 50% probability), their savings might last until 2048. Average markets improve the longevity of the savings and their ability to keep spending.

The amber area then shows that in good market scenarios (up to 25% probability), the money lasts the full span of their planned horizon (to 2050). Of course, it’s possible markets will be even better but we think it would be unwise to count on that, so we don’t show it.

That’s quite a range of outcomes, isn’t it?

Everyone’s different

Of course, this is just one couple with one level of savings, a chosen goal and a particular investment approach. Everyone is different in retirement and thus needs their own forecast of their likely range of outcomes. Our advisers can help you tailor a forecast to your own circumstances. And you can get a preliminary forecast yourself by logging in to your account.

Here are a few things we find:

- People with a greater dependence on the Age Pension have less volatility in their range of outcomes because the “steady Eddie” Age Pension provides the dominant part of their retirement funding. The less Age Pension they’re entitled to, the higher the fluctuations.

- Investments with a higher growth exposure (eg more Australian and international shares) will have a broader range of outcomes in their sustainable spending levels – they’re more dependent on good market/bad market outcomes. But the higher expected returns of greater exposure to growth assets often justifies the higher volatility over long periods. So, most retirees will want to maintain a significant exposure to growth assets.

- By contrast, “safe” investments like cash are very risky if they dominate your retirement portfolio. They’re unlikely to keep up with inflation.

- Many people don’t want to plan for a constant spending level. Instead, they might want to start retirement with a higher level of spending during an “active” phase of retirement and reduce the spending levels over time. Our forecaster allows them to plan their own spending levels…and work out the likelihood of success.

- There are things you can do if good markets don’t shine on your retirement. Typically, it means adjusting your spending levels to something more sustainable.

Preparing for the range of outcomes you can expect is at the heart of good retirement planning. Our advisers have the tools and expertise to help you think this through.

I’d like to comment on the 4th dot point regarding a ‘constant level of spending through the retirement journey’, a point which receives very little consideration, discussion with advisors, or attention in investment calculators.

I feel this is an important glaring omission in the whole future spending versus dwindling financial asset ‘guestimates’ (advice) that we rely on. We will all have varying levels of spending as we age – and this a key point.

Retirement calculators and advisors need to be able to factor in typical reductions (or changes) in spending levels with increasing age as it is not a constant in the vast majority of cases.

Perhaps advisors and calculators (which I use frequently) should have a tiered approach of ones remaining financial assets versus diminishing or changing levels of spending with age as this would be far more enlightening and useful.

In the retirement forecaster , how do you enter my husband’s “income” …he is retired and has no income from employment, but only from his allocated pension . Do I put zero ?

Hi Julie, yes please just put 0 for the income if he only receives payments from superannuation and nothing else.